Stocks extended the losing spell for the second consecutive week as beleaguered investors continued their sell-offs on sector-wise stocks.

Brokers said the market extended losses as the institutional investors could not support the market because of liquidity crunch while fresh concern erupted over the final selection of major bourse's strategic partner.

The securities' regulator, which has been against the selection of the Chinese consortium from the very beginning, Tuesday sent a number of queries to the DSE about the consortium's proposal and asked it to submit reply along with tender documents by March 4.

The market started the week in continuation of previous week's downturn and the first two trading sessions of the last five trading days saw a combined 132 points loss but rest of the three sessions gained 96 points.

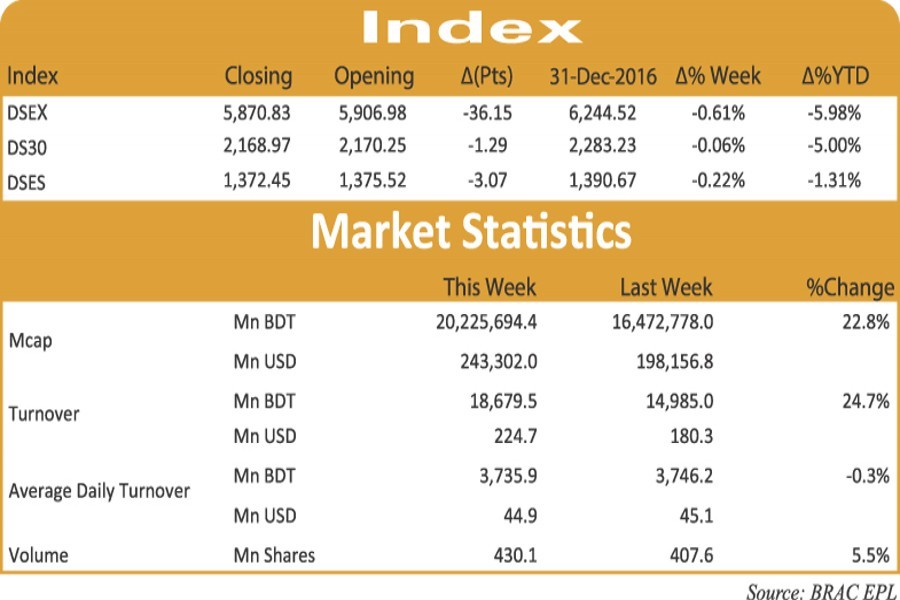

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went down by 36 points or 0.61 per cent to settle at 5,871 points over the previous week.

"The market witnessed correction for the second consecutive week amid ambiguity over the Dhaka bourse's share sales to a strategic partner and concerns over the existing liquidity crunch," commented International Leasing Securities, in its weekly analysis.

Global credit rating agency Standard & Poor's has put the banking sectors of Bangladesh at higher risk category which compelled the investors to liquidate their position from bank and financial institution sectors, the stockbroker said.

"Selling of shares mostly from bank, food, financial institutions and textile sectors contributed to the fall in indices in the week although the bargain hunters took position on lucrative price levels in cement and telecom sectors' stocks," said the stockbroker.

Turnover remained poor as investors were not confident enough to inject fresh fund in the market, said the stockbroker.

Some of the investors reshuffled their portfolio to the fundamentally strong large-cap stocks for protecting their downside risk in the turbulent market, the stockbroker added.

Two other indices of the premier bourse also ended in the red. The DS30 index, comprising blue chips, fell 1.29 points to finish at 2,169 and DSES (Shariah) index shed 3.07 points to settle at 1,372.

The port city bourse Chittagong Stock Exchange (CSE) also ended lower with the CSE All Share Price Index -- CASPI -- falling 172 points to settle at 18,079 and Selective Categories Index -- CSCX -- losing 108 points to finish at 10,911.

Turnover, the crucial indicator of the market, stood at Tk 18.68 billion against Tk 14.98 billion in the previous week as last week saw five trading sessions instead of previous week's four.

The daily turnover averaged Tk 3.73 billion, which was 0.28 per cent lower than the previous week's average of Tk 3.75 billion.

Block trade contributed 7.30 per cent to the total weekly turnover, where stocks like Square Pharma, Grameenphone, British American Tobacco, BRAC Bank and Maksons Spinning dominated the block trade board.

The pharmaceuticals sector dominated the turnover chart, grabbing 19 per cent of the week's total turnover, followed by engineering with 14 per cent and banking 13 per cent.

Four listed companies -- Dutch-Bangla Bank, United Finance, Linde Bangladesh and Glaxo SmithKline -- recommended dividend last week.

"Capital market remained volatile throughout the week amidst investors' optimism and watchfulness ahead of dividend declarations," commented EBL Securities, in its weekly analysis.

The market capitalisation of the DSE also fell 0.42 per cent as it was Tk 4,095 billion on opening day of the week while it stood at Tk 4,078 billion on Thursday.

Losers outnumbered gainers by 203 to 113, while 22 issues remained unchanged on the DSE floor.

Square Pharmaceuticals topped the week's turnover chart with 2.24 million shares worth nearly Tk 701 million changing hands, followed by IFAD Autos with Tk 628 million, Unique Hotel & Resorts Tk 543 million, Olympic Industries Tk 462 million and Grameenphone Tk 365 million.

EBL First Mutual Fund was the week's best performer, posting a gain of 13.19 per cent while GSP Finance was the week's worst loser, slumping by 25.26 per cent following its price adjustment after record date.