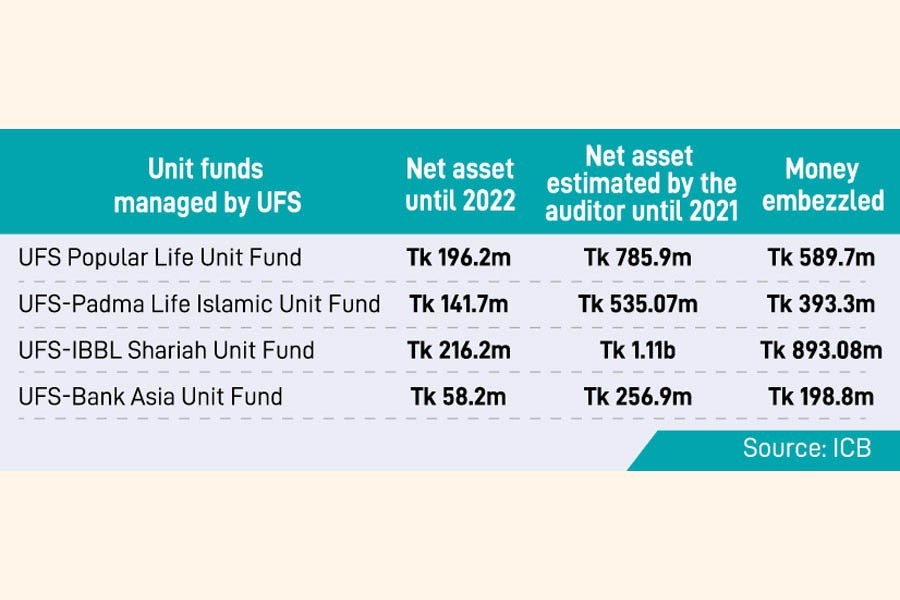

A recent scrutiny reveals that Universal Financial Solutions' (UFS) top executive siphoned off Tk 2.07 billion from scam-hit four unit funds, higher than the reported Tk 1.58 billion.

Ahmed Zaker & Co. Chartered Accountants appointed as the auditor had certified that the unit funds had Tk 2687.92 million until the end of 2021, but when the trustee, Investment Corporation of Bangladesh (ICB) examined the assets up to the end of 2022, it found the big chunk of money missing.

That means about 74-80 per cent of the funds had been set aside by the UFS's top executive Syed Hamza Alamgir before he fled the country with the money.

The new findings have surfaced as the state-run ICB scrutinized the unit funds following the news of the embezzlement from UFS Popular Life Unit Fund, UFS-Padma Life Islamic Unit Fund, UFS-IBBL Shariah Unit Fund, and UFS-Bank Asia Unit Fund managed by the UFS Equity Partners.

The trustee of the assets also filed a case against the UFS directors, including Mr Alamgir, with Paltan Police Station on January 1, and the case is being dealt by the Criminal Investigation Department (CID).

ICB officials said they had gone into the legal fight to recover Tk 2.07 billion from the UFS directors.

The ICB filed another case with the district judge court on January 12 after the UFS's directors had failed to reply to a notice on refunding of the misappropriated money within three days on receipt of the notice.

Initially, it was reported that the UFS's top executive had fled with Tk 1.58 billion from the four unit funds.

UFS-IBBL Shariah Unit Fund had seen the highest amount gone missing. The auditor certified that the value of the assets managed under the scheme was more than Tk 1.11 billion at the end of 2021.

But the ICB found that net assets amounted to Tk 216.19 million at the end of 2022, with 80 per cent of the unit siphoned off.

Similarly, UFS Popular Life Unit Fund was squeezed by 75 per cent, UFS-Padma Life Islamic Unit Fund by 74 per cent, and UFS-Bank Asia Unit Fund by 78 per cent.

Following the scam, the Bangladesh Securities and Exchange Commission summoned the audit firm to hear an inquiry but the firm did not abide by the order.

Then the securities regulator banned the firm on January 18 from auditing listed securities.

Meanwhile, the BSEC finalized a process to appoint a new auditor to figure out the assets embezzled.

The ICB officials said the exact amount taken away will be known on completion of an audit by a new firm.

ICB's role to protect unit holders

Officials of the ICB said they were not aware of the UFS's bad intention. As trustee, they had made sure whether dividends had been distributed as per the rules and regulations.

An ICB official said that before the scam the unit funds had distributed 70 per cent dividend from the income realised.

The funds also maintained 60:40 ratio of investments in the capital market and money market, he said requesting for anonymity.

Usually, the auditor gives qualified opinion if there is any deviation or abnormalities in the management of the funds.

"But the auditor's report had no matter of emphasis or qualified opinion, and consequently no alarm was raised about any fund misappropriation," the official said.

ICB Managing Director Abul Hossain said the corporation had sued the UFS's directors considering the interest of the unit holders.