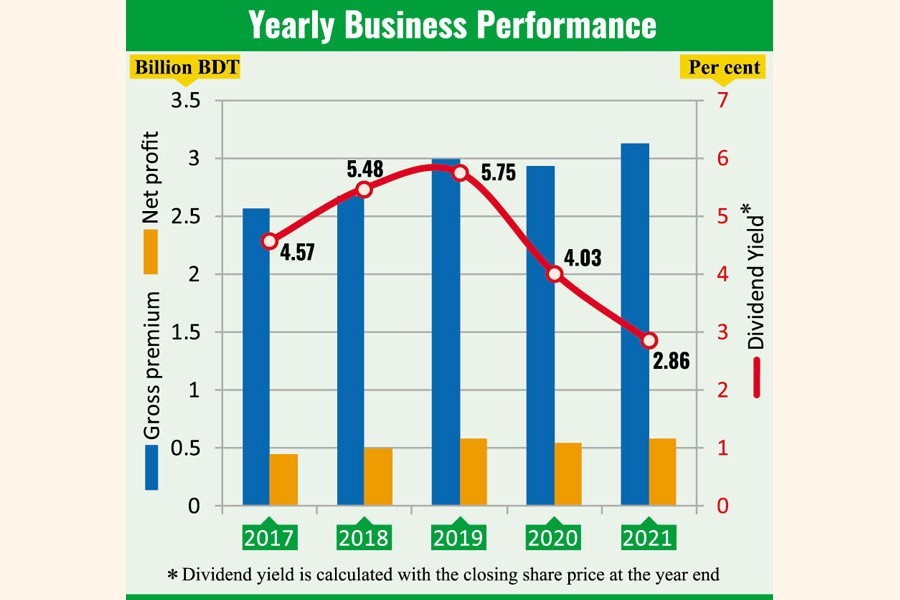

Reliance Insurance, one of the leading general insurers in Bangladesh, posted a record profit in 2022, despite it being a challenging year, backed by higher gross premium income.

The insurer's profit grew at 4.79 per cent year-on-year for 2022 to Tk 616 million, the highest since its listing in the stock market in 1995.

The growth was achieved at a time when economic indicators were all in decline, said Badal Chandra Rajbangshi, chief financial officer (CFO) of Reliance Insurance.

The insurance company also secured more than 10 per cent growth in gross premium, he said but did not disclose the exact figure.

Its dividend yield was 4.28 per cent for 2022.

Reliance provides insurance coverage for fire, marine cargo, marine hull, engineering, personal accident, overseas medical claims, motor vehicles etc.

Financial performance of the company has been consistently positive on the back of its adherence to the insurance underwriting, which has helped earn trust of its clients, in turn helping the business thrive, Mr Rajbangshi said.

That is why the company has been able to ensure good returns to its shareholders, he added.

However, the stronger dollar and largely non-existent third-party insurance for vehicles slowed down insurance business, said Mr Rajbangshi. Otherwise, the profit would have been much higher, he added.

Third-party insurance is a policy purchased by the insured from the insurer for protection against claims by a third party. For example, the owner of a vehicle pays a premium to an insurance company to cover the damage in a road accident involving the vehicle.

In Bangladesh, no one buys third-party insurance products since it is not mandatory. As per the Motor Vehicles Ordinance 1983, third-party insurance was compulsory but it is not mandatory under the Road Transport Act 2018 which is in effect. Income from the segment plunged after the withdrawal of the requirement.

Reliance Insurance is actively pursuing unconventional lines of business, such as liability, bankers blanket bonds (BBB) and extended warranty insurance, said the company CFO.

It is also extending its research & development work to develop crop insurance products at the micro insurance level and find the viability in the context of adverse weather events in Bangladesh due to global warming, he said.

"We put emphasis on prudent underwriting, choosy investment instruments, optimisation of reinsurance, and human capitalisation to reap the fruits of the prospects."

The company's gross premium income has increased for the last two consecutive years, facilitated by penetration into the new line of business.

Despite the hefty profit, the company's stock price fell 1.76 per cent to Tk 61.40 on Monday.

The net asset value per share dropped slightly to Tk 64.15 in 2022. This happened due to the drop in the market value of investments in securities and other investments, the company said in its stock exchange filing.

The net operating cash flow per share also fell 17 per cent to Tk 6.60 due to the hike in agent commission expenses and reinsurance payment.

Meanwhile, overall the insurance industry in Bangladesh is grappling with a major crisis as the shortage of US dollars has made it difficult for local insurers to make premium payments to foreign reinsurers.

There are 46 general insurers and 34 life insurers operating in Bangladesh, of them 56 are listed on the stock market.

Out of the non-life insurance companies in Bangladesh, about 12 reinsure their business with companies in the United Kingdom, Germany, Singapore, South Korea, Switzerland, Thailand and India, industry people say.

Reliance Insurance is one of the companies that reinsure their policies overseas and are now suffering the most for not being able to remit premium due to the greenback crunch.

The company official said clients of the insurer included many reputed national and multinational conglomerates.

"Over the years, Reliance has established a track record as a sound and dependable insurer, consistently meeting its commitments and by providing insurance solutions to the individual needs of its clients," he added.