Reckitt Benckiser Bangladesh reported an 18.4 per cent year-on-year drop in profit in 2022, mainly for costlier raw materials and a sharp devaluation of local currency against the dollar.

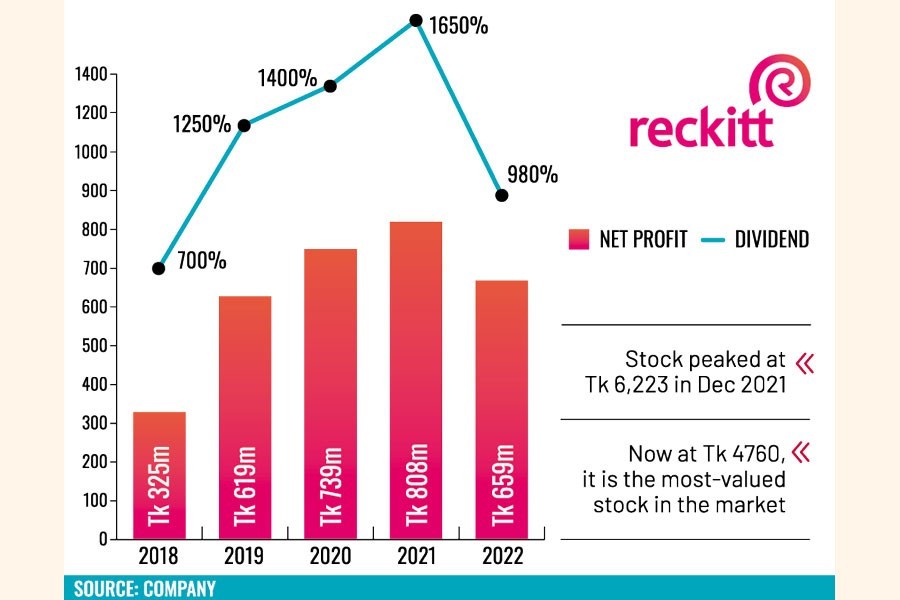

The listed multinational company that sells health and hygiene-related products logged an annual profit of Tk 659 million last year.

As income declined, so did the company's earnings per share (EPS) from Tk 171.03 in 2021 to Tk 139.50 last year.

Reckitt Benckiser had seen its business growth accelerate after the Covid outbreak when the use of hygiene products shot up in measures to contain the spread of the Coronavirus.

Its top-selling products are meant for hygiene, such as Dettol and Harpic. They are also household names in the particular areas.

As the pandemic waned and the Russia-Ukraine war began leading to a global economic slowdown, consumers' purchasing behavior changed.

The huge demand for hygiene products diminished due to inflationary pressure squeezing people's capacity to buy even essential items. At the same time, raw materials became costlier in the global market, and the taka became cheaper against the dollar increasing import costs.

The taka has lost its value by about 25 per cent against the greenback since Russia's invasion of Ukraine in February last year.

Reckitt Benckiser is largely dependent on imports for raw materials. Due to the cost escalation, the market saw lower demand for its products.

Company Secretary Md Nazmul Arefin said that due to an unprecedented increase in the prices of key ingredients (soap and noodles), costs of sales soared 21.23 per cent year-on-year in the nine months through September 2022.

Bangladesh witnessed a decade high inflation at 9.52 per cent in August last year. Although inflation cooled gradually over the last few months to 8.57 per cent in January, it is still higher than expected.

High inflation affected consumption patterns; many people shifted from branded products to non-branded ones to cope with higher expenses.

"Escalation of production costs and the dwindling demand for hygiene-related products in the post-pandemic period might have impacted the company's business," said Md Sajedul Islam, senior vice president of the DSE Brokers Association of Bangladesh.

People have to spend more on food items, so they cut spending on non-essential products, he added.

Due to the raging inflation, businesses tied to beverages, personal care, and other non-essential consumer products had to endure shrinking profit margins in the recent quarters.

Reckitt Benckiser is yet to disclose its sales revenue for 2022. However, sources said the revenue was around Tk 4.70 billion in 2022, down from 4.94 billion a year earlier.

Meanwhile, Reckitt Benckiser plunged 23 per cent on the bourses from its peak at Tk 6,223 a year ago. Though it has remained static at the floor price of Tk 4,760.7 since October last year, it is the most-valued stock in the market.

The company declared the highest cash dividends among the listed companies for three years in a row since 2019, luring investors to its stock. That resulted in the share price going through the roof.

For 2022, Reckitt Benckiser cut its cash dividend sharply to 980 per cent, lowest in four years since 2018.

The multinational companies are well-managed and have a reputation of their product quality, which help them earn more as well as pay hefty dividends to shareholders every year, said Mr Islam.

Listed in 1987, Reckitt Benckiser manufactures toiletries, sanitization products, pharmaceuticals and food products.

Its brands include Dettol, Finish, Lysol, Veet, Strepsils, Woolite, Vanish, Trix and Harpic. In Bangladesh, the most popular products of Reckitt Benckiser are Dettol soap, Dettol liquid and Harpic.

In 2019, Reckitt Benckiser widened its market shares in the bar soap category and is holding the top position in the toilet cleaner category.

Its paid-up capital is Tk 47.25 million, authorised capital is Tk 250 million and the total number of securities 4.72 million.

Sponsor-directors own 82.96 per cent stake in the company while the government owns 3.77 per cent, institutional investors 4.48 per cent, foreign investors 2.82 per cent and general public 5.97 per cent.