Earnings of most of the multinational companies (MNCs) listed with the country's stock market increased in 2021 compared to the previous year thanks to lower operating cost and reduction of corporate tax rates.

Currently, there are twelve multinational companies listed with the Dhaka Stock Exchange, which account for approximately 21 per cent of DSE's total market capitalisation.

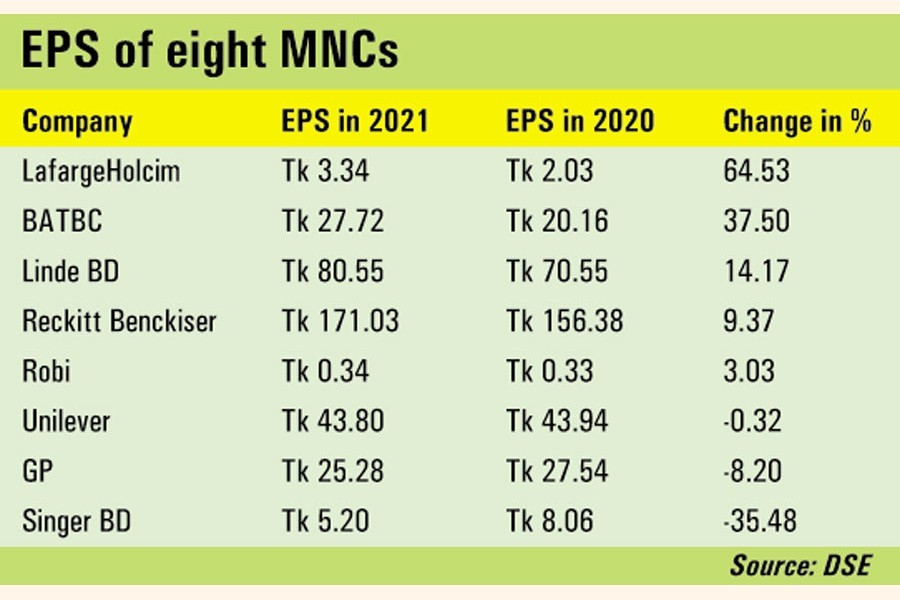

The EPS of five multinational companies, out of eight that declared annual earnings rose, while three fell marginally in 2021, according to data available with the DSE.

EPS is the portion of a company's profit allocated to each outstanding share of common stock. In short, it serves as an indicator of a company's profitability.

The EPS of LafargeHolcim Bangladesh, British American Tobacco Bangladesh, Linde Bangladesh, Reckitt Benckiser (BD), Robi Axiata rose between 3.03 per cent and 64.53 per cent in 2021 compared to the previous year.

On the other hand, EPS of Unilever Consumer Care, Grameenphone and Singer Bangladesh fell between 0.32 per cent and 35.48 per cent in 2021.

Market insiders said the multinational companies have been doing well due to their strong fundamentals, brand value, good management and quality of products which helped them attain profit growth.

"The multinational companies have a reputation for their product quality, making them earn more as well as pay hefty dividends," said a leading merchant banker.

The multinational cement maker-LafargeHolcim Bangladesh- has posted the highest 64.53 per cent growth in its consolidated EPS in 2021 backed by strong cost control and efficiency improvements.

British American Tobacco Bangladesh has reported a 37.50 per cent growth in net profit for 2021 compared to the previous year.

The EPS of Linde Bangladesh, an oxygen supplier, also rose by 14.17 per cent in 2021 due to increased net profit and decrease of corporate tax rate compared to the previous year.

Reckitt Benckiser -- a UK-based health and hygiene products manufacturer, saw a 9.37 per cent growth in its earnings per share in 2021 due to lower operating cost and reduction of corporate tax rates.

Robi Axiata, the second largest mobile phone operator, posted a 3.03 per cent rise in its earnings per share in the financial year ended on December 31, 2021.

Most of the multinational companies have also recommended substantial amounts of cash dividends for the year ended on December 31, 2021, in line with their profit growth.

"Dividend in cash is an indicator of the financial strength of a company," said the merchant banker.

Reckitt Benckiser topped the list in terms of dividend declaration this year like the previous year. The company declared a record 1650 per cent cash dividend for the year 2021.

This is the highest cash dividend among all the listed companies in the history of Bangladesh capital market. In 2020, it disbursed a 1400 per cent cash dividend.

Among other MNCs that declared dividends as of Wednesday Linde Bangladesh declared 550 per cent cash, Unilever Consumer Care recommended 440 per cent cash, Grameenphone declared total 250 per cent cash, Singer BD declared 60 per cent cash, LafargeHolcim recommended 25 per cent cash and Robi Axiata declared a total 5.0 per cent cash dividend for the year ended on December 31, 2021.