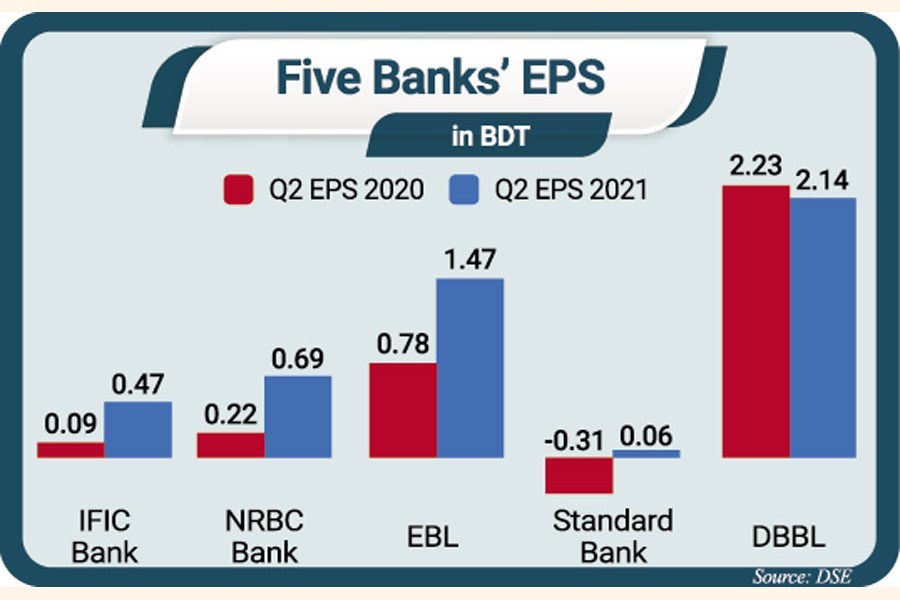

Standard Bank has returned to profit in the second quarter (Q2) that ended on June 30, 2021, against the same quarter last year while Dutch-Bangla Bank's earnings dropped slightly in April-June, 2021.

IFIC Bank, NRB Commercial Bank, Eastern Bank have also posted between 88 per cent and 422 per cent EPS growth in April-June, 2021, according to filings with the Dhaka Stock Exchange (DSE) on Wednesday.

Most listed banks have registered such whopping growth in EPS amid stable interest rate, bullish capital market, investing in bonds, and lower provisions against defaulted loans owing to the postponed loan classification, said a top banker, requesting anonymity.

Standard Bank: Standard Bank's un-audited consolidated earnings per share (EPS) stood at Tk 0.06 in April-June, 2021, as against a loss of Tk 0.31 per share in the same quarter a year earlier.

The bank's consolidated EPS for six months that ended on June 30, 2021, also rose 283 per cent to Tk 0.23, up from Tk 0.06 in the same period last year.

Following the news, its shares price rose 1.08 per cent to close at Tk 9.40 each on Wednesday.

IFIC Bank: IFIC Bank has posted an impressive 422 per cent increase in its earnings in the second quarter that ended on June 30, 2021, compared to the same quarter of the previous year.

The bank's consolidated earnings per share (EPS) stood at Tk 0.47 in April-June, 2021 as against Tk 0.09 in the same period a year ago.

The bank's consolidated EPS for six months ended on June 30, 2021, also rose to Tk 0.91 for January-June 2021 as against Tk 0.51 for January-June 2020.

The bank informed that EPS was higher due to a higher level of net interest income, investment income, and fee-based income.

The NOCFPS was also higher due to a higher level of deposits growth than lending growth, said the bank.

The bank's share price rose 0.74 per cent to close at Tk 13.60 after the news.

NRB Commercial Bank: The newly listed NRB Commercial Bank has posted about 214 per cent increase in its earnings in the second quarter that ended June 2021 compared to the same quarter last year.

The bank's consolidated earnings per share (EPS) stood at Tk 0.69 in April-June, 2021 as against Tk 0.22 in the same period a year earlier.

The bank's consolidated EPS for six months ended on June 30, 2021, also jumped to Tk 1.11 for January-June 2021 as against Tk 0.49 for January-June 2020.

The bank's consolidated NOCFPS was minus Tk 0.78 for January-June 2021 as against Tk 1.27 for January-June 2020.

The consolidated NAV per share was Tk 15.30 as of June 30, 2021, and Tk 10.95 as of June 30, 2020.

EBL: Eastern Bank has posted more than 88 per cent increase in its earnings in the second quarter (Q2) that ended on June 30, 2021, compared to the same quarter last year.

The bank's consolidated earnings per share (EPS) stood at Tk 1.47 in April-June, 2021, an increase of 88.46 per cent, from Tk 0.78 in the same period of the previous year.

Its consolidated EPS for six months ended on June 30, 2021, also rose to Tk 2.56 for January-June 2021 as against Tk 1.65 for January-June 2020.

Dutch-Bangla Bank: Dutch-Bangla Bank's earnings per share (EPS) fell by 4.03 per cent to Tk 2.14 for April-June, 2021 as against Tk 2.23 for the same period a year earlier.

However, the bank's EPS for six months ended on June 30, 2021, rose 4.38 per cent to Tk 3.57 for January-June 2021 as against Tk 3.42 for January-June 2020.

The bank's NOCFPS was Tk 23.93 for January-June 2021 as against Tk 29.18 for January-June 2020. The consolidated NAV per share was Tk 53.15 as of June 30, 2021, and Tk 46.77 as of June 30, 2020.

Following the news, its share price fell 1.87 per cent to close at Tk 83.70 each on Wednesday.