DBH Finance PLC posted a 24 per cent year-on-year fall in profit in the third quarter this year as interest income from loans dropped significantly.

DBH Finance, formally known as Delta Brac Housing Finance Corporation, exclusively focused on home loans, reported a net profit of Tk 238 million for July-September 2022, reduced from Tk 314 million in the same quarter last year.

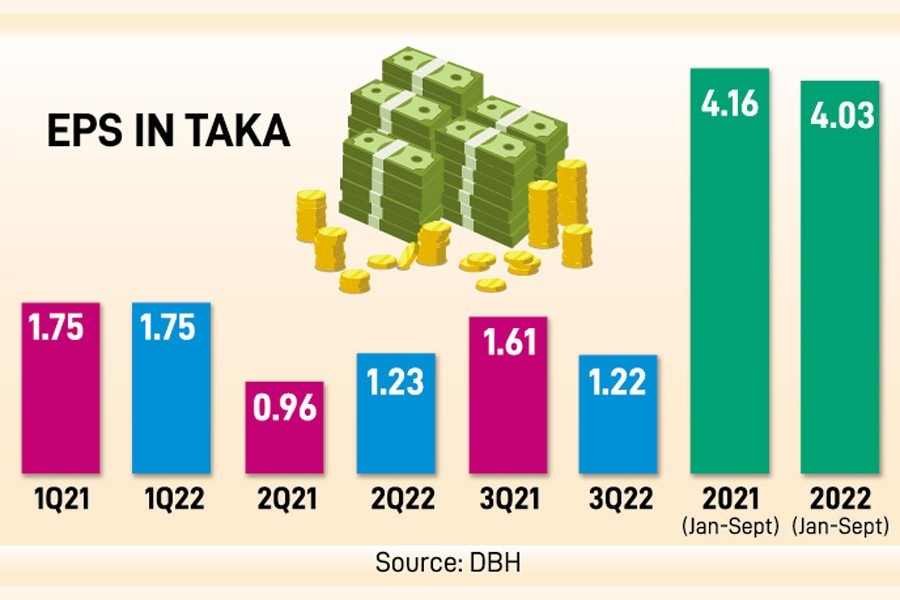

As a result, earnings per share dropped in Q3, according to a filing with the Dhaka Stock Exchange (DSE) on Thursday.

EPS had a 28 per cent year-on-year growth in the second quarter of 2022 while it registered no change in the first quarter.

Listed in 2008, the stock remained stuck at the floor price-Tk 57.80 -- on Thursday.

The company's profit was brought down in Q3 by a drop in net interest income due to the cap on lending rate, said an official of the company on condition of anonymity.

The net interest income slumped 23 per cent to Tk 421 million in July-September 2022 from a year ago, according to its un-audited financial statements.

In March this year, the Bangladesh Bank imposed a ceiling on non-bank financial institutions' interest rate on deposits at 7.0 per cent and lending at 11 per cent as the central bank found NBFIs' lending rates were much higher than the rates offered by banks.

The company's total loan portfolios stood at Tk 44.11 billion as of September 30, 2022, a 2.05 per cent rise from what was a year ago.

In 2021, DBH Finance recorded a 17 per cent annual growth in net profit, inspiring 15 per cent cash and 10 per cent stock dividends.

Since the inception in 1996, the company made commendable growth in creating home ownerships in the country. It launched two other retail products--- personal loan and car loan.

A major constraint on the business of financial institutions has been the narrowing of the gap between the deposit rate and the lending rate, said a merchant banker.

DBH has been playing an active role in the real estate sector, but sales of flats and properties in the recent months slowed down due to the rising inflation and higher construction costs, he said.

Despite challenges, DBH has always been able to keep the operational cost down and mobilize funds at relatively lower cost due to its excellent market reputation which enabled the company to remain competitive in the market, the merchant banker said.

According to the Real Estate and Housing Association of Bangladesh, many realtors are not launching new projects at this moment in fear of low return from investments.

The hike in raw materials prices pushed up the price of flats by Tk 1,500 per square foot on an average in the past six months.