Dhaka bourse closed the Thursday's session marginally lower amid mixed performance of major sectors as investors adopted cautious stance seeing corrections observed in previous three consecutive sessions.

On the day, turnover value on Dhaka Stock Exchange (DSE) declined moderately as many investors were on the sideline and remained reluctant to inject fresh funds.

General insurance sector which saw the highest price appreciation in previous session also witnessed price correction on the premier bourse DSE.

Majority number of listed securities on Thursday lost prices. But the DSE broad index DSEX escaped large fall riding on large cap companies including Grameenphone, British American Tobacco Bangladesh Company, and Beximco.

The market opened the day's session positively but the DSE broad index DSEX lost 26 points within 10 minutes.

Later, the DSEX tried to overcome the initial loss but investors' selling pressure led volatility and the broad index again went down sharply during mid session and finally it escaped large fall riding on last hour's buoyancy.

At the end of the session, the DSEX settled at 7243.26 points with a loss of 0.07 per cent or 5.17 points.

Shariah based index DSES closed at 1567.43 points with a rise of 0.05 per cent or 0.83 points.

DS30 index comprising blue chip securities closed at 2719.13 points with a rise of 0.05 per cent or 1.56 points.

The market operators said many investors are watching the market's movements as they believe that a natural correction was overdue to clutch the prolonged bull-run of the market.

Of 376 issues traded, 114 advanced, 219 declined and 43 were unchanged on the premier bourse DSE on Thursday.

The DSE featured a turnover of Tk 14.33 billion which was 26.58 per cent less than the turnover of the previous session.

Of total turnover, Tk 506 million came from transactions executed in block board.

"Despite higher-earning disclosures, the market ended in red trajectory dragged by selling in most of the large-cap sectors namely pharmaceuticals & chemicals and bank," said a market review of EBL Securities.

Of the sectors which saw price correction, general insurance declined1.5 per cent, pharmaceuticals & chemical 0.4 per cent, paper & printing 1.1 per cent and IT 0.9 per cent.

Of the sectors which witnessed price appreciation, tannery advanced 3.0 per cent, cement 1.9 per cent, financial institutions 0.8 per cent and textile 0.6 per cent.

Investors' participation was concentrated mostly on pharmaceuticals & chemical sector which grabbed 13.90 per cent of market turnover followed by banking 13.70 per cent and textile 9.70 per cent.

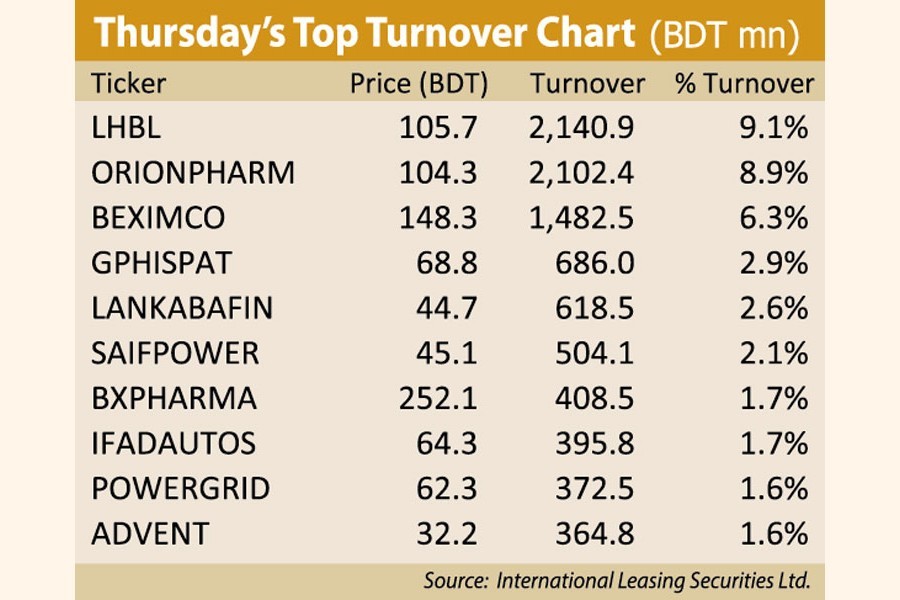

Fortune Shoes topped the scrip wise turnover chart with a value of Tk 957 million followed by Beximco Tk 823 million, IFIC Bank Tk 768 million, Orion Pharma Tk 762 million and NCC Bank Tk 729 million.

Alif Manufacturing Company was the number one gainer with a rise of 9.57 per cent or Tk 1.8 to close at Tk 20.60 each. H. R. Textile was the worst loser after declining 7.71 per cent or Tk 5.7 to close at Tk 68.20 each.

CASPI, benchmark index of Chittagong Stock Exchange (CSE), declined 0.31 per cent or 67.15 points to close at 21116.72 points.

Of 294 issues traded, 90 advanced, 179 declined and 25 were unchanged and the port city bourse CSE posted a turnover of Tk 462.21 million on Thursday.