Dhaka bourse on Monday witnessed a sharp loss extending the losing streak for six sessions in a row as panic-driven investors continued their sell offs.

Most of listed securities including large cap ones triggered the day's sharp fall observed in broad index of Dhaka Stock Exchange (DSE).

The turnover value also declined as many investors showed reluctant approach in case of injecting fresh funds.

Following the Monday's loss of 1.24 per cent or 89.18 points, the DSE broad index DSEX shed 270.71 points in last six sessions in a row.

The president of DSE Brokers Association (DBA) Sharif Anwar Hossain said there is no specific reason which can trigger the continuous correction observed in recent sessions.

"The nature of our investors is to follow others who execute sale or buy. Many investors are offloading shares following others with a view to reduce losses amid declining trend of the market," said the DBA president Mr. Hossain.

Of large cap companies which saw price correction, the share price of Grameenphone declined 1.38 per cent, MJL Bangladesh 1.12 per cent, British American Tobacco Company Bangladesh 1.90 per cent, Square Pharmaceuticals 1.91 per cent, Renata 0.23 per cent and Walton Hi-Tech Industries 1.30 per cent on Monday.

These companies have significant influence on broad index of the premier bourse DSE.

The market opened the Monday's session positively and the DSEX displayed ups and downs for one and half an hour.

After mid session, the DSEX came down steadily amid investors' sell offs and closed the day's session with a large correction and settled below 7100 points.

At the end of the session, the DSEX closed at 7097.27 points with a loss of 1.24 per cent or 89.18 points.

Shariah based index DSES declined 1.36 per cent or 21.14 points to close at 1525.17 points.

DS30 index comprising blue chip securities closed at 2678.55 points with a loss of .98 per cent or 26.58 points.

Of 374 issues traded, 33 advanced, 324 declined and 17 were unchanged on the premier bourse DSE.

The DSE posted a turnover of Tk 13.93 billion which was 16 per cent less than the turnover of previous session.

Of total turnover, Tk 134 million came from transactions executed in block board.

Of major sectors which saw price correction, bank declined 0.5 per cent, engineering 1.2 per cent, financial institutions 2.6 per cent, fuel & power 1.0 per cent, general insurance 1.2 per cent, pharmaceuticals & chemicals 1.2 per cent and telecommunication 0.9 per cent.

Investors' participation was concentrated mostly on pharmaceuticals & chemicals sector which grabbed 14.6 per cent of market turnover followed by banking 13.2 per cent, engineering 8.5 per cent and textile 8.4 per cent.

According to another market review of EBL Securities, investors were on the sideline due to consecutive corrections as they think that the market may decline further as the bull-run had overheated the market earlier.

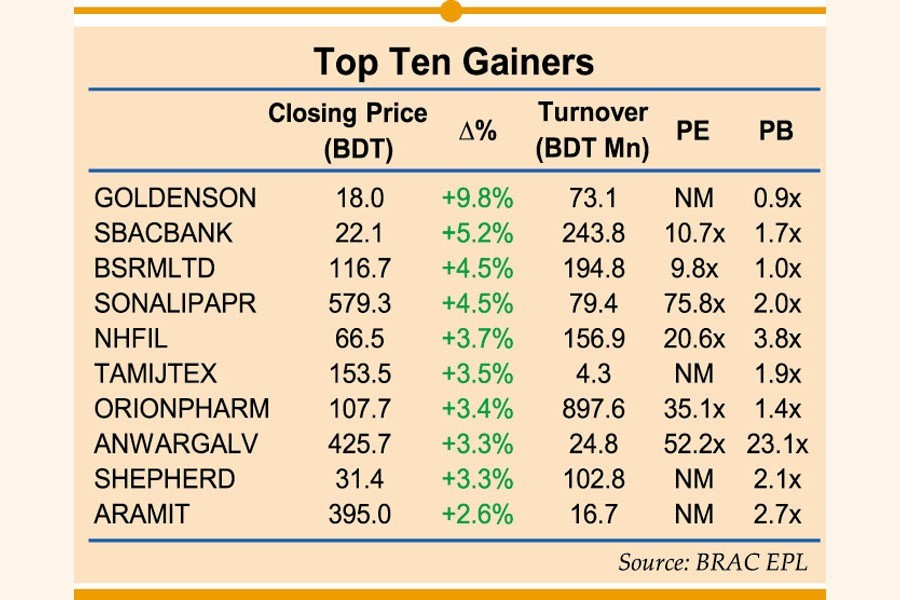

Orion Pharma topped the scrip wise turnover chart with a value of Tk 897 million followed by Delta Life Insurance Company Tk 811 million, LafargeHolcim Bangladesh Tk 667 million, British American Tobacco Bangladesh Company Tk 662 million and Fortune Shoes Tk 660 million.

Golden Son was the number one gainer with a rise of 9.76 per cent or Tk 1.60 to close at Tk 18 each.

Meghna Condensed Milk Industries was the worst loser after declining 8.11 per cent or Tk 1.5 to close at Tk 16.80 each.

CASPI, benchmark index of Chittagong Stock Exchange (CSE), declined 1.49 per cent or 314.83 points to close at 20707.68 points.

Of 307 issues traded, 35 advanced, 257 declined and 15 were unchanged and the CSE posted a turnover of Tk 745.52 million on Monday.