GPH Ispat Limited suffered losses for a second consecutive quarter this fiscal year, as huge foreign exchange losses and frequent power outages pushed up the cost of production although the steel manufacturer posted a decent revenue growth.

GPH, listed on the bourses in 2012, booked losses for the first time in the first quarter (Q1) of the FY '23 owing to sharp depreciation of local currency against the dollar.

However, the loss in the second quarter (Q2) is much lower than the first quarter (Q1).

According to the unaudited financial statements published on Wednesday, the steel manufacturer has registered a loss of Tk 55.88 million for October-December of the FY '23, as against a profit of Tk 499 million in the same quarter a year before.

In Q1 of FY '23, the company incurred a loss of Tk 794.07 million.

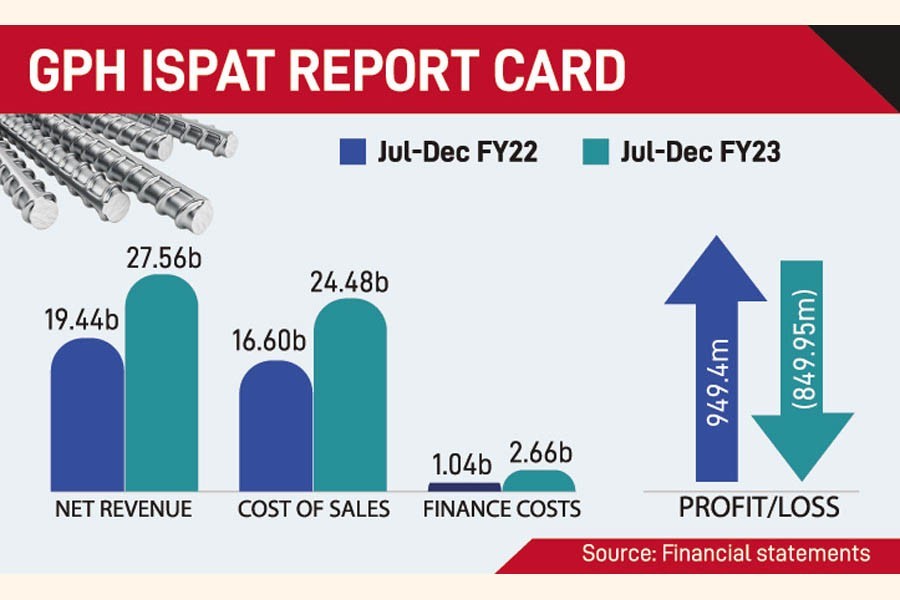

The cumulative loss in the first half (July-December) of this fiscal stood at Tk 849.95 million while it made a profit of Tk 949.4 million in the same period of FY '22.

The company saw its production costs jump 47 per cent to Tk 24.48 billion year-on-year in six months through December 2022.

Company Secretary Abu Bakar Siddique said the significant increase in foreign currency conversion rate, higher prices of raw materials and power supply disruption pushed up the production costs.

The company is also facing problems in opening letters of credit (LC) for import of raw materials due to dollar shortage in the country, said Mr Siddique, also an executive director of GPH.

The company's finance cost also soared 156 per cent year-on-year to Tk 2.6 billion in July-December 2022. The taka has been devalued more than 14 per cent against the greenback in six months through December 2022.

A foreign exchange gain or loss occurs when a company buys and/or sells goods and services in a foreign currency, and that currency fluctuates relative to the local currency.

The steel manufacturer's net revenue, however, rose 42 per cent year-on-year in the six months through December 2022, thanks to the increased production capacity following the completion of its expansion plant.

The new plant went into commercial production early this year, which was built using quantum technology -- the first of its kind in Asia and the second in the world -- at a cost of Tk 25 billion.

Presently, the annual production capacity of GPH Ispat is 1050,000 tonnes of billet and 790,000 tonnes of rod and medium section products.

The company saw its revenue go up after products from the new plant hit the market. The sales price per tonne has also increased, compared with the corresponding period last year.

The expanded production at the plant is expected to increase GPH's market share in the steel industry. But business could not reach the expected level due to foreign currency losses.

The company's net operating cash flow per share was negative Tk 2.21 for July-December 2022 as against Tk 0.82 for July-December 2021 as the payments to suppliers and others were higher than collection against sales proceeds.

In FY2022, GPH Ispat's profit dropped 18 per cent year-on-year to Tk 1.49 billion. It declared 5.50 per cent cash and 5.50 per cent stock dividends for the previous fiscal.

Its share price remained stuck at floor at Tk 44.80 since November 24 last year.

Incorporated in 2006, GPH Ispat is engaged in the manufacturing and trading of MS Billet and MS Rod. The company features a state-of-the-art laboratory to ensure the highest quality of the finished products.

Meanwhile, almost all the listed steelmakers, including leading one --Bangladesh Steel Re-Rolling Mills -- suffered losses in the first half of FY23 due to increase in foreign currency conversion rate.

The crisis has been intensified by frequent power outages caused by gas supply shortage. On top of that, the taka continued to lose value against the dollar, causing steel manufacturers to bleed.

Industry insiders say although the raw materials prices are cooling off in the global market in recent months from a record high, the steel manufacturers could not reap any benefit as most of them could not open letters of credit due to the dollar crisis.

The overall LC opening in the country slumped 14 per cent year-on-year in July-December of FY23 and the settlement declined 9 per cent, according to the data from the Bangladesh Bank.

There are about 40 active steel manufacturers with a combined capacity of producing more than 10 million tonnes of steel a year. The steel industry in Bangladesh is worth Tk 550 billion, according to the Bangladesh Steel Manufacturers Association (BSMA).