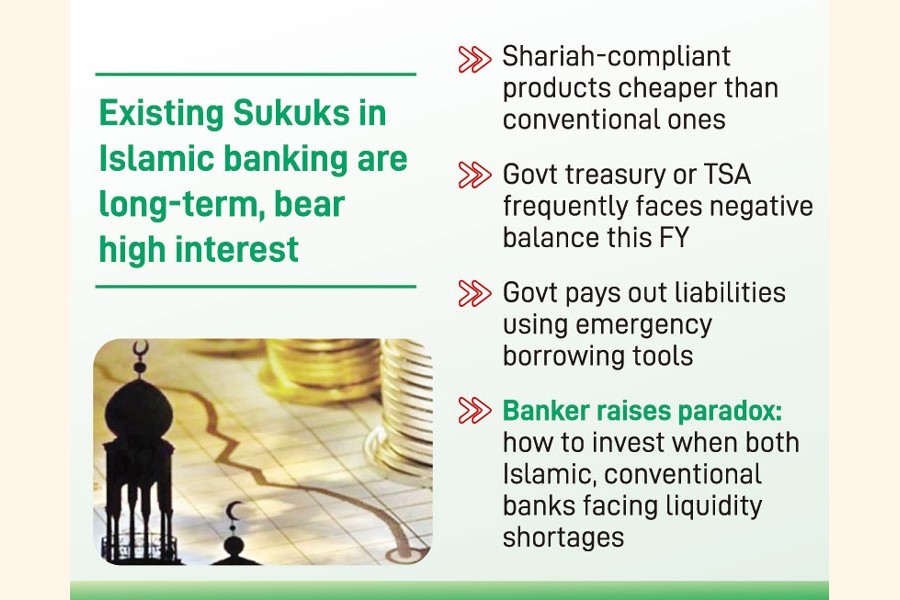

Introducing a new short-term Islamic bond styled 'Sukuk' is now under government consideration to meet its momentary requirement of liquidity which has shown negative balance frequently this fiscal year.

A decision in this regard was made at a recently held meeting of the CDMC or cash and debt management committee of the ministry of finance with finance division senior secretary Fatima Yasmin in the chair.

Those who attended the meeting argued that this new fixed-income instrument would also emerge as a cheap borrowing tool for the government as the shariah-compliant products become cheaper than the conventional ones.

The meeting mentioned that the daily balance of the government treasury, called TSA (treasury single account), frequently faced negative balance during the last couple of months. The negative balance in the TSA stood at Tk. 81.12 billion at the end of December 14, 2022.

Revenue shortfall was singled out as the main reason behind the TSA having negative balance, meeting sources said.

The central bank, which operates the government treasury on behalf of the Bangladesh government, however, pays out the liabilities when the bills are submitted, by using emergency borrowing tools.

As per a section of the Constitution of Bangladesh, it's mandatory to pay its debt timely.

Currently, the government procures resources for its short-term liquidity support through treasury bills having 14-day, 91-day, 182-day, and 364-day tenure. Conventional banks participate in the auction.

Of the short-term borrowing tools, the government usually depends much on the 92-day bill to meet its emergency finance for the budget execution as it has around 72-percent share of the total short-term debts in the banking system.

The government borrowed a total of Tk 792.11 billion in the fiscal year 2021-22 both from long-term and short-term banking instruments. Of the borrowings, the short-term tools had nearly 33-percent shares during the last fiscal year, official documents show.

The government's interest expenditure, one of the biggest heads of revenue outlays, is also rising in lockstep with higher borrowing from domestic sources.

Usually, interest payments on the national savings certificates come to the biggest amount but the banking-system-borrowing cost is also expanding gradually. Almost every year it surpasses the budget estimations.

The government estimated Tk 215 billion as interest expenditure on banking sources for FY 2021-22, but actually it had to pay over 13-percent higher amounting to Tk 243.88 billion. Similarly, the target of interest expenditure for the banking system was nearly 26-per cent higher in the fiscal year 2020-21.

The CDMC mentioned that the Islamic banks now have liquidity shortages, and for this reason, they proposed enhancing the quota for conventional banks to invest in Sukuk. Traditional banks can also invest in Islamic bonds but their stakes usually remain around 15 per cent.

However, if the government executes the decision, such Sukuk will work similarly as the bills do, people familiar with the matter told these correspondents.

But, a number of top executives in the banking industry told the FE that the government is planning to introduce such short-term tools at a time when the country's both Islamic and conventional banks have been facing liquidity shortages.

Such crisis surfaced in media news on few loan scams in the recent past in some banks, leading to massive cash withdrawals. The panic withdrawal resulted in deposit growth plunging into single-digit domain.

"The Islamic banks in particular have liquidity shortages, so how will they invest here?" questioned one top executive of a shariah-compliant bank, wishing not to be named.

He quipped: "Irony is that once we had huge liquidity and but no option to invest. Now many windows are opened to invest but the liquidity remained scarce."

Bangladesh introduced the Shariah-compliant Sukuk or first Islamic bond eyeing prospective investors who avoid traditional interest or 'Riba' on December 28, 2020. The first-ever Bangladesh government Investment Sukuk was issued to execute a project meant to provide safe water to the public, amounting to Tk 80 billion.

On December 30, 2021, the government's second Sukuk raised Tk 50 billion to finance infrastructure development in state-run primary schools.

The government also issued its third Sukuk, which was based on 'istisna'a (manufacturing)' and 'ijarah (lease)' contract, worth Tk 50 billion. The government borrowing from Sukok has totalled Tk 180 billion so far.

The central bank acts as the special purpose vehicle (SPV) and trustee to issue government Sukuk.

[email protected] and [email protected]