The country's mutual fund (MF) industry remains smaller than many regional countries, including neighbouring India.

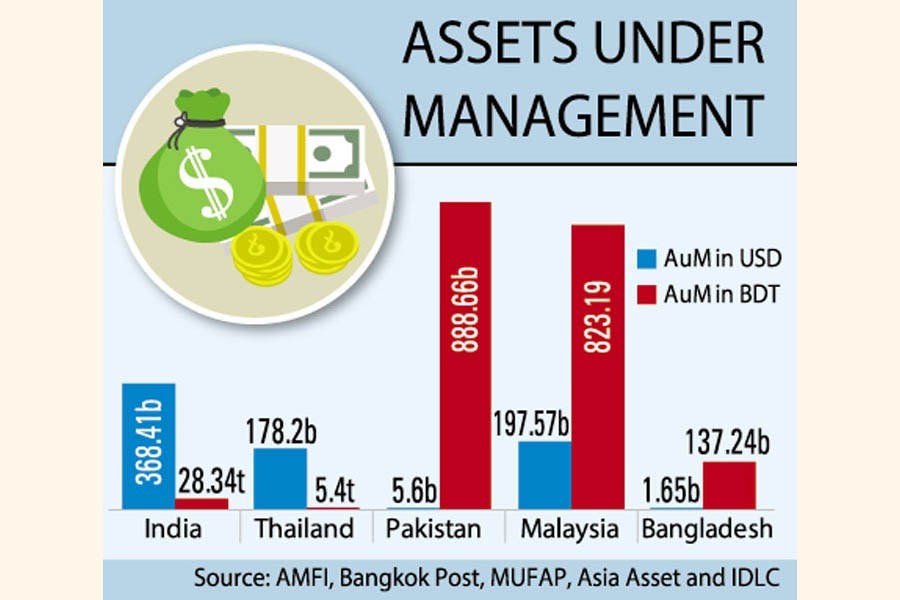

For instance, India's MF industry has outsized Bangladesh's gross domestic product (GDP), thanks to top-notch professionalism of the Indian fund managers and aggressive marketing. The GDP of Bangladesh is estimated at US$330 billion, lower than India's US$ 368.41 billion mutual-fund industry as of October 2020.

The securities regulator and analysts blamed unprofessionalism of fund managers and non-compliance with fund management rules for the stunted growth of the MF industry in Bangladesh.

The MF industry of Bangladesh is worth US$1.65 billion only, which is much lower than those of Pakistan, Thailand and Malaysia.

Local fund managers held the prolonged erosion in the capital market and inadequate publicity campaign responsible for the insignificant growth of the country's MF industry.

Former chairman of the Bangladesh Securities and Exchange Commission Faruq Ahmad Siddiqi said a significant number of investors of the country are day-to-day traders, who tend to book quick profits from small cap companies.

"This is why they have no interest in MFs. And such a tendency among investors has contributed little to the industry's expansion," said Mr Siddiqi.

He said investors of MFs overwhelmingly rely on professionals for managing their investments.

But the efficiency and integrity of the fund managers remain questionable over the years.

"As a result, many investors are unwilling to rely on fund managers as they think they themselves are more capable in managing their investments than the professionals," the former BSEC chairman said.

Most of the MFs were launched following the stock market bubble after 2009 with a view to making quick returns.

"That was not the professionalism on the part of the fund managers and the MFs have yet to overcome the effects of the 2010-11 equity market crash," Mr Siddiqi maintained.

Television commercials with the slogan '…Mutual Fund Sahi Hai' are frequently aired on the Indian electronic media and even such commercials were aired during the live broadcast of the World Cup cricket matches.

Because of secured returns, the units of MFs are given as gifts to the newly-wed couples in India.

According to information available with the Association of Mutual Funds in India (AMFI), the assets managed by the Indian MF Industry was 6.46 trillion rupees as on October 2010 and the amount rose to 28.34 trillion rupees by October 2020, a four-fold jump in a decade.

***On the other hand, assets managed by MFs in Bangladesh were US $ 1.65 billion or Tk 137.24 billion as of September 2020. In 2010, an amount of Tk 41.69 billion was managed under the portfolios of closed-end MFs.

Among other regional countries, the size of MF is US $ 178.20 billion in Thailand, US$ 5.60 billion in Pakistan, and US$ 197.57 billion in Malaysia, according to information of the associations of fund managers of the respective countries.

Presently, the number of listed MFs (closed-end) in Bangladesh is 37 while the number of open-ends is 61, according to the BSEC.

Of 37 listed closed-end MFs, the market price of the units of 22 funds is presently under face value of Tk 10 each. The units of the majority number of listed MFs have been traded below face value for a long time.

The commission has so far issued licences to 48 asset management companies to manage MFs.

Asked, BSEC chairman Prof Shibli Rubayat Ul Islam said there were some problems with the governance and the management of the MFs.

"Many mutual-funds skipped paying dividend as per investors' expectations. They also did not make investments in line with the proportion set in the relevant securities rules," Prof. Islam said.

He said the industry will see better results if proper management of MFs could be ensured.

"We have many good financial analysts who are being matured day by day. They need more funds," Mr Islam said.

He said the MFs will be able to attract investors if returns are greater than fixed deposit receipts (FDRs).

"We are trying our best. It will take at least two years to shape up the capital market," the BSEC chief said.

Responding to another question, he said, the narrow scope for publicity and the significant erosion in the capital market hampered the growth of the MF industry.

Dr Hasan Imam, president of the Association of Asset Management Companies & Mutual Funds (AAMCMF), agreed Bangladesh's MF sector has lower penetration compared with those of the developed and emerging capital markets.

"The share market has gone through a bearish trend in the last 10 years. This makes it difficult for MFs, which invest mostly in listed securities in the share market to generate profits and acquire the capacity to pay dividend," said Mr Imam.

He said with the exception of the state-owned Investment Corporation of Bangladesh, the private fund managers have no scale or capacity to expand the distribution channels for the sector.

"In Bangladesh, there is a lack of diverse sources of investment capital for MFs such as pension schemes, insurance funds, etc. Bangladesh's capital market is relatively young and this takes time to develop," Mr Imam said.

Chief executive officer of the ICB AMCL A. T. M. Ahmedur Rahman said unit holders expect high dividends from the MFs.

"Otherwise, they will not be attracted to such investment vehicles. But the amount of dividends from the MFs declined for different reasons," Mr Rahman said.

For example, he said, the portfolios managed in Bangladesh witnessed erosions of up to 48 per cent, which has not happened in other countries.

"After 2010-11 stock market debacle, the AMCs injected huge funds into listed securities to save the market following requests from different quarters. As a result, it was difficult for the AMCs to attract a significant number of investors to the MFs," he noted.

To add to the woes, investments made by some AMCs, faced troubles for not complying with the rules regarding investment ceiling, he added.

CEO of VIPB Asset Management Shahidul Islam said the investment management industry in Bangladesh has yet to develop compared to that of other countries.

"We hope the industry will be developed day by day," Mr Islam said.

The closed-end MFs managed by the ICB AMCL distributed cash dividends ranging from 4.0 per cent to 6.0 per cent for the fiscal year ended in June.

The CEO of VIPB Asset Management said many MFs did not recommend dividend for the year ended on June 30, 2020 due to the poor market situation.

As per the existing rules, an asset management company is required to invest at least 60 per cent of a fund in the capital market. The remaining 40 per cent of the fund will have to be invested in the money market and fixed income securities.

Of 60 per cent set for the capital market, a minimum of 60 per cent will have to be invested in listed securities.

The mutual funds can also invest in the pre-IPO placement shares after obtaining regulatory consent. As tax-free entities, the MFs also avail 10 per cent quota in initial public offerings.