Eastern Cables, the state-run wire maker, reported to have gained a profit of Tk 8.98 million in the fiscal year 2021-22, even after incurring losses in the first three quarters amounting to Tk 56 million.

The Chattogram-based cable and conductor manufacturer suffered a loss of Tk 27 million in the first quarter, Tk 21 million in the second quarter and Tk 8.0 million in the third quarter of FY2022.

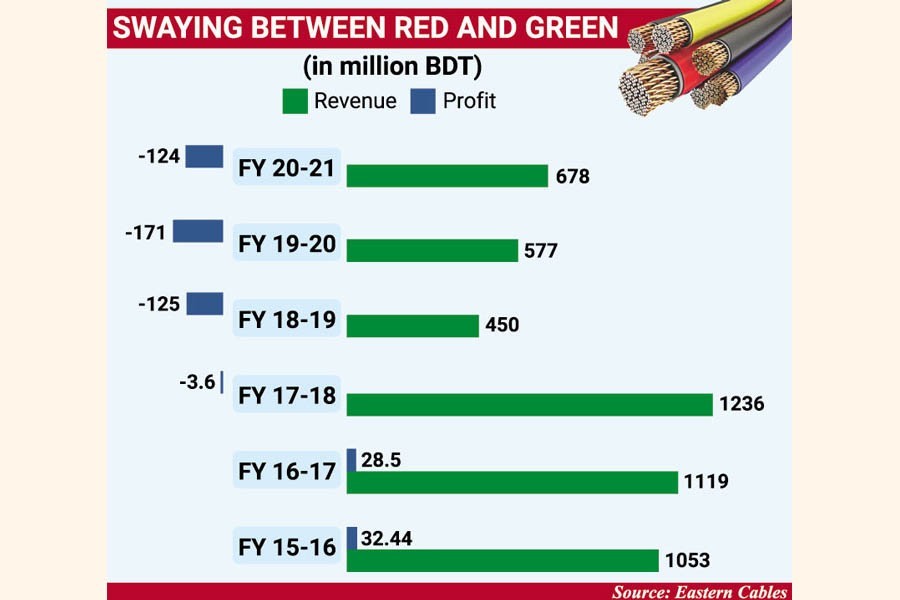

The annual profit is a retreat from losses for four consecutive years since FY18. As a result, earnings per share (EPS) climbed up to Tk 0.34 for FY22 from a loss of Tk 4.68 per share a year ago.

Eastern Cables returned to profit by reducing overhead cost and increasing the selling prices of the products, said company Secretary Md Golam Mawla.

However, a merchant banker said requesting anonymity that it was unlikely for Eastern Cables to have ensured profit after losses of Tk 56 million in the first nine months through March 2022.

He questioned the possibility of the company's earning a profit of Tk 65 million within one quarter after losses, not only in the three quarters but also in the last four years.

The merchant banker said the company revalued its assets during the last quarter of FY22 and might have transferred some money as profits.

Eastern Cables reevaluated its property, plant and equipment to Tk 8.96 billion, up from a written-down value of Tk 160 million until December 2021.

The surplus amount of Tk 8.80 billion boosted the net asset value (NAV) per share to Tk 344.06 for the fiscal year 2021-22, increased from only Tk 10.42 in the previous fiscal year.

"The net asset value per share jumped due to the asset revaluation of the company," said the company secretary.

The board has recommended 2.0 per cent cash dividend for FY22.

Despite the profit, Eastern Cables was the day's second top loser on the stock market on Wednesday, plunging by 11.42 per cent or Tk 26.20 per share to Tk 203.20.

The company's shares already soared before the corporate declaration due to much hype, and that might be the reason behind the price erosion, said the merchant banker.

The stock price jumped 30 per cent or Tk 52 each just in two weeks before the dividend declaration.

The company also disclosed a profit of Tk 21.12 million in the first quarter (Q1) of FY23 ended in September against a loss of Tk 27 million in the same quarter last year.

Eastern Cables, a subsidiary of Bangladesh Steel & Engineering Corporation (BSEC), failed to pay any dividend to investors in the last four years for losses.

The company also failed to achieve its sales target during the time facing a hard competition with the private sector, said company officials. It could not won international tenders for selling its products, they added.

Meanwhile, Eastern Cables has started exporting products to China under a deal signed with the Chinese National Technical Import and Export Corporation in July this year, officials said.

Total export to China under the agreement will be worth $4.20 million.

Listed in 1986, Eastern Cables is the biggest cable and conductor manufacturer in Bangladesh. It produces PVC-insulated and PVC sheathed single-core and multi-core low-tension domestic cables. The production line also includes electric controls and aluminium conductors.

BBS Cables (listed), BRB Cables, Paradise Cables, Khawaja Cable, Poly Cable and Transom Cables are major competitors of the company.

Local cable companies meet more than 90 per cent of the domestic demand.

According to Bangladesh Electrical Merchandise Manufa-cturers Association, approximately 100 companies and 50,000 people are directly or indirectly involved in making and marketing cable wires in Bangladesh.