Stocks witnessed yet another bearish session Thursday, extending the losing streak for the fourth straight day, amid a confidence crisis among investors.

The market started on a negative note and the key index lost about 60 points until the mid-session. However, it recovered some early losses in the later part of the session, eventually ending over 21 points down.

DSEX, the core index of the Dhaka Stock Exchange (DSE), slid 21.24 points or 0.31 per cent to settle at 6,641. DSEX lost over 130 points in the past four consecutive days.

Turnover, the crucial indicator of the market, remained low and the total turnover amounted to Tk 5.15 billion, which was 5.10 per cent higher than the previous day's one-year lowest turnover of Tk 4.90 billion.

Market operators said the ongoing pessimism kept investors mostly inactive as they were continuously losing their risk taking appetite in the market amid persistent volatility.

"The looming uncertainty over the global economy and the commodity market instability continued to hurt investors' sentiment," said a merchant banker.

The investors preferred to hold onto their cash fearing a price hike of necessities further amid the ongoing economic turmoil, he said.

"The recent rise of call money rate indicates that the real economy is using much more money for paying bills due to the inflation which slowed down the funds flow to the capital market," said International Leasing Securities, in its regular market analysis.

The stock market regulator has taken various initiatives to increase fund flow to the market, but no initiative appeared to be working as investors lost confidence in the market, according to a leading broker.

He noted that due to the rising inflation globally, the country's economy started feeling the pinch as import expenditure increased significantly, which created an imbalance in the current account balance and caused a dollar shortfall in the financial market.

The ongoing Russia-Ukraine conflict has been worsening the situation amid disrupting the global supply chain, he added.

EBL Securities said turnover remained sluggish as most investors on the sidelines owing to the temporary circuit breaker, which caused many stocks to remain dearer at the current price level for investors.

Two other indices also ended lower with the DSE 30 Index, comprising blue chips, shedding 7.44 points to finish at 2,451 and the DSE Shariah Index (DSES) lost 2.61 points to close at 1,453.

Major sectors showed mixed performances. Cement sector witnessed the highest loss of 1.30 per cent, followed by financial institutions with 0.70 per cent, food 0.40 per cent and power 0.10 per cent.

On the other hand, engineering, banking and telecom sectors lost 0.70 per cent, 0.20 per cent and 0.10 per cent respectively.

Prices of more than 60 per cent traded issues fell on the prime bourse, as out of 381 issued traded, 230 declined, 99 advanced and 52 remained unchanged on the DSE trading floor.

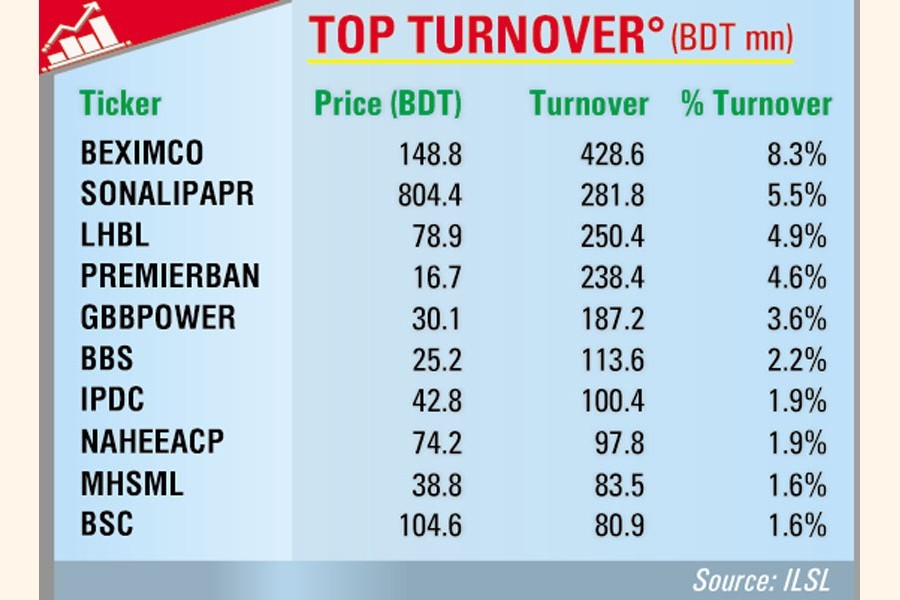

Beximco topped the turnover list with shares worth Tk 428 million changing hands, followed by Sonali Papers & Board Mills (Tk 277 million), LafargeHolcim (Tk 250 million), GBB Power (Tk 187 million) and Bangladesh Building Systems (Tk 113 million).

The newly listed JMI Hospital Requisite Manufacturing continued to top the gainer list for the sixth straight session, posting a 9.96 per cent gain.

The medical equipment manufacturer's share rose 76.50 per cent in the last six trading days since debut on March 31 and closed at Tk 35.30 on Thursday, against its issue price of Tk 20 each.

Uttara Bank was the day's top loser, losing 13.84 per cent, following its price adjustment after a record date.

The Chittagong Stock Exchange (CSE) also ended lower with the CSE All Share Price Index - CASPI -losing 65 points to settle at 19,501 and the Selective Categories Index - CSCX - shedding 38 points to close at 11,700.

Of the issues traded, 170 declined, 56 advanced and 39 issues remained unchanged on the CSE.

The port-city bourse traded 7.20 million shares and mutual fund units with turnover value worth Tk 184 million.