The net withdrawal of foreign funds invested in shares listed with the Dhaka Stock Exchange (DSE) hit Tk 2.83 billion (283 crore) in May last.

The foreign investors were in a selling mood throughout the month.

They sold shares worth Tk 6.24 billion (624 crore) against the purchase worth Tk 3.41 billion in the month, according to the DSE statistics.

The net withdrawal of foreign funds in May might be the highest in a single-month in recent years, said market insiders.

The net foreign investment in April also was negative.

The overseas investors collected shares worth Tk 5.03 billion in the month but sold shares worth Tk 5.28 billion, DSE data shows.

The net fund withdrawal stood at Tk 247 million.

Khairul Bashar Abu Taher Mohammed, Chief Executive Officer (CEO) of MTB Capital, said the foreign investors continued to withdraw part of their fund due to the rising appreciation of US dollar against Taka.

The secretary general of Bangladesh Merchant Bankers Association (BMBA) said the foreign investors were pulling out their funds from frontier markets.

"The overseas investors are pulling out their fund not only from Bangladesh but also from other frontier markets due to rising trend of dollar against local currencies," he stated.

Mr Bashar said foreign investors were mostly on a selling spree, especially on large-cap stocks, taking a toll on the stock indices too.

He, however, expressed his hope that the foreign investments would turn around in near future.

He pinned his hopes on the Chinese consortium that already signed a strategic partner deal with the DSE.

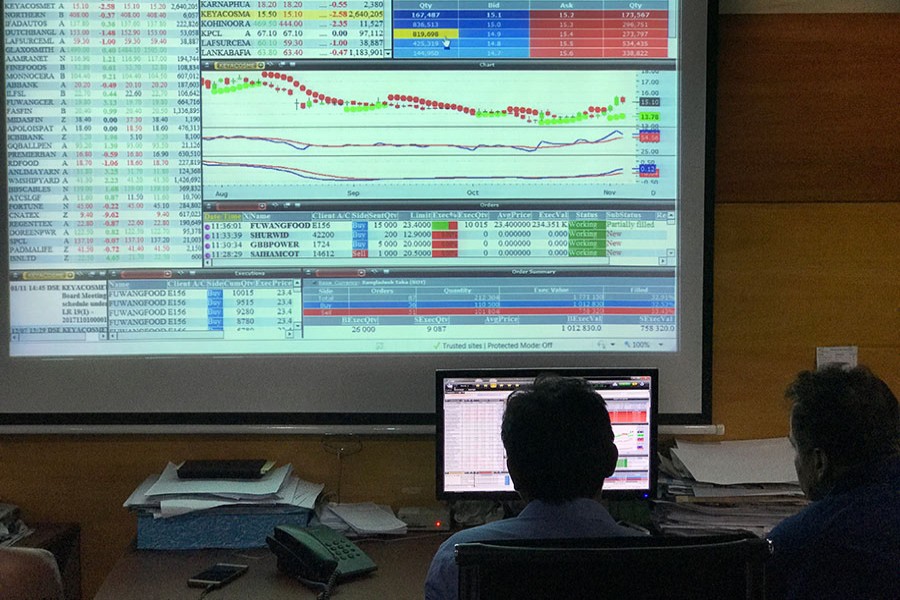

The stock indices of the DSE fell sharply in May.

The DSEX, the prime index of the DSE, registered a cumulative loss of 396 points or 6.90 per cent.

The daily turnover, an important gauge of the capital market, also came down to Tk 4.33 billion on an average in May.

Mostaque Ahmed Sadeque, president of the DSE Brokers Association said, the foreign investors continued selling large-cap stocks.

However, he said the foreign investors were not the market drivers.

Their investments make up less than 2.0 per cent of the DSE's total market cap, he added.

A local stockbroker, who deals with foreign investors, said despite the sharp decline in portfolio investments in stocks, the foreign fund managers still see potential of the Bangladesh stock market.

They view it as a potential one among the emerging markets due to positive macroeconomic indicators, he added.

Foreign investors' preferred sectors were banks, non-bank financial institutions, power and energy, pharmaceuticals, telecoms and IT, said a merchant banker, he stated.

They also focused on some multinational companies that announced healthy dividends and generated good profits, he further said.

In 2017, the overseas investors bought shares worth Tk 65.76 billion and sold stocks worth Tk 48.71 billion.

That took their net investment to Tk 17.05 billion, the DSE data shows.

In 2016, the net foreign investment was Tk 13.41 billion.

The foreign investors then purchased shares worth Tk 50.57 billion and sold their holdings worth Tk 37.16 billion.