Probe-body chief Khondoker Ibrahim Khaled said Monday a "powerful vested quarter", consisting of 200 persons, were behind the collapse of the stock-market and they still dictate terms.

There is a "powerful vested quarter involved in it", Mr Khaled, a former deputy governor of Bangladesh Bank, told a seminar organised at a city hotel by an online news-portal.

The chief of the probe committee on latest capital-market crash was highly critical of the country's existing status of demutualization of the exchanges, saying this, in true sense, is not "fully/purely demutualised".

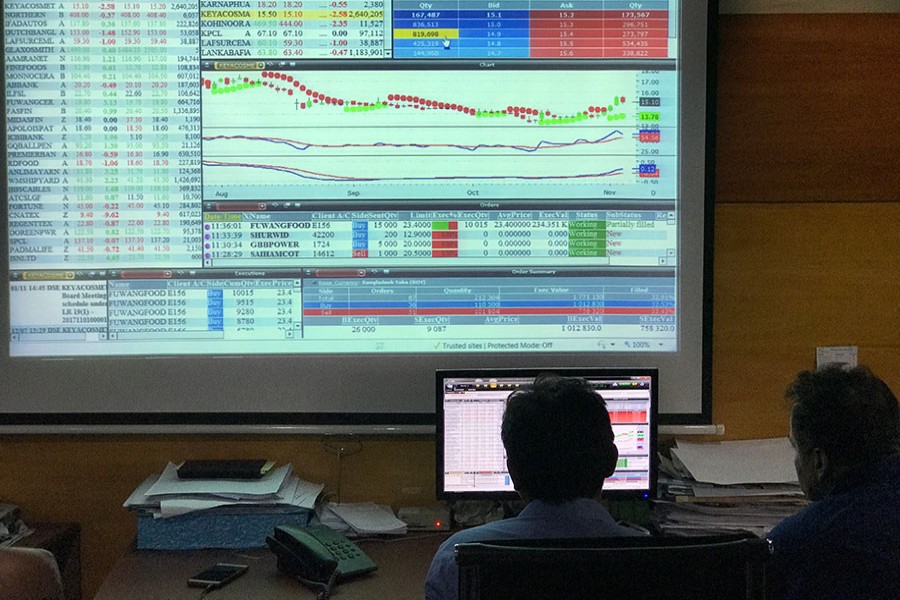

"The demutualisation of the exchanges-DSE and CSE - is not 100 per cent demutualised," said Khondoker Khaled, who was head of the probe body on the 2010 capital-market debacle.

Former caretaker-government adviser Dr AB Mirza Azizul Islam, ex-chairman of the Bangladesh Securities and Exchange Commission (BSEC) Faruk Ahmed Siddiqui and commissioner of the BSEC Swapan Kumar Bala, among others, also spoke at the meet.

Khaled, who joined the function as special guest, said the racket on the DSE consists of 200 persons. "They are so powerful that despite having 40 per cent stakes in the exchange, they dictate everything."

The two exchanges were demutualised or converted into a company by shareholders sometime in 2013 and the existing members hold 40 per cent stakes. Of the remaining 60 per cent, 25 per cent are held by strategic partner/s and the 35 per cent later uploaded.

He said players and administration are different. "Actually the remaining 60 per cent is just similar to that of the independent directors of the banks."

Narrating demutualization experience of the Bombay Stock Exchange, Khaled said they also had opposed it but the then Prime Minister of India who had different capacities on the Indian financial market made their business challenging by creating National Stock Exchange. And later they agreed to go by the book.

On a note of sarcasm, the noted banker said this is actually 'mutualisation (among them)'.

He suggests that the number of members should be at least 1,000 to ensure level playing field on the stock-market.

He termed it difficult demutualisation that so far any strategic partner failed to dig in.

Meanwhile, a Chinese consortium consisting of its two exchanges is in the final process of being strategic partners of the DSE. The CSE is still searching for its strategic partners.

The main topic of Monday's seminar was role of IPOs (initial public offerings) in Bangladesh's industrialisation.

While speaking at the function, Dr Mirza Azizul Islam said there are many reasons behind the low number of IPOs on the market but he believes the slow pace of investment is prime one.

The percentage contribution of the private investment to the GDP remained almost stagnant, he noted.

"There is simply 1.0 percentage-point change in a decade since 2008-09," Dr Islam told the meet.

The economist, who attended the seminar as chief guest, was critical of a large number of merchant banks active on the bourses.

"The large number of merchant banks should compete with each other and there should be a reflection of it," he said.

He mentioned that there is directive by the authorities concerned on submission of IPO proposals every alternate week. "They are just proposing firms doing business in Islampur clothing market," Dr Islam said, actually to mean here weak firms submitting IPOs.

He aired doubt about accurate "due diligence" by the merchant banks when they propose IPOs.

He said earlier there was RPO (repeat public offering) and such system may deepen the fund withdrawal from the public.

He said the authorities should seek obstructions to its revival again.

While speaking on the delay in IPOs, Dr Islam said firms who will issue such RPOs usually have extensive experiences on how to prepare documents and quicken the process.

He said there is also one important reason why that many do not prefer to get involved with the capital market-and that is many believe they need not repay loans to the banks.

"The capital market has some sort of accountability as the listed firms need to submit quarterly reports and conduct annual general meetings."

Former BSEC chairman Faruk Ahmed Siddiqui spoke on the poor listing by the multinational companies, arguing that they are not interested to go public as they do not need funds.

"If there were no expansion and no need for money, they will not go public."

He said there is tax benefit for the listed companies but yet there is no example who has been interested in the market to avail of this facility.

While speaking as special guest at the seminar, BSEC Commissioner Mr Bala said IPOs process takes time as the companies fail to comply with the obligation of producing all relevant documents.

There are many deficiencies while they submit their IPO proposals.

Presently, IPO floating takes to two to three years after submission and it is much longer when they submit the same under book-building method.

Mr Bala, who also served as the managing director at the country's prime bourse, DSE, said they face another obstruction while they are at the final stage of clearing prospectus by CIB (credit-information bureau).

First vice president of Bangladesh Merchant Bankers' Association Md Ahsan Ullah pointed out that India takes just 90 days for floating an IPO.

India usually appoints legal firms who prepare and scrutinize the IPOs.

"We may follow this experience," he said.

Md Moniruzzaman, managing director at IDLC Investment Ltd, said the success ratio in IPO lottery is very much low.

"We hardly find lottery winner even in 100 participants in IPOs, so how the BO holders will be encouraged," he wondered.

However, chief reporter of Gazi TV Raju Ahmed presented keynote paper at the seminar, while Amirul Islam Nayan, executive editor at Businesshour24 moderated the talk.