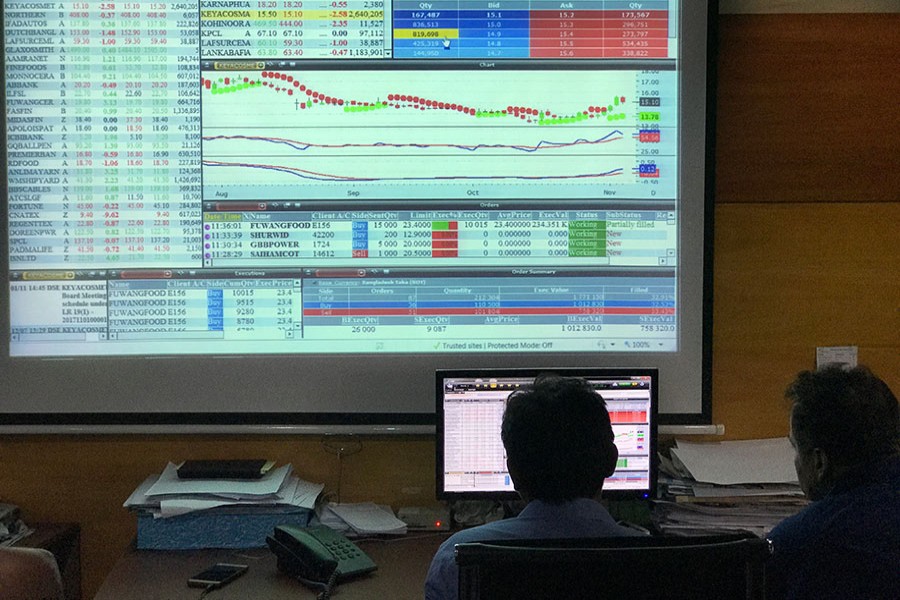

Finance minister AHM Mustafa Kamal expressed his dissatisfaction on Thursday over the conditions of the capital market, which saw seesaw trading in recent weeks.

"Our capital market, as if, is not aligned with the mainstream and as if it is not a part of Bangladesh," the minister rued. "It is totally disintegrated in an isolated area," he added.

He made the remarks after meeting the World Bank's regional director Zoubida Allaoua at his Sher-e-Bangla Nagar office in the capital.

The minister said the country's economy is doing well and the economic fundamentals are also strong.

"…market and our macroeconomic indicators are also very positive, only in one area I fail to understand, why it is happening like that…and .that is our capital market," stressed the minister venting out his unhappiness.

Mr Kamal said he will sit with the stock market people soon.

"They won't be able to prove that the government has deserted them. We gave them whatever they asked for," he asserted.

That said, the businessman-turned-politician sounded upbeat, saying the market will rebound in the foreseeable future.

Referring to his meeting with the World Bank official, the minister said the main focus of discussion was developing the country's capital market.

"We'll have to develop our capital market because we want to give some relief to the banking sector," he said.

Mr Kamal said the bankers have created a mismatch by giving long-term loans from short-term deposits.

This type of mismatch will go when the capital and bond market is developed, he said.

He also said good shares will be in supply to the capital market to make it vibrant.

Replying to a query, the minister said that the government was in no way facing shortage of funds.

He asked the people to let him know if anyone did not get money from banks and failed to make the settlement of letters of credit.

The minister noted that the country is saddled with a fund of Tk 920 billion, which is more than the requirement. "It's not something we're hiding."

He said, "If we had shortage of fund, we would have sold savings instruments or what America does -- we had to print money in the name of quantitative easing. We are not doing that," he added.

Mr Kamal said until now Bangladesh's debt to GDP (gross domestic product) ratio is 34 per cent, which is among the lowest in the world.

World Bank's Zoubida Allaoua said the bank has been supporting Bangladesh's development strategy for a long period.

"And as part of that, we had a discussion on developing the corporate debt market, it is an effort for diversifying access to finance, especially for small and medium enterprises and other sectors that need better access to finance," she said.

Ms Allaoua also said Bangladesh has huge potential for better growth in the future, and it needs a healthy financial sector and a vibrant debt market, which can support that expansion.

"Access to finance by the corporate is extremely important, so we discussed regulatory and enabling environment," she said.

Bangladesh has good fundamental macroeconomic framework, she said, responding to a question over the country's debt position.