In 2022 when the stock market was highly illiquid for the imposition of floor prices, the possibility of capital gains dwindled, often to nil for stretches of time for majority securities.

Companies' distribution of profits in the form of cash dividends was what investors could get, in such a scenario, as returns on investments.

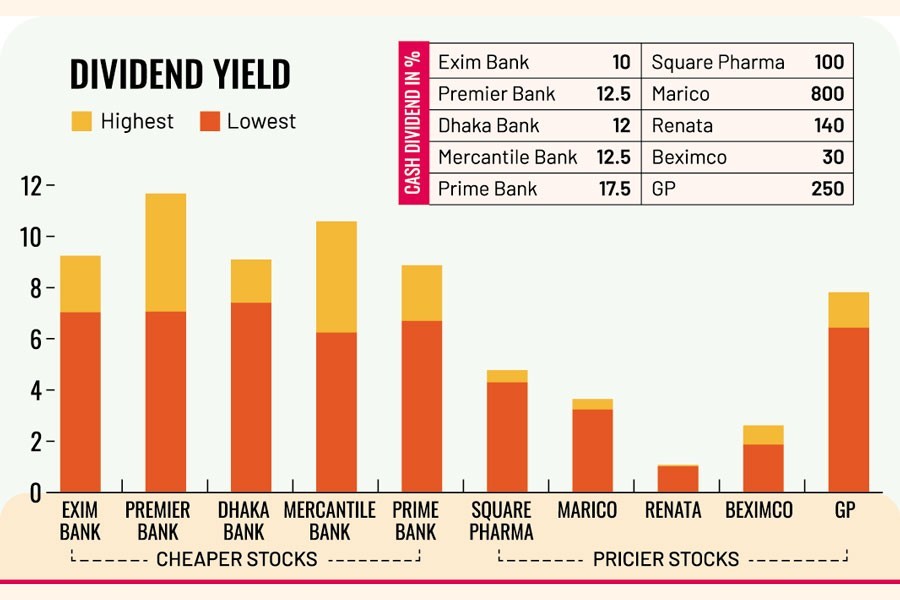

If dividend yield is taken into consideration, cheaper bank stocks served investors better last year than others, including the well-known companies on a high business growth trajectory, such as Square Pharmaceuticals, Marico, and Renata.

Dividend yield of a stock shows how much an investor received in annual dividend for a particular year for owning a share of the company relative to the share price.

Five banks -- Exim Bank, Premier Bank, Dhaka Bank, Mercantile Bank, and Prime Bank, which are even cheaper than many other stocks in the banking sector, ensured dividend yields ranging from more than 6 per cent to nearly 12 per cent.

On the other hand, dividend yields of big-cap pricier stocks -- Square Pharmaceuticals, Marico, Renata and Beximco -- remained way below 5 per cent. Only Grameenphone is an exception among the stocks that used to dominate the turnover chart before the regime of the price movement restriction, with a dividend yield of more than 6 per cent.

Since the dividend yield goes up and down in tandem with the stock price, when yearly dividend is a constant number for a particular stock, it changes every day for that stock.

For investors, their purchasing price is relevant for the return they have got. Hence, the rate at which shareholders enjoyed returns must have been within the lowest and highest dividend yields within the given year, 2022 in this case.

For example, the stock price of Exim Bank was highest at Tk 14.20 and lowest at Tk 10.80 in the year up to its record date. Having a face value of Tk 10, it provided 10 per cent cash dividend. So, the dividend yield hovered between 7.04 per cent and 9.25 per cent.

Similarly, Premier Bank provided dividends at a rate of 7.06-11.68 per cent of its stock price, Dhaka Bank at 7.41-9.10 per cent, Mercantile Bank at 6.25-10.59 per cent and Prime Bank at 6.70-8.88 per cent of the stock price.

Though Square Pharmaceuticals, Marico, Renata and Beximco provided much higher cash dividends, their dividend yields were much less than the banks' because of their high prices on the bourses. The face value of their shares is also Tk 10.

Square Pharma traded at between Tk 208.90 and Tk 232.20 in the year until the record date. It distributed 100 per cent cash dividend to shareholders in 2022. The dividend yield turns out to move between 4.30 per cent and 4.78 per cent.

Another pharmaceutical company Renata is even costlier in the stock market, having traded at Tk 1295-Tk 1378.30. Its 140 per cent cash dividend led to a dividend yield of 1.02-1.08 per cent.

Similarly, Marico Bangladesh, the third-most expensive stock in the market, gave an impressive 800 per cent cash dividend, annualised, in 2022. Still, its dividend yield was between 3.24 per cent and 3.65 per cent.

The banks in this study follow the calendar year for recording their financial performance while Square Pharma, Renata and Beximco follow the financial year ended in June. Marico's financial year is March-April.

Whatever the case, shareholders received dividends against their company ownership in 2022 if they held onto their holdings until the record date.

Their possibility to get a higher return out of their investments would have been thin for investments in stocks that had big jumps and plunges in the year. Predicting the reasonable price to buy a stock would be difficult in that case.

But prices of the stocks analysed in here did not move up and down much on the bourses. Some even languished at the floor prices for long stretches of time.

Ahsanur Rahman, chief executive officer at BRAC EPL Stock Brokerage, said companies have separate dividend policies, but the ones having better dividend payout ratios are better options for investors.

Dividend payout ratio is the ratio of the total amount paid to shareholders in dividends by a company relative to its net income. It is considered a better parameter to weight a stock than dividend yield.

From the historical records, banks seem to have maintained good dividend payout ratios, said Mr Rahman.

Many experts, however, suggest investing for long term in companies with a consistent growth, such as Square Pharmaceuticals, Grameenphone, Renata, and British American Tobacco Bangladesh (BATBC).

It is because some companies have a higher growth potential than others. The companies that can grow faster may deprive investors of dividends for now to invest in expansion and accelerate its growth. That would lead to a much higher equity growth and capital gains.

"Some companies may be an option for availing higher dividends only. But the companies having strong fundamentals are the best options for total returns, including capital gains," said Arif Khan, vice chairman at Shanta Asset Management.

A list of 30 top companies, prepared by IDLC Securities, with high dividend yields ranging from 5.2 to 9.6 per cent excluded all the big-cap pricier but fundamentally-strong stocks. Grameenphone is an exception occupying the seventh position.

Exim Bank, Premier Bank, Dhaka Bank, Mercantile Bank, and Prime Bank took first to fifth position in the order. The dividend yields were calculated with the closing prices on February 12.

Grameenphone distributed 250 per cent cash dividend while its stock price hovered between Tk 319.70 and Tk 387.80. That leads to a dividend yield ratio of 6.44 -7.82 per cent, closer to the level of the banks.

Md. Moniruzzaman, managing director at IDLC Investments, said sustainable growth in earnings, asset quality and corporate governance should get priority for safe investments and returns.

On whether 2022 was a good year for taking positions in cheaper stocks, Arif Khan, of Shanta Asset Management, said, "It's difficult to speak about the sustainable price level due to floor prices. Nevertheless, investors had the scope of choosing some companies for better returns."