The capital market stakeholders have demanded immediate implementation of the recommendations made by the Ministry of Finance intended to infuse new life into the moribund stock market.

The demand came at a press briefing held Thursday on the Dhaka Stock Exchange premises.

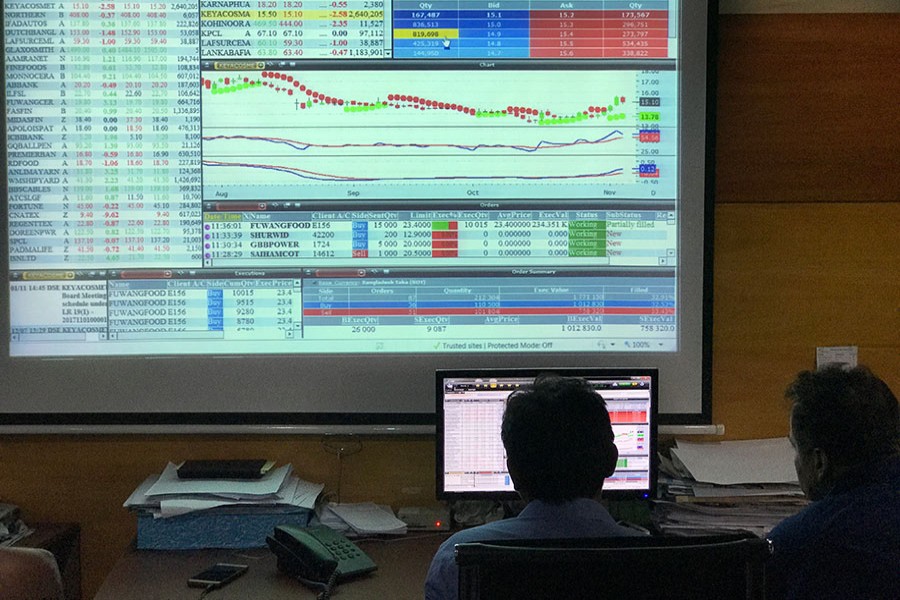

DSEX, the prime index of the Dhaka Stock Exchange, has lost 672 points or 10.76 per cent since January 1, 2018.

Identifying liquidity shortage as the key reason for the market's freefall, the leaders of Bangladesh Merchant Bankers Association and DSE Brokers Association of Bangladesh recently sent a set of proposals to the ministry of finance.

The proposal includes the revision of exposure limit to help revive the capital market.

They also proposed redefining of banks' capital market exposure, extending the timeframe for lowering banks' loan-deposit ratio and increasing the investment capacity of the state-owned Investment Corporation of Bangladesh (ICB).

"Considering the present market situation, the Ministry of Finance has sent these proposals to the Bangladesh Bank for special consideration after holding a meeting on Wednesday," said DBA president Mostaque Ahmed Sadeque.

Mr. Sadeque also urged the central bank to consider the calculation of banks' exposure limit based on buying price instead of market price as many banks' market exposure increased even without fresh investments as the market price went upward.

"Those who have funds are not able to invest in the market as the banks' exposure is calculated on the basis of market price," Mr. Sadeque said.

He also urged the central bank to withdraw the circular issued on February 25, 2014 regarding banks' capital market exposure.

Mr. Sadeque expressed his optimism that if the central bank address the issues immediately, the capital market will rebound soon.

He said that the Wednesday's meeting discussed their proposals and sent those to the central bank for special consideration.

Finance Minister AMA Muhith, Bangladesh Bank governor Fazle Kabir and Bangladesh Securities & Exchange Commission chairman M Khairul Hossain were present at the meeting.

BMBA president Mohammed Nasir Uddin Chowdhury said high interest rate on banks' deposit offered by the commercial banks is another reason behind the liquidity crisis in the capital market.

"Many investors withdrew funds from the capital market as banks offered higher interest rate on deposits," Mr. Chowdhury said.

Noting that the advance-deposit-ratio has an impact on the capital market, he said that though the central bank has extended the timeframe for adjusting AD ratio, some banks has taken preparations for adjusting the ratio.

The banks are not able to expand their credit for this, Mr Chowdhury said.

He said that subsidiaries are not able to invest the fund taken from parent companies as the invested money is also taken into consideration while calculating the exposure limit.

He said the state-owned banks having sufficient funds should come forward to injecting lifeline into the cash-strapped capital market.

He also urged the central bank to address the issues immediately for the interest of the country's capital market.