Insufficient capital adequacy and lack of deterrent penalties, among other frailties, are seen responsible for recurrent embezzlement of investors' money and shares by a section of stockbrokers.

A latest incident of defalcation of investors' shares and money in Tamha Securities leads investors and experts to diagnose the reasons for embezzling funds by a section of the stockbrokers this way.

This securities' dealer allegedly pocketed its clients' hard-earned money worth around Tk 870 million.

Such insidious incidents of pocketing clients' money and shares also took place earlier also, they say and name Banco Securities and CREST Securities who allegedly misappropriated a substantial amount of investors' money and shares both.

Former chairman of Bangladesh Securities and Exchange Commission (BSEC) Faruq Ahmad Siddiqi cautions the market will suffer serious lack of confidence if misappropriation of investors' money and shares goes unabated.

"A lack of regular monitoring and strict enforcement is mainly remissible for the incidents of embezzling investors' money and shares," says Mr Siddiqi.

The misappropriation of investors' money is normally determined by the shortages of investors' funds deposited into consolidated customer accounts maintained by stockbrokers.

The securities regulator had addressed the shortage of clients' funds worth around Tk 953.13 million for the fiscal year 2018-19.

In most of the commission meetings held in recent years the securities regulator warned stockbrokers and imposed penalties for fund shortages in consolidated customer accounts.

The former BSEC chairman feels it's not difficult to contain such occurrences if exemplary punishments such as cancellation of broking licences are ensured following their crimes.

Previously, the securities regulator had made decisions of cancelling some licences of the brokers who embezzled investors' money and shares.

But, those brokers were able to continue their business operations as the securities regulator withdrew the decisions following the adjustments of clients' funds.

"The incidents of pocketing investors' money and shares will continue if a stockbroker is acquitted even after committing serious crimes like embezzlement of clients' funds," says Mr Siddiqi.

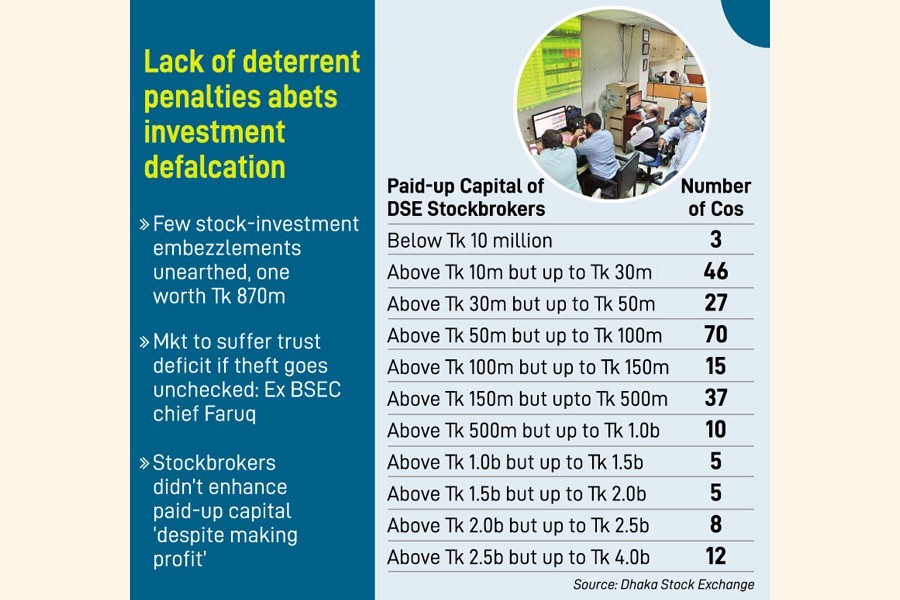

The BSEC enacted the risk-based capital adequacy rules on May 29, 2019 setting minimum capital requirement ranging between Tk 50 million and Tk 150 million for the stockbrokers in accordance with the nature of their operations.

But the paid-up capitals of the majority of stockbrokers on Dhaka Stock Exchange (DSE) still remain below Tk 150 million, posing threat to the safety of investors' money kept in custody of the brokers.

The DSE officials said the exchanges' stockbrokers were allowed to enhance their paid-up capital phase by phase by June 30, 2022.

"But, the situation says that most of the brokers will not be able to comply with the rules within the deadline," says one DSE official.

He mentions that the stockbrokers, other than those who received licence after demutualisation, are also the shareholders in the stock exchanges.

The stockbrokers did not expand their paid-up capital despite making profits year after year and realised money against the exchange's shares sold to Chinese strategic partner.

The allegations of misappropriating investors' shares and money so far were raised mainly against the brokerage firms which are not subsidiaries of corporate entities.

"The brokerage firms which are the subsidiaries are liable to parent companies and their boards. The officials of the subsidiaries will lose jobs if they embezzle their clients' money and shares," says Saiful Islam, a director of BRAC EPL Stock Brokerage.

He notes that corporate practice maintained by the subsidiary brokerage firms ensures the safety of their clients' funds and money.

"Such corporate practice is absent from many brokerage firms which are not subsidiaries," says Mr Islam, also a former senior vice-president of the DSE.

The brokerage firms owned by primary shareholders of the premier-bourse DSE are not able to be included in the list of top 10 or 20 brokers.

The firms which were on the 20 top brokers' list in 2021 are subsidiaries of corporate entities like banks, insurers and financial institutions.

LankaBangla Securities topped the chart of top 20 brokers selected for the year 2021 followed by ICB Securities Trading Company, UCB Stock Brokerage, IDLC Securities, City Brokerage, City Brokerage and BRAC EPL Stock Brokerage.

A market-insider says the scope of dissolving investors' claims got reduced as the stockbrokers realised money by selling their shares held with the exchange.

Before the 2010-11 stock-market debacle, many ones were interested to purchase a brokerage firm even for Tk 1.0 billion following the then bull run of the market.

After the burst of bubble, the value of a brokerage firm came down below Tk 300 million and all brokers already realised money selling 25 per cent of their shares held with the exchange.

"Under such a situation, it's difficult to dissolve investors' claims lodged against a rogue stockbroker, having a market value of Tk around Tk 250 million, who maintains investors' funds worth around Tk 500 million," says the DSE official about the dichotomy.