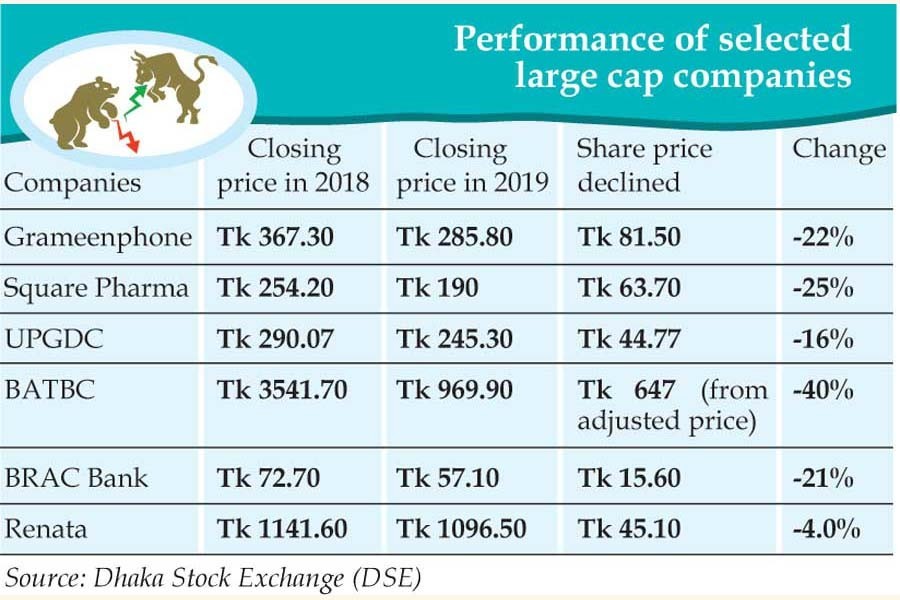

Large cap listed companies played a significant role in the huge erosion of the broad index during the just concluded year because of the companies' significant share in market capitalisation.

The price movements of some six large companies have around 35 per cent share in market capitalisation of the Dhaka Stock Exchange (DSE).

The companies are Grameenphone, United Power Generation & Distribution Company (UPGDC), British American Tobacco Bangladesh Company (BATBC), BRAC Bank and Renata.

The price movements of these companies leave huge impacts on the broad index of the premier bourse DSE in line with the free float market cap calculation of the companies.

The core index DSEX shed 4.30 points following 1.0 per cent price correction witnessed by the Square Pharmaceuticals.

Similarly, for 1.0 per cent share price correction witnessed by Renata, BATBC, BRAC Bank and Grameenphone, the DSEX loses 1.94 points, 1.90 points, 1.61 points and 1.59 points respectively from the core index.

As a result, the price corrections of these companies left huge negative impact on the DSE broad index DSEX which declined 17.31 per cent or 932.71 points to close at 4452.93 points on closing session of 2019.

Except the marginal price correction witnessed by Renata, the share prices of the remaining five large cap companies declined ranging from 16 per cent to 40 per cent in the just concluded calendar year.

Md. Moniruzzaman, managing director at IDLC Investments, said some large cap companies lost prices as their growth declined compared to peer companies.

"Secondly, due to the spat between the Grameenphone and its regulator created uncertainty among general investors. Thirdly, the liquidation of funds in the frontier markets also cast negative impact on the market prices of some large cap companies," Moniruzzaman told the FE.

The share price of Grameenphone closed at Tk 367.30 each on the closing session of 2018.

The company's share price displayed volatility throughout the 2019.

Finally, the company's share price closed at Tk 285.80 each with a loss of 22 per cent or Tk 81.50 compared to closing price of the previous year.

The share price of Square Pharmaceuticals closed at Tk 254.20 each on the closing session of 2018.

The company's share price fluctuated ranging from Tk 250 to Tk 270 till August, 2019.

The company witnessed sharp price correction in last four months of the just concluded calendar year.

At the end of the year, the company's share price came down to Tk 190 with a loss of 25 per cent or Tk 63.70 per share from the closing price of the previous year.

The share price of United Power Generation & Distribution Company (UPGDC) closed at Tk 290.07 on the closing session of 2018.

In 2019, the company's share price and rose up to Tk 419.10 on February 20, 2019.

Later, the company's share price displayed ups and downs and came down to Tk 245.30, which was 15.43 per cent less than the closing price of 2018.

The share price of British American Tobacco Bangladesh Company (BATBC) closed at Tk 3541.70 per share on the closing session of 2018.

Later, the company displayed an upward trend in January, February and March and closed at Tk 4904.20 each on March 18, 2019.

Following the issuance of stock dividend the company's adjusted share price settled at Tk 1616.90 on April 7, 2019.

Afterwards, the share price movement almost remained flat till December and finally closed at Tk 969.90 each on December 30, 2019.

During the just concluded year, the company's share price declined 40 per cent from the adjusted price of April.

The BATBC disbursed 500 per cent cash dividend and issued 200 per cent stock dividend for the year ended on December 31, 2018.

The share price of BRAC Bank closed at Tk 72.70 each on the closing session of 2018.

Later, the company's share price rose up to Tk 87 in March and the price displayed ups and downs and closed at Tk 57.10 each on December 30, 2019.

As a result, the company's share price declined 21.45 per cent or Tk 15.60 in the just concluded year.

The share price of Renata closed at Tk 1141.60 each on the closing session of 2018.

Later, the company's remained almost flat till July and later displayed an upward trend in November and closed at Tk 1345.80 each on November 13, 2019.

During rest of the sessions, the company's share price declined significantly following major corrections of the market.

On the last session of 2019, the share price of Renata closed at Tk 1096.50 with a loss of 4.0 per cent compared to the closing price of the previous year.