Dhaka bourse closed the week lower as most major sectors witnessed price correction, with investors taking to the sidelines.

In the outgoing week, investors' participation declined 29 per cent, leaving a negative impact on the benchmark index and the turnover as well.

As most listed securities entered the correction territory, the market capitalisation on Dhaka Stock Exchange (DSE) saw a decline of 0.34 per cent or Tk 20.11 billion, compared to the previous week.

Major sectors such as financial institutions, engineering, fuel & power, pharmaceuticals & chemicals and telecommunications contributed most to driving down the benchmark DSEX index.

However, general and life insurers came forward to save the DSEX from a large fall.

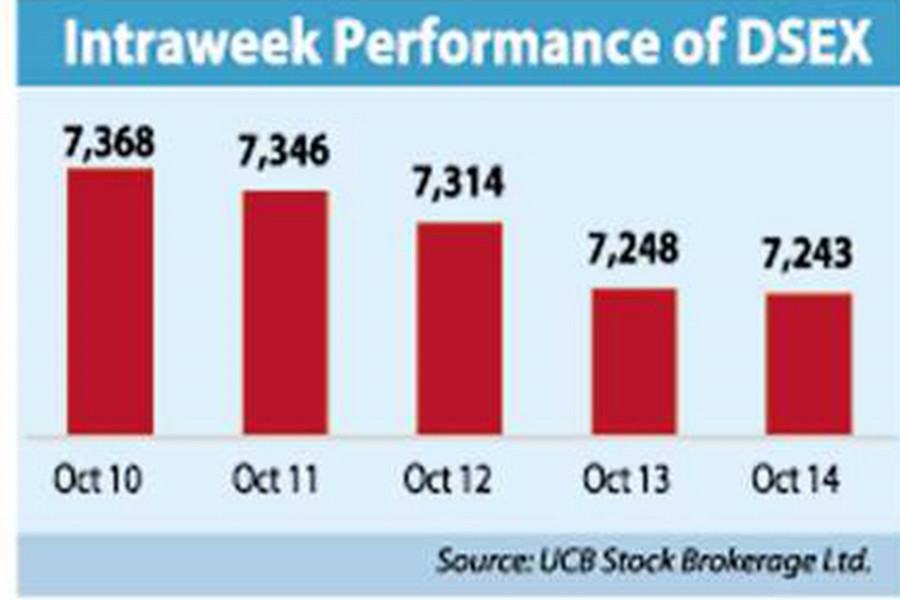

During the week, four trading sessions, out of five, saw the DSEX slip into the red.

The market index closed the first session of the week marginally higher only to retreat in the next four sessions.

At the end of the week, the DSEX settled 1.36 per cent or 99.70 points lower at 7243.27 while the blue-chip DS30 index ended at 2919.14 points, losing 1.74 per cent or 48.25 points.

The Shariah-based DSES index also fell 1.78 per cent or 28.35 points to close at 1567.44 points.

According to a market review of the International Leasing Securities, the broad index of the premier bourse -- DSEX -- slipped into the red as many investors opted to book profits.

"They booked profit from large-cap sectors, especially travel & leisure, services & real estate and ceramic sectors. The bargain hunters, however, showed their buying appetite, especially for mutual fund sector," it said.

Meanwhile, the daily average turnover of DSE also dropped 28.78 per cent to Tk 18.12 billion, compared the previous week.

Of 382 issues traded, 124 advanced, 231 declined and 23 remained unchanged during the week.

On Thursday, the last day of the week, the market capitalisation at the DSE stood at Tk 5.80 trillion, down 0.34 per cent from the previous week.

According to a market analysis by EBL Securities, continuous corrections and declining turnovers have prompted investors to adopt a wait-and-see approach.

It also said investors also continued their portfolio restructuring to take positions on the fundamentally sound stocks based on ongoing earnings and dividends declarations.

Of the major sectors that experienced price correction, financial institutions fell 5.3 per cent, fuel & power 3.7 per cent, telecommunications 3.1 per cent, engineering 1.9 per cent, pharmaceuticals & chemicals 1.3 per cent and textile 0.2 per cent.

On the other hand, tannery sector advanced 5.2 per cent, mutual fund 1.9 per cent, general insurance 1.4 per cent and banking sector 0.2 per cent.

Investors' participation was concentrated mostly on pharmaceuticals & chemicals sector which grabbed 15.6 per cent of the market turnover, followed by textile (12.1 per cent), fuel & power (10.3 per cent), banking (10.1 per cent) and engineering (8.7 per cent).

LafargeHolcim Bangladesh topped the scrip-wise weekly turnover chart with a daily average turnover of Tk 1.17 billion.

NCC Bank was the number one gainer, advancing 29.51 per cent to close at Tk 15.20 each.

Daffodil Computers was the worst loser, shedding 12.93 per cent to close at Tk 65.30 each.

The indices of Chittagong Stock Exchange (CSE), namely CSCX and CASPI, also slumped by 196.2 points and 324.6 points respectively.