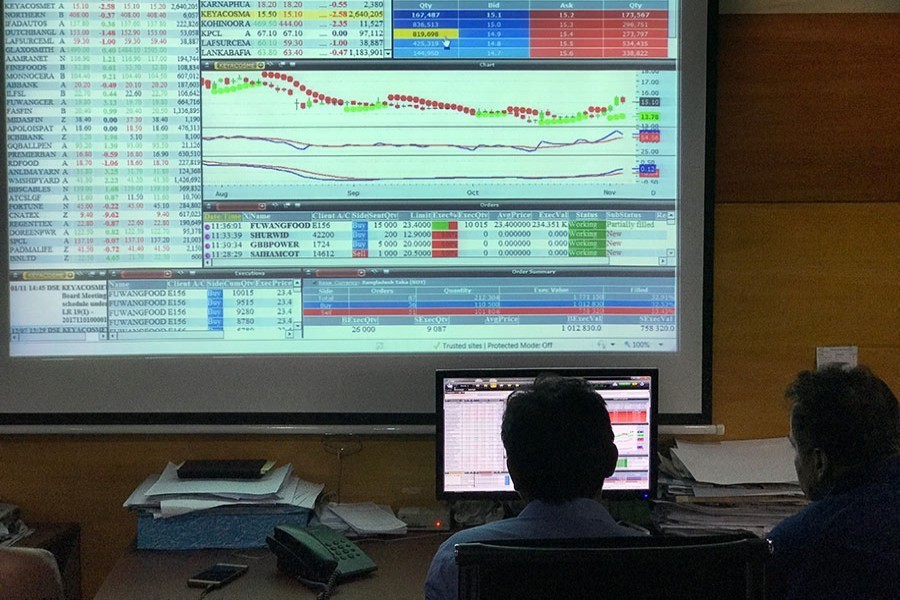

The benchmark index in the Dhaka stock market plummeted in the outgoing week after a single-week break, as investors rushed to book profit ahead of annual earnings and dividend declaration season.

Of the five trading days this week, three sessions faced corrections and the two other sessions ended marginally higher.

Week on week, DSEX, the prime index of Dhaka Stock Exchange, dropped 94.59 points or 1.33 per cent to settle at 6,991 after gaining 62.43 points in the previous week.

Market analysts said heavy profit-booking sell-offs in major sector stocks, particularly on Thursday, the last day of the week, pulled the market lower.

The market witnessed high volatility almost all the weekdays as investors traded cautiously amid profit-booking tendency, they said.

The latest circular of Bangladesh Bank regarding the capital market exposure limit of non-bank financial institutions created a panic among investors, according to International Leasing Securities.

As a result, the non-bank financial institutions sector suffered a big loss of 5.10 per cent during the week.

The central bank brought the non-banking financial institutions under its regular monitoring and listed the instruments which will be treated as stock market investment for NBFIs.

All listed shares, debenture, corporate bonds, mutual funds and other products at market prices shall be considered share market investment when it comes to the NBFIs, according to the BB circular issued on Tuesday.

The loans to their subsidiary companies doing direct or indirect business with the stock market will also be considered stock market investment.

The NBFIs have also been asked to submit reports on capital-market investments to Bangladesh Bank on a quarterly basis.

Trading activities remained sluggish as most investors remained on the sidelines, looking for opportunities to take new positions in prospective companies ahead of the December-end declarations, said a leading broker.

During this week, the blue-chip DS30 index also slipped 23.64 points to finish at 2,573 and the DSE Shariah Index (DSES) lost 9.47 points to close at 1,508.

The week's total turnover clocked in at Tk 59.67 billion on the prime bourse, down from Tk 66.18 billion in the week before.

The daily turnover averaged out at Tk 11.93 billion on the premier bourse, which was 10 per cent lower than the previous week's average of Tk 13.23 billion.

Investors were mostly active in the pharma sector, which captured 13.3 per cent of the weekly total turnover, closely followed by miscellaneous (12.7 per cent) and engineering (11 per cent).

Market capitalisation of the DSE also declined 1.03 per cent to Tk 5,609 billion on Thursday from Tk 5,667 billion in the week before.

Major sectors suffered losses with general insurance facing the highest correction, losing 6.40 per cent, followed by non-bank financial institutions (5.20 per cent), life insurance (3.40 per cent), power (2.0 per cent), cement (1.60 per cent), engineering (1.50 per cent), telecom (1.40 per cent), banking (1.10 per cent and pharma (1.0 per cent).

More than 72 per cent traded issues lost prices during the week, as out of 386 issues traded, 280 declined, 87 advanced and 19 issues remained unchanged on the DSE trading floor.

Fortune Shoes was the most traded stock with shares worth Tk 5.01 billion changing hands, followed by Beximco, Orion Pharma, Bangladesh Shipping Corporation and Saif Powertec.

Apex Foods was the week's top gainer, posting a 30.54 per cent gain, while the newly listed Union Insurance was the worst loser, shedding 16.49 per cent after the recent 'abnormal' price hike.

The Chittagong Stock Exchange (CSE) also ended lower, with the CSE All Share Price Index (CASPI) plunging 310 points to settle at 20,459 and the Selective Categories Index (CSCX) losing 189 points to close the week at 12,283.

Of the issues traded, 261 declined, 87 advanced and eight remained unchanged on the CSE trading floor.

The port city's bourse traded 74.50 million shares and mutual fund units with turnover value of Tk 2.18 billion.