Shares of around 13 per cent listed companies are being traded at the prices below their face value of Tk 10 as they have failed to perform as per investors' expectation.

Of 319 companies listed with the country's stock exchanges, the share prices of 44 have gone down below face value.

Many of those companies were also shifted to 'Z' category for not recommending any dividend.

Of 44 companies, 15 are textile companies, nine are non-banking financial institutes (NBFIs), four each are banks, engineering companies and pharmaceutical companies.

Among the companies whose shares are being traded below face value, the share price of United Airways (BD) has come down to lowest level on the Dhaka Stock Exchange (DSE).

The company's share price closed at Tk 1.40 each on Thursday on the premier bourse DSE.

Preferring anonymity, a DSE shareholder said many of the companies whose shares went down below face value do not deserve an offer price of Tk 10 per share in the IPO (initial public offering).

"The exchange has no role in bringing companies having poor fundamentals. The exchange has no authority of even giving an opinion on the IPO proposal," the DSE shareholder said.

He said the regulator approved the companies' IPO proposals assessing their financials," the DSE shareholder said.

"The share price of a company automatically will come down below face value if the sponsors go public with ill motive."

"Many companies issued bonus shares year after year without expansion move. Later the sponsors of those companies went out of the market by selling their shares," the DSE shareholder said.

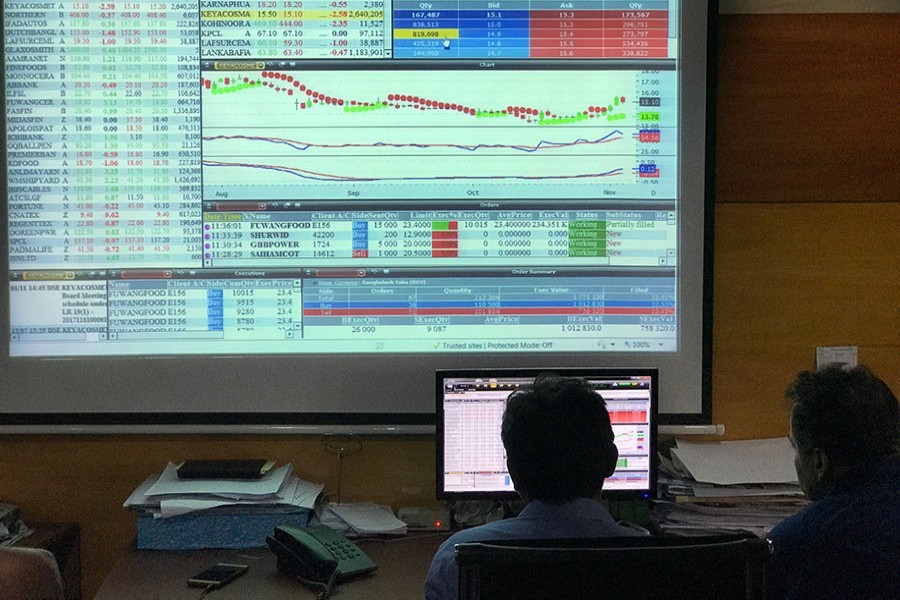

He also said DSE featured a daily turnover of above Tk 20 billion before the 2010-11 market debacle but the presently the turnover came down below Tk 4.0 billion.

On Thursday, the share price of Alif Manufactruing Company closed at Tk 7.80 each, Allex Industries Tk 9.40, C & A Textile Tk 2.10, Dacca Dyeing Tk 3.30, Delta Spinners Tk 4.20, Familytex (BD) Tk 2.40, Generation Next Fashions Tk 3.0 and Maksons Spinning Mills Tk 5.50.

Of other textile companies, the share price of Mithun Knitting & Dyeing Tk 8.40, Nurani Dyeing & Sweater Tk 9.50, RN Spinning Tk 4.0, Safko Spinning Mills Tk 8.90 each, Tallu Spinning Mills Tk 3.60, Tung Hai Knitting & Dyeing Tk 2.60, and Zahintex Industries Tk 4.80.

On Thursday, the share price of Bangladesh Industrial Finance Company closed at Tk 2.60 each, Fareast Finance & Investment Tk 2.90, FAS Finance & Investment Tk 7.20, and International Leasing & Financial Services Tk 6.30.

Of other NBFIs, the share price of Peoples Leasing and Financial Services Tk 3.0, Premier Leasing & Finance Tk 7.30, Prime Finance & Investment Tk 6.60, Union Capital Tk 6.90 and First Finance Tk 3.90.

Of the listed banks, the share price of AB Bank closed at Tk 8.20 each, ICB Islamic Bank Tk 2.90 each, National Bank 8.30, and Standard Bank 8.90 on Thursday.

Of the pharmaceuticals and chemicals companies, the share price of Beximco Synthetics closed at Tk 3.50, Central Pharmaceuticals Tk 9.10, Far Chemical Industries Tk 8.30 each, and Keya Cosmetics Tk 3.40.

Of the engineering companies, the share price of Appollo Ispat Complex closed at Tk 4.60 each, Bd. Thai Aluminium Tk 9.40, Golden Son Tk 7.1, and Olympic Accessories Tk 6.90.

Of other companies, the share price of Bangldesh Services closed at Tk 5.20 each, Fu-Wang Ceramic Industries Tk 7.90, Shinepukur Ceramics Tk 9.10, Meghna Pet Industries Tk 8.60 each and Khan Brothers PP Woven Bag Industries Tk 5.60.

Many 'Z' category companies incurred loss for the year ended on June 30, 2019.

The companies are Golden Son, Alltex Industries, familytex (BD), Meghna Pet Industries, and Zahintex Industries.

Earlier, the Dhaka Stock Exchange (DSE) reviewed the performances of 14 companies which violated the listing regulations by recommending no dividend in last five years.

The DSE reviewed the companies' performance as per the section 51 (1) (a) of the DSE Listing Regulations, 2015.

The section says any listed securities may be de-listed if the issuer has failed to declare dividend (cash/stock) for a period of five years from the date of declaration of last dividend or the date of listing with the Exchange.

The premier bourse DSE has not yet taken take its final decision regarding the fate of 14 companies as the securities regulator has not delivered its instruction in this regard.