Universal Financial Solutions appears to have committed another fraud of Tk 500m

Investor National Bank has tried "all means to recover the money" but failed

MOHAMMAD MUFAZZAL | Sunday, 8 January 2023

The National Bank Limited (NBL) emerges as a victim of another financial fraud by asset manager Universal Financial Solutions (UFS) Equity Partners as it has failed to track down its investment of Tk 500 million into two special purpose funds.

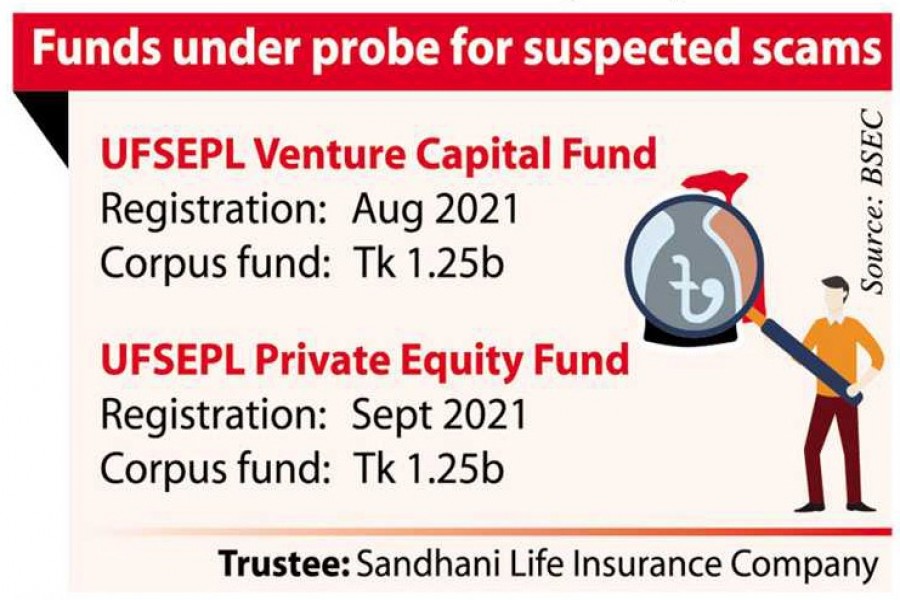

Both the funds -- UFSEPL Venture Capital Fund and UFSEPL Private Equity Fund -- were registered at the end of 2021. The NBL disbursed Tk 250 million for each of the funds on receiving an NOC from the Bangladesh Bank (BB).

In the last nearly one year, fund manager UFS Equity Partners has not given any details to the NBL about the utilization of the money.

With no clue about the investment, the central bank scrapped the NOC in July 2022. It also asked the NBL to recover its contribution.

NBL Managing Director Md Mehmood Husain said the lender had tried all means to recover the money but to no avail.

"We are in trouble as the top person of the Universal Financial Solutions is out of communication," he added.

The Bangladesh Securities and Exchange Commission (BSEC) launched an investigation in December last year to find out if illicit payments had been made out of bank accounts of the alternative investment funds to the benefits of the fund manager and other parties.

The developments have heightened concerns over the operations of UFS Equity Partners that already made headlines after its top executive Syed Hamza Alamgir fled the country siphoning off Tk 1.58 billion from four other financial instruments.

The scam-hit funds are UFS Popular Life Unit Fund, UFS-IBBL Shariah Unit Fund, UFS-Bank Asia Unit Fund, and UFS-Padma Life Islamic Unit Fund.

In January 2022, the central bank issued an NOC to the NBL in favour of its investments of Tk 1 billion in UFSEPL Private Equity Fund and Tk 1 billion in UFSEPL Venture Capital Fund.

Commercial banks are allowed to invest up to Tk 2 billion in special purpose funds as per a 2015 circular of the BB. Such investments are not taken into account in estimating banks' exposure to the stock market.

The NOC was issued attaching some conditions to be fulfilled by the investor.

The first installment for each fund was supposed to be disbursed against a specific investment proposal and the entire amount to be paid in four installments. The second installment would follow only after proper utilization of the first installment. The central bank was to be apprised of the use of the investment on quarterly basis.

The UFS received Tk 500 million from the NBL in the first installment, saying the money would be invested in the money market.

But in March 2022, when the bank sought information about the utilization of the investment, the UFS kept the matter hanging for long and then supplied fake documents, according to bank officials.

The inquiry committee has been asked to collect bank statements of both the funds from their inception.

When asked about findings, a member of the committee, which comprises an additional director, a deputy director, and an assistant director, said, "The probe is yet to be completed".

In a letter, the BB instructed the NBL to get the money back with the help of the trustee, Sandhani Life Insurance Company, of the funds.

Mizanur Rahman, company secretary of Sandhani Life Insurance, said that the fund manager had been extending time to provide information at first. Then the trustee held a meeting with the asset manager on November 22 and it said the NBL's fund would be returned by December.

"Now, the securities regulator has to dig out what the fund manager did with the money."

mufazzal.fegmail.com