ake steps for setting complaint box in every district and upazila for common people to submit objections about unauthorized financial institutions and individual moneylenders, the High Court orders Bangladesh Bank.

At the same time, the court in its order Tuesday asked the central bank to prepare a complete list of the unauthorized financial institutions and moneylenders and submit it within two months.

An HC bench comprising Justice Abu Taher Md Saifur Rahman and Justice AKM Zahirul Huq passed the orders after holding hearing on a writ petition filed for such action to discipline freewheeling FIs against the backdrop of umpteen irregularities.

Following the writ petition the High Court on September 27 in 2021 asked the relevant bodies of the government to take legal action against the institutions which are dealing in financial activities, including microcredit business, across the country without any valid licence or approval.

It also asked the Bangladesh Bank governor to form a special committee regarding the activities of the unauthorized financial institutions as well as the microcredit financial institutions across the country and to submit a report to the court within 45 days.

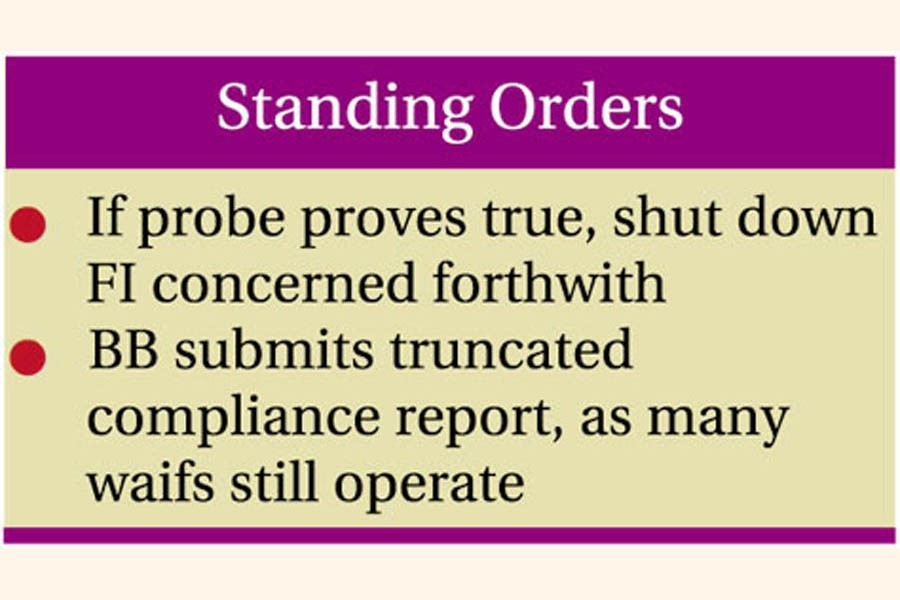

"During the investigation, if the existence of any unauthorized or unlicensed financial institution or microcredit financial institution is found, shut down the offices of those entities at once and take legal action against the responsible persons with the help of the local administration," the court also says in its strict direction for the respondents.

Complying with the High Court orders, the Bangladesh Bank has formed a high-powered special committee to probe the allegations against the unauthorized and unregistered financial institutions as well as the microcredit financial institutions.

In a compliance report Bangladesh Bank has also stated that it has issued letters to the Deputy Commissioners (DCs) and Superintendents of Police (SPs) of the 64 districts to prepare the list of the unauthorized financial institutions and individual moneylenders.

Thereafter, the central bank has received some lists from some of the DCs and SPs in the meantime and it will take legal action against those financial institutions immediately, also reads the compliance report.

A total of 19 teams are working to look into the allegations against the unauthorized financial institutions.

Some unregistered financial institutions are continuing their activities by taking advantage of filing lawsuits and writ petitions. The High Court fixed April 20 for fixing a date for hearing on the writ petitions filed by those institutions who are taking advantage.

In the earlier order the High Court also had issued a rule upon the government bodies concerned to explain in four weeks as to why their failure to monitor and supervise the activities of the unauthorized financial institutions and microcredit financial institutions should not be declared 'illegal'.

Finance secretary, Bangladesh Bank governor, Microcredit Regulatory Authority's executive vice-chairman and director-general of the social welfare department were asked to comply with the ruling.

The writ petition was filed with the High Court seeking its direction upon the government bodies to take necessary steps for imposing a ban on the informal high-interest money-lending activities across the country.

Barrister Syed Sayedul Haque Suman, a Supreme Court lawyer, filed the petition with the High Court on September 7 last year as public-interest litigation.

Barrister Suman himself took part in the hearing in support of his petition, while Barrister Munirujjaman Munir appeared for the Bangladesh Bank and deputy attorney-general Barrister Wayesh Al Haruni represented the state.

During the hearing, Barrister Suman said only 746 institutions have the licence from the Microcredit Regulatory Authority to run microcredit functions, while thousands of institutions are conducting microcredit operations across the country sans licence.