Tax-payment culture has not yet developed even among numerous government organisations although finance ministry is willing to allocate requisite funds, says the revenue board's chief at a new budget talk.

"Some government organisations have 'anti-tax payment attitude," the National Board of Revenue (NBR) chairman, Abu Hena Md Rahmatul Muneem, told economic reporters at the meet Tuesday.

The revenue board gets flooded with applications for tax exemption, and often grievances are expressed against the agency for not considering these tax pleas.

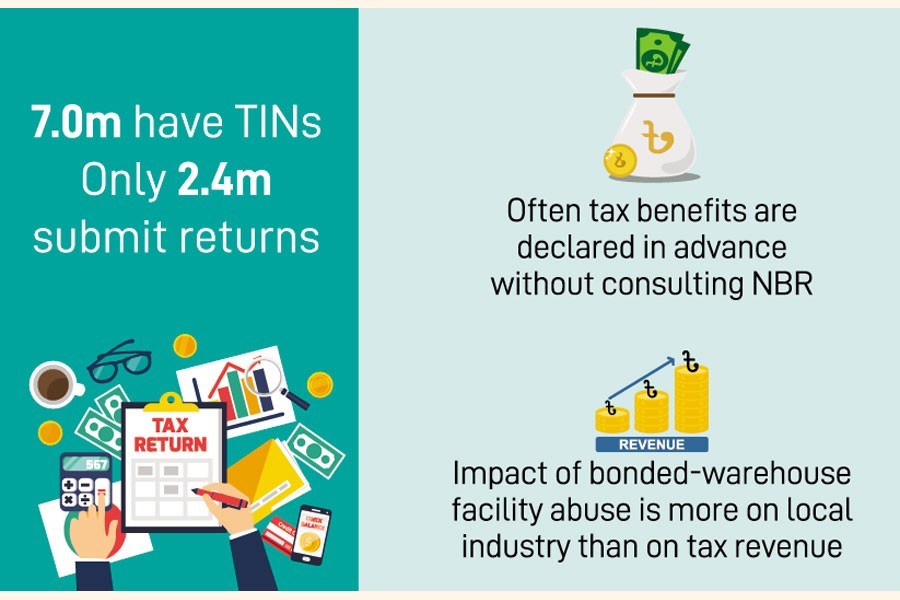

Poor tax culture is a barrier to expansion of tax net. Sometimes tax benefit is declared in advance without consent of the authority concerned, he laments.

The NBR chief made the comments at the pre-budget meeting with the Economic Reporters Forum (ERF) at the NBR premises in the capital, as stitches to the upcoming national budget began to be given.

Responding to a question on the gap between the numbers of TIN holders and the tax-return filers, Mr Muneem said the NBR would work to explore ways to find out the occasional TIN holders who obtain TINs for getting some services once.

Such TIN holders constitute a large number in the TIN database, he added.

Currently, the number of TIN holders stands at around 7.0 million, while 2.4 million taxpayers submit tax returns although submission is mandatory for all TIN holders.

Responding to a question, the NBR chairman hinted at looking into the issue in the next budget.

Online tax-return submission would help increase the number of tax returns, he opined.

The NBR chairman said the agency would make future plans keeping in mind the challenges in revenue collection after signing Free-Trade Agreement (FTA) or Preferential Trade Agreement (PTA).

However, expansion of domestic market and boosting local production would help increase tax collection after the country's graduation to a middle-income status.

On bonded-warehouse facility, he said the NBR remained cautious in offering new bonded-warehouse facility following its widespread abuse that affected local industry.

"We are struggling to check the abuse of duty-free facility under bonded- warehouse facility."

Impact of such abuse is higher in local industry compared to that on revenue.

Once the bond system is automated under an ongoing project, the NBR would be able to keep proper record of the facility, and extend it to other industries, he notes.

On drafting new law, the NBR chairman said time constraint for framing new laws as per the Supreme Court directives, given nine years ago, put the board under pressure to complete the draft within a short time.

The NBR is willing to offer fiscal support on the basis of performance of the industries, but adequate research is needed for that, he adds.

Masud Sadiq, NBR member (customs policy), said the highest rate of import tariff ought to be brought down gradually for trade liberalisation.

"Supporting a domestic industry for a long time could be reviewed, as toddlers should not get support for an unlimited period," he added.

Zakia Sultana, member (VAT policy), said VAT-refund system did not work properly, as the businesses concerned failed to keep proper documents.

Sams Uddin Ahmed, member (income tax), told the meet the tax authority has some weakness in enforcement, causing slow growth of tax returns.

ERF President Sharmin Rinvy placed the budget proposals in writing, while Secretary-General S M Rashidul Islam spoke on the programme.

The ERF proposals include raising tax-free ceiling for individual taxpayers to Tk 0.5 million, bringing foreign nationals under tax net, popularising online tax return and electronic fiscal device, checking VAT evasion, bringing house property owners under tax net, waiving tax on contribution to foreign media, and framing new laws after impact assessment, etc.