Interest spread widens further as the banks raise their lending rates, riding on higher credit demand, with deposit returns for the savers held in check, bankers say.

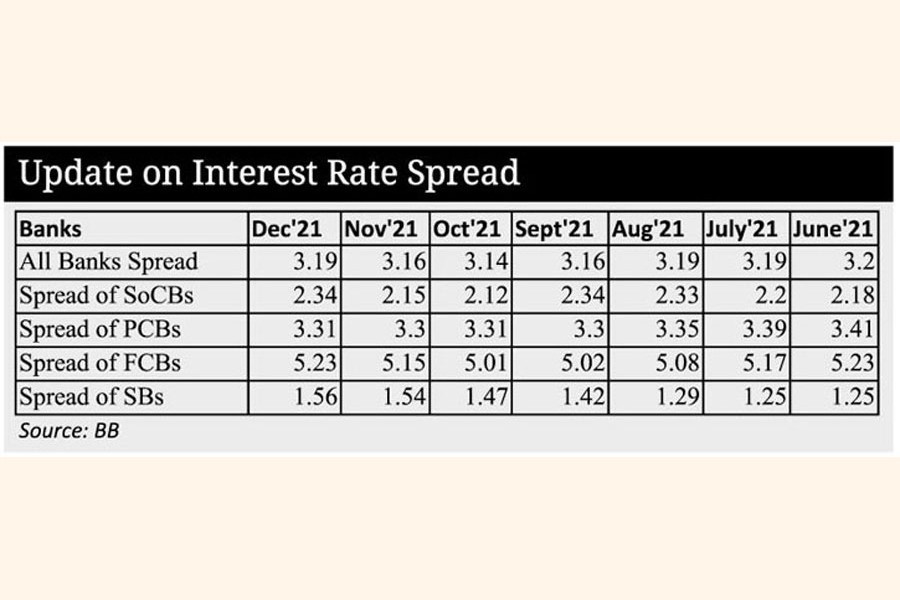

The weighted average spread between the lending and deposit rates offered by the scheduled banks rose to 3.19 per cent in December 2021 from 3.16 per cent a month before. It was 3.14 per cent in October.

"Effective yield has increased slightly through recovery and rescheduling of loans in December," Syed Mahbubur Rahman, Managing Director (MD) and chief executive officer (CEO) of Mutual Trust Bank Limited, told the FE Sunday while explaining the gap.

The weighted average interest rate on lending rose to 7.18 per cent in December 2021 from 7.15 per cent in the previous month while such rate on deposits remained unchanged at 3.99 per cent, according to the latest statistics of Bangladesh Bank (BB).

The interest rates on lending increased slightly during the period under review following a rebound in demand for credits, particularly from the private sector, in recent months, according to the senior bankers.

Bangladesh's credit demand, they say, has maintained an upturn in recent months following gradual reopening of economic activities - both at domestic and global levels - after more than one year of shattering Covid-19 assault.

The growth in the private-sector-credit flow rose to 10.11 per cent in November 2021 on a year-on-year basis from 9.44 per cent a month before. It was 7.55 per cent in May 2021.

"Higher trade financing for settling import-payment obligations through discounting of bills in foreign currency has pushed up the private-sector-credit growth in the recent months," a senior executive of a leading private commercial bank (PCB) told the FE on the day.

He also says the existing trend of trade financing may continue in the coming months if the higher prices of essential commodities on the global market remain unchanged.

"There is no scope to lower the interest rates on deposit further following the BB directive," the private banker explains.

All the scheduled banks have already been instructed to fix interest rates on term deposits with maturity of three months and above at rates not less than the rate of inflation published three months before.

"The pressure on deposit rates may rise if the government borrows from the market as per announcement in the budget," he also says, adding that continuously selling of the US dollar by the central bank may create market demand for the local currency.

Talking to the FE, another executive of a PCB said some banks were now offering lending rates around minimum 8.0 per cent instead of 7.50 per cent earlier to their 'good paymasters' among the borrowers.

Maximum lending rate was fixed at 9.0 per cent with effect since April 2020.

"The existing upward trend in lending rate may continue in the coming months if the demand for credits persists," the private banker predicts.

Meanwhile, the average spread with state-owned commercial banks (SoCBs) was 2.34 per cent in December, 3.31 per cent with PCBs, 5.23 per cent with foreign commercial banks (FCBs) and 1.56 per cent with specialised banks (SBs).

In April 2020, the spread squeezed significantly to 2.92 per cent from 4.07 per cent in March following the implementation of the single-digit interest rate in the banking sector.

Earlier, the central bank had instructed all the scheduled banks to fix a maximum 9.0-per cent interest rate on all loans except credit cards as part of the government initiative towards bringing down the rate to single digit from April 01, 2020.