The local currency depreciated significantly against the US dollar Thursday as Bangladesh again allowed banks to fix their exchange rates freely on the foreign-exchange market, officials said.

The central bank allowed the authorised dealer (AD) banks to fix their exchange rates individually in response to their appeal aiming to restore stability on the country's foreign-exchange (forex) market, they said.

"We've taken the decisions aiming to increase the inflow of remittances as well as export proceeds that will also help improve supply of the foreign exchange to the market," Md Serajul Islam, Bangladesh Bank's spokesperson, told the FE while explaining the main objective of the latest moves.

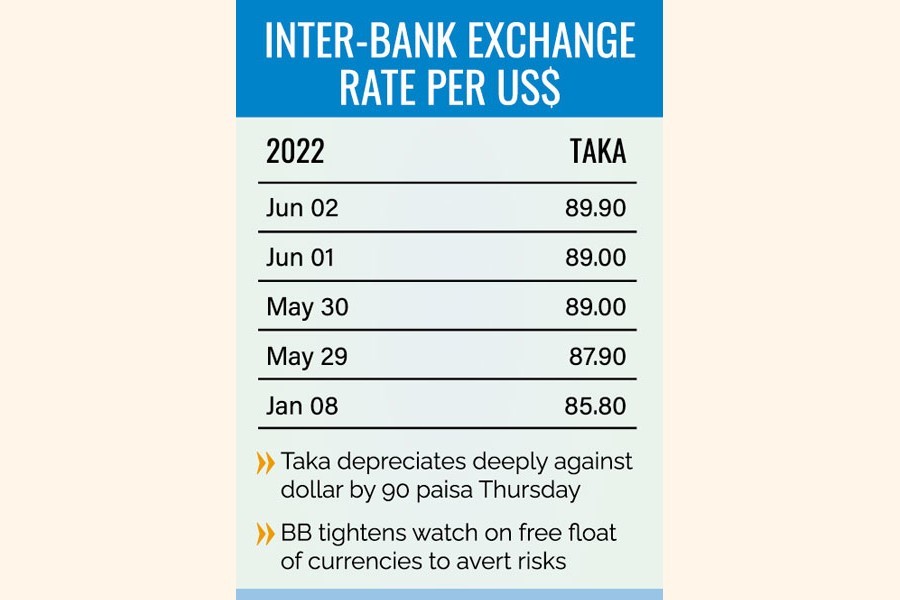

The Bangladesh Taka (BDT) lost its value by 90 paisa on the inter-bank foreign-exchange market on the day, just after four weeks of a similar fall, according to market operators.

The US currency was quoted at Tk 89.90 each on the day against Tk 89.00 on the previous working day. It was Tk 87.90 on May 29 last.

The central bank, meanwhile, ramped up watch on the money market amid the shift. "We've strengthened our monitoring and supervision on the market to know if exchange rates are being quoted by individual banks properly," a senior official of the Bangladesh Bank (BB) told the FE.

As part of the latest regulatory move, all the authorized dealer banks have been asked to submit their announced two rates along with net open position (NOP) by 11am each working day to the relevant department of the central bank.

NOP means the net sum of all foreign-currency assets and liabilities of a financial institution, inclusive of all of its spot and forward transactions and off-balance sheet items in that foreign currency.

The rates are the sale of bills for collection, generally known as BC, for settling import payments along with the rates which are offered to the overseas exchange houses, according to the central banker.

Earlier on May 30, the local currency depreciated by Tk 1.10 or 1.25 per cent to Tk 89.00 on the inter-bank market from 87.90 of the previous working day.

In the meantime, the local currency has lost its value by Tk 4.10 or nearly 5.0 per cent since January 2022. The dollar was traded at Tk 85.80 on January 08 last.

The same day, the exchange rate of the local currency also depreciated similarly against the greenback at customers' level for settling import payments.

The US dollar was quoted between Tk 88.20 and Tk 91.95 for the sale of bills for collection, generally known as BC, only for settling import payments on the day against the rate fixed at Tk 89.15 of the previous level, according to the central bank's latest monitoring report.

The AD banks may quote foreign-currency-exchange rates to the overseas exchange houses by applying due diligence and considering the situation on the inter-bank forex market.

"The banks are now allowed to fix their exchange rates in line with floating exchange-rate regime," a top central banker said while explaining the latest situation on the forex market.

Currently, Bangladesh is maintaining a floating exchange-rate regime where the currency rate is set by the forex market based on supply and demand relative to other currencies.

The country adopted floating exchange-rate regime in May 2003 as part of a comprehensive medium-term economic programme to promote growth and alleviate poverty.

Actually, the banks are now allowed to fix their exchange rates individually following a meeting of Selim R F Hussain, chairman of the Association of Bankers, Bangladesh (ABB), with BB Governor Fazle Kabir on Wednesday evening.

Earlier in the day (Thursday), the ABB chief briefed all the treasury heads of its member banks about Wednesday's meeting outcome.

Mr Hussain urged the treasury heads to be more responsible in fixation of exchange rates "in national interest" and to work closely for brining stability on the forex market by avoiding unhealthy competition.

Talking to the FE, Syed Mahbubur Rahman, managing director and chief executive officer of Mutual Trust Bank Limited, said: "We've to play a sensible role looking into interest of the economy.''

Meanwhile, the central bank continues its foreign-currency liquidity support in a bigger way to scheduled banks for managing volatility on the country's forex market.

The BB sold US$130 million directly to three state-owned commercial banks (SoCBs) along with a private commercial bank on Thursday to help them meet the growing demand for the greenback.

On Wednesday, the central bank sold similarly amount of the greenback to three SoCBs on the same ground.

"We've provided the US currency to the banks for settling import- payment obligations particularly for LNG (liquefied natural gas), fuel oils and fertilizers," another central banker said.

The central bank has so far injected $6.21 billion from the reserves directly into the commercial banks as liquidity support for settling their import-payment obligations in the current fiscal year (FY), 2021-22.

The local currency is maintaining a depreciating mode against the US currency mainly due to higher outflow of foreign exchange following 'hefty growth' in import payments compared to the inflow in the last few months.

The mismatch has resulted in widening current-account deficit in a macroeconomic imbalance that prompts the government to adopt some thrift measures and putting baits on offer for netting foreign exchange to secure depleting forex reserves.