Leading economist Dr Ahsan H Mansur has suggested focusing more on taming inflation, reducing trade deficit by adopting contractionary import policy, instead of chasing ambitious GDP-growth target in the next fiscal year (FY).

The Executive Director of Policy Research Institute (PRI) also suggested allocating special funds for the flood-hit north and north-eastern part of the country to make the next budget a bit more people-friendly.

He was addressing a webinar titled "Bangladesh Economy and National Budget of FY 2022-23" organised by Economic Development Research Organisation (EDRO) on Thursday.

Centre for Policy Dialogue (CPD) Senior Research Fellow Towfiqul Islam Khan, Professor of Institute of Health Economics (IHE) of University of Dhaka Dr Syed Abdul Hamid and Professor of Agricultural Economics of Bangladesh Agricultural University (BAU) Dr Fakir Azmal Huda also spoke at the programme, presided over by EDRO Executive Director Md Tanjil Hossain.

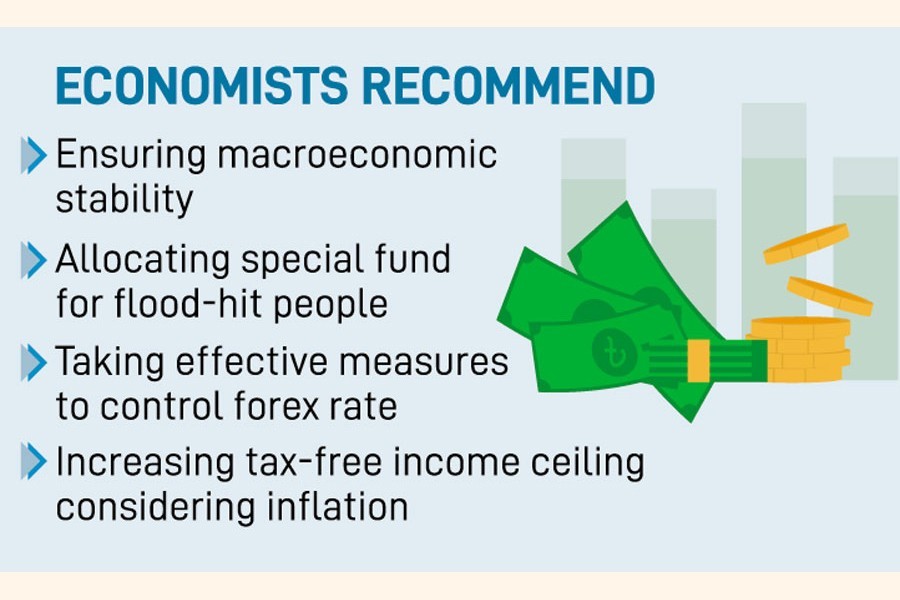

Terming the GDP growth target of 7.5 per cent for the upcoming FY unattainable, Dr Mansur said, "This is a year of prudence considering global and domestic economic situation … macroeconomic stability should be at the centre of all policies."

He said the key targets of the government should be finding ways to manage the soaring inflation, cutting unnecessary imports, broadening coverage of social protection amid the recent flood, etc.

Besides, controlling the exchange rate of the US dollar that depreciated taka and put pressure on the reserves will be a big challenge for the government in the next fiscal if effective measures aren't taken in time, he opined.

He said that though a Tk 827.45 billion has been proposed for subsidies and incentives in the budget, it would not be enough if energy and fertiliser prices increase in the global market in the upcoming months.

He also said there is an uncertainty over budget financing with foreign funds amid the current global situation as well as initiation of debt payment of mega projects from the next year.

Moreover, the high target of domestic borrowing will further put pressure on the already stagnated private sector investment, he added.

Dr Mansur also said that due to the minimal growth in revenue collection, the proposed budget which is not that big compared to the global scenario, a cut in the budgetary allocation may take place by the end of the FY.

The size of the proposed budget is about 15.2 per cent of the GDP, but it may come down to 13 per cent when implemented, he said.

Speaking at the event, Dr Hamid said the framework of the national budget is finalised by March, so discussion on the budget in April, May and June have little to no impact on the budget.

Like previous years, the government has proposed allocation of Tk 1.0 billion for research in the health sector, he said, adding: "The people responsible for carrying out research are inefficient and for that reason, they can't even spend the allocated funds."

He also said some 20-30 per cent of the allocated budget for the health sector remains untouched every year.

"People from general cadre, having no knowledge of medical science, are posted in the health ministry while public health professionals, lacking managerial capacity, are posted in the DGHS," he said adding: "If the situation is like that how would they be able to spend the money?"

If the right people aren't employed for the technical issues, no improvement may come in the health sector, he said.

CPD Senior Research Fellow Mr Khan said the recent trends show that the government would pass the budget in parliament as proposed, without considering the recommendations made by different quarters.

The proposed budget will benefit mostly the businesses but to ease the common people's sufferings to some extent, the tax-free income ceiling should be increased considering the inflationary situation, he said.

Besides, he suggested the government withdraw its decision of allowing money launderers to bring back their money home from abroad by paying certain penalties.

Withdrawal of such a scheme would be a good political decision for the government, he added.

In a presentation, the EDRO executive director urged the government to raise allocation for education, health and social safety net programmes (SSNP) as part of public welfare. He also emphasised on the need for increased monitoring of budget implementation for its better impact.

To tame the inflation, he suggested reducing tax on imported and locally produced daily essentials.