The provisioning shortfall against their loans in the country's banking system swelled in the first quarter (Q1) of current calendar year despite the fact loan classification has been on a relaxed mode because of the pandemic.

The shortfall increased to more than Tk 51 billion in the Q1 when the classified loans recorded a marginal rise, officials said. As usual, the state-owned banks with their huge load of soured loans were the culprits.

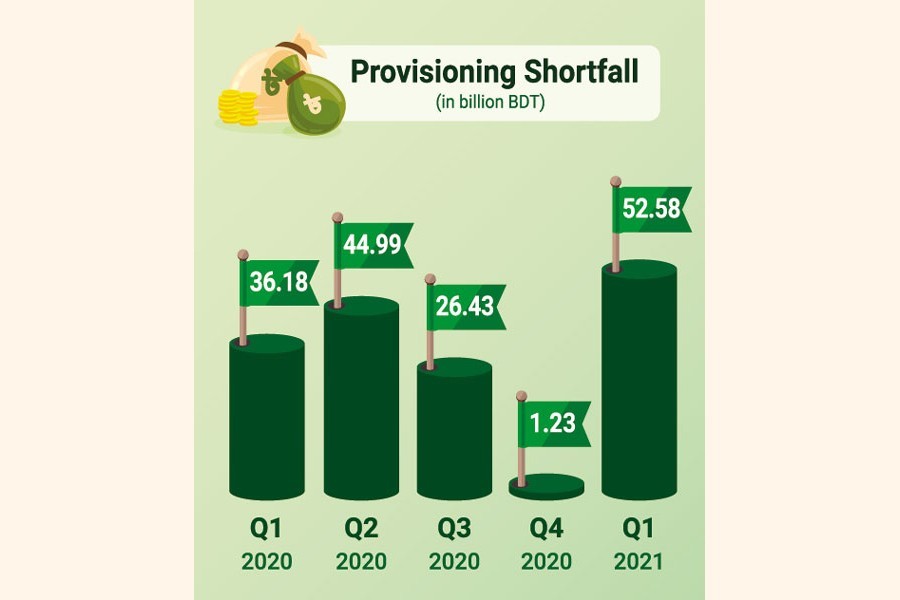

The aggregate amount of provisioning shortfall rose to Tk 52.58 billion during the January-March period of 2021 from only Tk 1.23 billion three months before, according to the Bangladesh Bank (BB) latest statistics.

"The amount of provision shortfall increased significantly mainly due to the rising trend of non-performing loans (NPLs)," a BB senior official told the FE on Wednesday.

The volume of classified loans increased by more than 7.0 per cent or Tk 63.51 billion to Tk 950.85 billion in Q1 of 2021 from Tk 887.34 billion in the preceding quarter, according to the consolidated statement of classified loans covering both domestic and offshore banking units.

The central bank has started preparing the statement since the final quarter of the last calendar year.

Earlier, the BB prepared two statements of classified loans separately for domestic banking units and offshore banking units.

The state-owned commercial banks (SoCBs) have faced more provisioning shortfall than that of the private commercial banks (PCBs) during the period under review, according to the central banker.

"The provisioning shortfall of two SoCBs pushed up the overall shortfall in the banking sector," the BB official said, explaining the latest provisioning shortfall situation in the SoCBs.

However, 10 banks out of 59 failed to keep requisite provisions against Q1 loans, particularly the classified ones, the BB data showed.

Of them, four are SoCBs, one specialised and others are PCBs.

The combined shortfall of these banks stood at Tk 122.60 billion during the period under review. During the final quarter of 2020, 11 banks failed to maintain required provisioning against their loans.

The combined shortfall of these banks stood at Tk 67.46 billion at the end of the last calendar year.

As per the BB's regulations, the banks have to keep 0.25 per cent to 2.0 per cent provisions against the general category of loans, 20 per cent against substandard category, 50 per cent against doubtful loans, and 100 per cent against bad or loss category of loans.

The banks usually keep required provisions against both classified and unclassified loans from their operating profits to mitigate financial risks, another BB official said. "The banks may reduce their provisioning shortfall by recovering default loans or increasing eligible collaterals against the credits," the BB official said, replying to a query.

He also said the banks will have to maintain due provisioning against all types of loans to protect the interest of depositors.

"The banks will have to enhance their profits as well as boosting recovery drives for reducing their provisioning shortfalls," Syed Mahbubur Rahman, managing director (MD) and chief executive officer (CEO) of Mutual Trust Bank Limited, told the FE.