Shadow banking is fast growing in Bangladesh partly because of new normal created by the pandemic but its monitoring needs to be tightened to avert any chaos on the financial market, BIBM rings the alarm bells.

Bangladesh Institute of Bank Management or BIBM makes the observations based on a study the findings of which were unveiled Wednesday at a seminar on shadow banking in Bangladesh with special reference to new-normal scenarios.

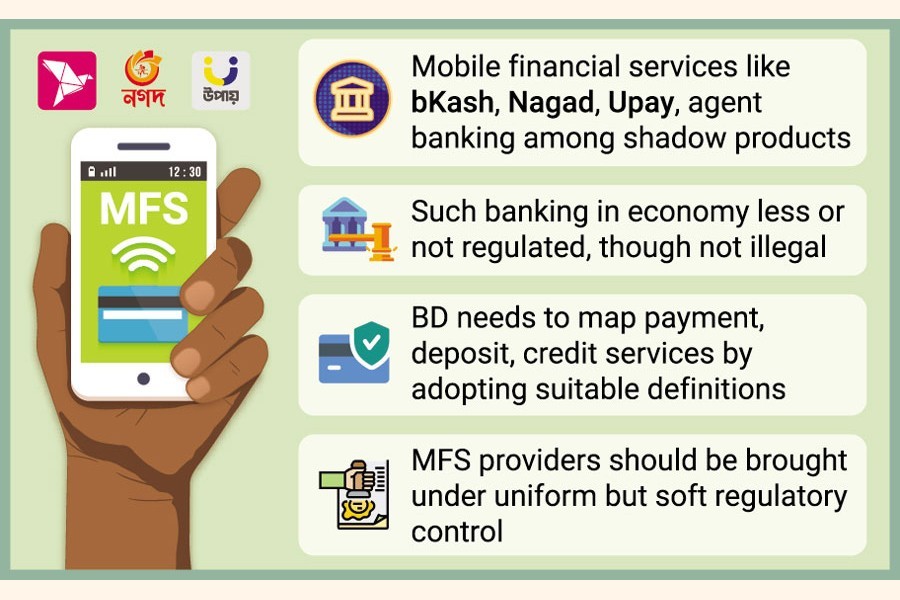

Its research paper says these types of banking in the economy are less or not regulated. However, these are not illegal and unethical. The growth of such banking has been expanding across the globe due to the coronavirus pandemic and the fastest growth of financial technology called fintech.

Some instruments of mobile financial services like bKash, Nagad, Upay are shadow products as they are controlled or operated by separate managements outside of banks. bKash is a separate company.

Similarly, agent banking is another example of shadow banking in Bangladesh as one part of the transaction is operated by people who are not banking people. Some vendors or local people operate it.

The postal department of the government and the cooperatives of the country have long been engaged in some forms of financing activities also recognised as shadow banking.

Capital market-related activities like services by the brokerage houses, merchant banks, and alternative investment funds are shadow- banking activities throughout the globe, the banking academics at the BIBM say in the research report-evidently in the wake of mind-boggling financial scams in the country and also across the globe that prompted some major countries to press the brake on upstart fintech operators.

However, the operations of banks, non-bank financial institutions, microcredit-finance institutions and insurance companies are regulated and supervised.

BIBM professor Dr Shah Md. Ahsan Habib led the research team. Professor and Director (Dhaka School of Bank Management) Md. Nehal Ahmed, assistant professors of the BIBM Rexona Yesmin and Tofayel Ahmed, General Managers of department of offsite supervision and forex reserves and treasury management of Bangladesh Bank Md. Anwarul Islam and Saiful Islam respectively worked.

The institute, however, suggests measures to strengthen financial-stability efforts. Bangladesh needs to map payment, deposit, and credit services by adopting a set of suitable definitions.

It recommends that all innovations for financial inclusion should have similar regulatory and business incentives for fair competition and efficient monitoring.

"MFS providers should be brought under uniform but soft regulatory control (mainly to follow certain procedures and furnishing certain information) or monitoring management for ensuring transparency and customer protections," the report says about booming mobile financial services.

Agent-banking activities and linkage arrangements should be under monitoring scanner by the regulated banks/NBFIs to handle reputation and crime risks under a given 'guidance framework' adopted by stakeholders' consultations, the study advocates.

It also suggests management of banks and financial institutions should set up their monitoring, capacity development, disclosure, and customer-protection arrangement to handle risks associated with their shadow-banking activities and elements like mobile banking, agent banking, and linkage programmes.