Government's growing dependence on at-source-tax collection, including tax on service-holders' pay, is practically shifting tax burden onto common people because of absence of effective refund mechanism (ERM).

Sources said despite tax squeeze for economic slowdown amid Covid-19 pandemic and corporate- tax cutbacks, the overall tax revenue recorded growth during the last financial year. The rise in the collection of withholding tax or payroll tax had made it possible.

People who do not have taxable income are compelled to pay tax in the form of source tax, which, according to experts, economists and accounting professionals, turns out to be 'tax injustice' as they are not getting credit for the paid tax.

The government offered a tax-free threshold for individual taxpayers up to Tk 0.3 million to facilitate low- income group of people.

However, they are being deprived of the exemption benefit due to the levying different forms of WHT (with-holding tax) on them.

The collection of withholding taxes is a common practice globally to mobilize tax revenue with effective refund system which is missing in the case of Bangladesh, analysts said.

Individual taxpayers in the country hardly get refund of their paid tax at source if it exceeds their actual payable taxes.

However, adjustment of source taxes can be done with the actual payable taxes on the basis of source- tax deduction.

Responding to the issue, a senior tax official, preferring anonymity, said they have no alternative but to focus on withholding-tax collection, following global practice, amid poor tax compliance and absence of automation to track all expenditures of taxpayers.

He said source-tax collection is also an 'effort-based' collection as it needs relentless efforts of the taxmen as deducting authorities often refrain from its depositary to the public exchequer.

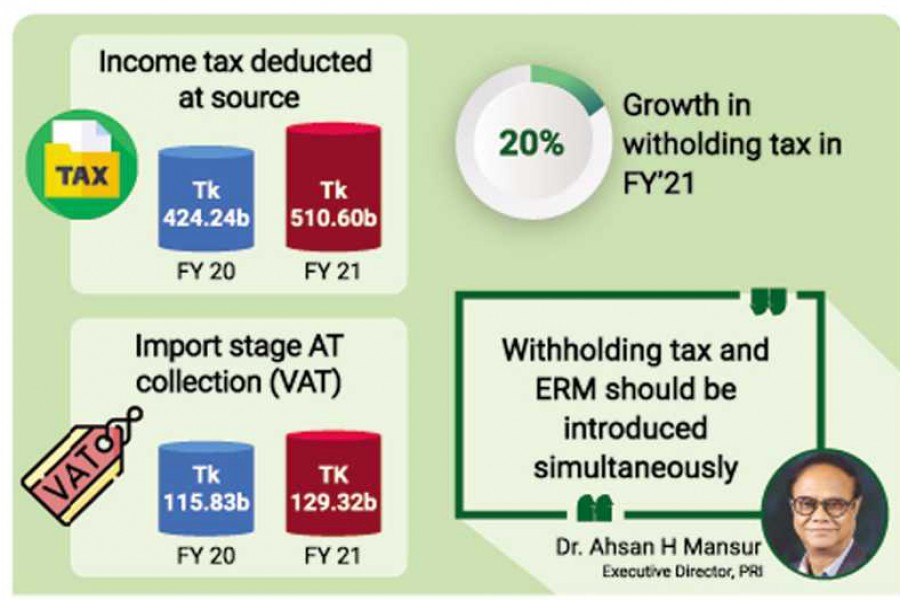

WHT collection by the income-tax wing of the NBR grew 20 per cent alone last year, making up the deficit from other segments.

A downward revision of corporate tax during the last few years did not affect the revenue collection as source tax was 'rationalized' upward, an FE analysis has found.

The revenue authority had focused some key areas where increase in source tax would help in mobilizing two-or threefold taxes than that of the estimated loss of the amount due to the lowering of corporate taxes.

Despite reduction in corporate-tax rate by 2.5 per cent in the FY'21 budget, its collection grew by 25 per cent that year.

According to the income-tax law, section 82 C, tax deducted at source on import stage is considered minimum tax which is not refundable.

Some 95.67 per cent of the aggregate income-tax collection in FY 21 came from withholding taxes, according to an analysis by the FE based on NBR data.

Some 2.4 million individual taxpayers submitted their annual tax returns to the NBR, paying Tk 36.92 billion at the time of return submission out of total Tk 852.24 billion aggregate income-tax collection.

Sadia Chowdhury, a housewife who lives in Dhaka's Kolabagan area, said she has to pay tax on interest gained from bank deposits, excise duty on principal amount of bank deposits, and source tax on investment in government savings certificate despite not having any taxable income.

"There should be exemption from payment of source tax, too, so that people not having taxable income can get relief in actual sense," she said.

Claiming refund of paid tax involves a cumbersome process and is still operated manually, she said.

Marginal group of people hardly claim tax refund visiting tax offices "for fear of harassment by taxmen", she added.

Executive Director of Policy Research Institute (PRI) Dr Ahsan H Mansur, who is also chairman of Brac Bank, terms it a tax injustice to increase withholding tax without ensuring refund system.

"Withholding tax and ERM should be introduced simultaneously so that taxpayers can get justice," he said.

He, however, supports casting wide the net of withholding tax to increase tax revenue, as practiced globally.

Taxation and Tariff subcommittee chairman of the Metropolitan Chamber of Commerce and Industry Adeeb H Khan also recommended ensuring smooth repayment system on WHT.

Currently, repayment of WHT is near- impossible, he said.

"It's a violation of a basic right and principle," he said.

He observed that often assessments are done in a way to ensure overpayment of tax.

"That way, tax authorities can say they are not violating any law or principle or basic right. This is very common in the cases of businesses," he said.

Individuals often pay tax in excess of the actual, but refund of the same is a rare incident, he remarked.

Former taxation sub-committee convener of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) Humayun Kabir said tax deducted at source (TDS) without ERM is causing distortions and its incidence is becoming, as if, an indirect taxation.

Indirect taxation is inequitable as it is levied at the same rate irrespective of income levels of consumers, said Mr Kabir, who is a council member of the Institute of Chartered Accountants of Bangladesh (ICAB).

"Non-refund or failure to refund the excess TDS over assessed tax in time is obviously an (state imposed) injustice upon taxpayers," he said.

Practically, it's a punishment to taxpayers when the tax-assessing authority acts adversely against the taxpayers (by levying tax using discretionary power on the basis of assumption and estimation) when the appeal administration fails to act impartially and independently, he deplored.

TDS without ERM negates progressive taxation principle and, therefore, inequality in society worsens, he said.

"Levying TDS on individuals who do not have taxable income is most unacceptable as it is causing worst impact upon poorer people," he said.

"Small savers having bank deposits or in government saving instruments or private-sector employees having gratuity or sum of life insurance after maturity, levying TDS upon them is not a pro-people fiscal policy for low- income group of people," he said.

It makes the effective rate of corporate tax higher, discourages foreign direct investment and brings bad reputation for the country's tax administration, he said about blowback from incongruous taxation to overall economy and social texture.