Banks have been asked to realise overdue export proceeds worth US$1.50 billion forthwith as the central bank tightens its stance to augment foreign-exchange flow into the market.

The directive came at the bankers' meeting held Monday at the central bank headquarters in Dhaka with Bangladesh Bank (BB) Governor Abdul Rouf Talukder in the chair-evidently at a crucial time of global financial, food and fuel crises with their chain effects on the domestic front.

It happened to be the first meeting under the leadership of the newly appointed governor, a top finance bureaucrat who has already issued a plethora of dos and don'ts about monetary matters trying to set things in order.

Besides, the bankers' roles as well as responsibility for implementation of the latest policy on loan rescheduling and restructuring were discussed at the meeting.

The top bankers have been asked to execute the policy properly, on an alert note that the central bank will show 'zero tolerance' in this regard.

Earlier on July 18, the BB rolled out a comprehensive policy relaxing loan-rescheduling and-restructuring processes aiming to facilitate the country's overall business activities.

Senior bankers, however, welcomed the latest loan-rescheduling and-restructuring policy, saying that it will help them manage their loan portfolios properly.

At the meeting, the bankers were asked to comply with all the ten regulatory measures announced by the central bank recently aiming to improve the foreign-currency-liquidity situation on the money market.

Among the regulatory measures are encashing 50 per cent of total foreign currency held in relevant ERQ accounts, slashing 5.0 percentage points of the net open position (NOP) limit of commercial banks and reporting prior to opening a letter of credit (LC) for imports worth $5 million or above to the central bank.

"It's our responsibility since the goods have already been shipped," Syed Mahbubur Rahman, managing director and chief executive officer of Mutual Trust Bank Limited, told the FE about the export proceeds.

"Definitely, we'll pursue our exporters as well as importing banks to realise the overdue as early as possible," the senior banker said while replying to a query.

At the same meeting, all the scheduled banks have been asked to report on foreign-exchange transactions properly to the departments concerned of the central bank to help manage the ongoing volatility on the forex market.

The latest BB moves come against the backdrop of an upturn in the country's current-account deficit alongside depreciating mode of the taka against the dollar mainly due to higher import-payment pressure on the economy.

Meanwhile, the Bangladesh Taka (BDT) further depreciated significantly against the US dollar mainly due to higher demand for the greenback for import payments. The local currency lost its value by 25 paisa on the inter-bank foreign-exchange market Monday under import-payment pressure, according to market operators.

The US currency-the high appreciation of which has posed a problem for American businesses even--was quoted at Tk 94.70 on the day against Tk 94.45 on the previous working day.

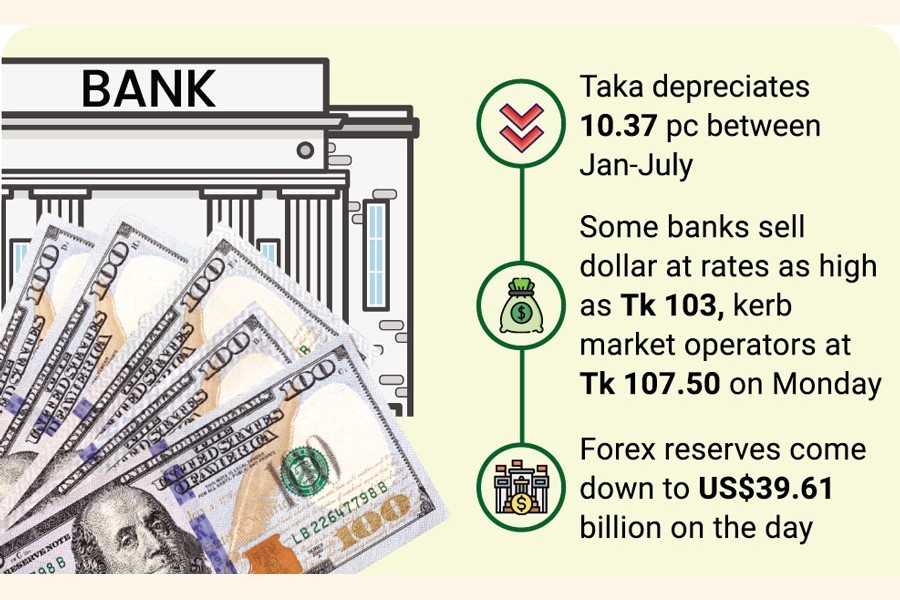

The local currency has lost its value by Tk 8.90 or 10.37 per cent since January 2022. The dollar traded at Tk 85.80 on January 08 last.

The same day, the exchange rate of the taka also depreciated similarly against the greenback at customers' level for settling import payments.

The US dollar was quoted at a maximum of Tk 94.75 for the sale of bills for collection, generally known as BC, on the day against Tk 94.50 of the previous level.

Some banks, however, traded the greenback ranging between Tk 94.75 and Tk 103 to their customers for settling import-payment obligations ignoring their announced rates, according to market operators.

On the other hand, the banks also quoted the dollar at maximum Tk 93.75 on the day to remitters as well as realised export proceeds or telegraphic transfer (TT) clean of their funds against Tk 93.50 of the previous working day.

Actually, the local currency is maintaining a depreciating trend - mainly due to higher outflow of foreign exchange - following a hefty growth in import payments amid global price rises, compared to the inflow in the last few months.

Meanwhile, exchange rate of cash dollar against the local currency on the open market, known as kerb market, reached maximum Tk 107.50 mark on Monday mainly due to lower supply of the greenback.

The US currency was traded at rates ranging between Tk 105 and Tk 107.50 on the day from Tk 104 of the previous day, according to the market operators.

"We sold the cash US dollar at maximum Tk 107.50 each on Monday evening to meet higher demand for the greenback," a senior currency trader told the FE.

However, the central bank continued providing its foreign-currency support to the scheduled banks for managing the forex- market volatility.

It sold $132 million directly to five commercial banks on Monday to help them meet the growing demand for the greenback.

The BB has so far injected $940 million from the reserves directly into commercial banks as liquidity support for settling their import-payment obligations in the current fiscal year (FY), 2022-23.

In FY'22, the central bank sold $7.62 billion from the reserves to the banks for the same purposes.

Bangladesh's forex reserves came down to $39.61 billion on Monday from $39.67 billion of the previous day - following higher sales of the greenback from the reserves to feed the market.