Net outflow of foreign direct investment (FDI) from Bangladesh declined further in the past fiscal year, according to a new estimate of the country’s central bank.

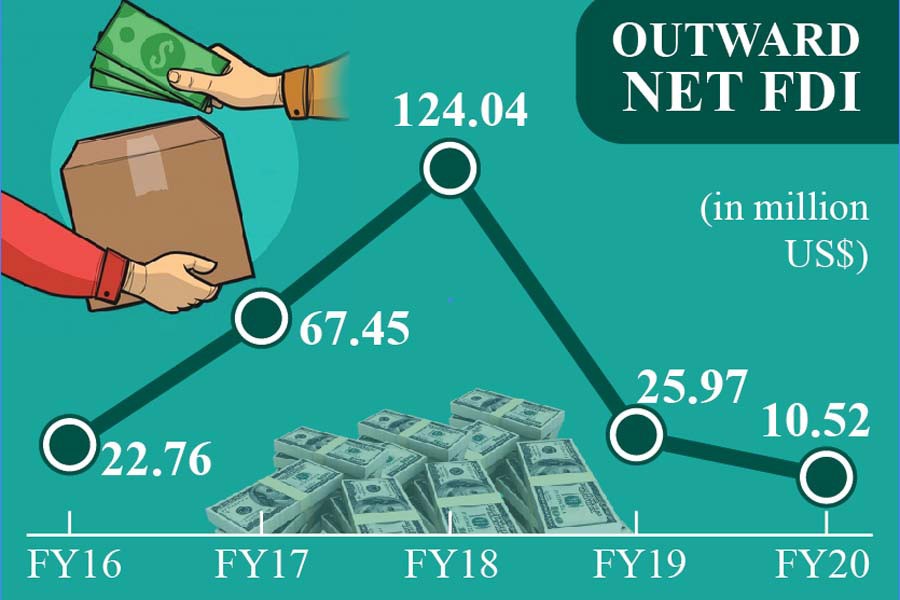

The estimate, released by Bangladesh Bank last month, showed that net outward FDI declined to US$10.52 million in FY20, which was $25.97 million in FY19.

The net amount of outward FDI reached $124.04 million in FY18, which was the highest ever.

Bangladesh Bank defined the outward direct investment (ODI) as ‘a business strategy in which a domestic firm expands its operations to a foreign country.’ This can be a green field investment, a merger or acquisition, or expansion of an existing foreign facility.

Central bank data further said that gross outflow of FDI from the country was 37.52 million in FY20.

The central bank report also said that Bangladesh was ‘walking very carefully’ about investing abroad.

“But in September 2015, the government amended the 1947 Act by adding a ‘conditional provision’ that permits outbound investment for export-related enterprises,” according to the central bank.

“By the dint of amendment outward foreign direct investments (OFDIs) by Bangladeshi firms has increased significantly,” it said. “Now such investments by Bangladeshi firms have gone to more than 20 host countries.”

The report, titled as ‘Foreign Direct Investment and External Debt: January-June, 2020’, also showed that in the last fiscal year top five destinations of FDI from Bangladesh were: Nepal, Kenya, India, United Arab Emirates (UAE) and Oman.

Combined outward FDI to these countries stood at $27.51 million while there was a negative outflow of $16.99 million to the rest of the countries in total.

Chemicals & Pharmaceutical sector alone shared 69.5 per cent of annual net FDI in the last fiscal year.

Bangladesh Bank has released data on outward FDI after five years. It last unveiled the data in 2015.

The central bank report also mentioned that some Bangladeshi bank branches and exchange houses operated their business abroad.