Classified loans in Bangladesh's banking system swelled to more than Tk 1.0-trillion mark again, as of September, despite receiving state policy support.

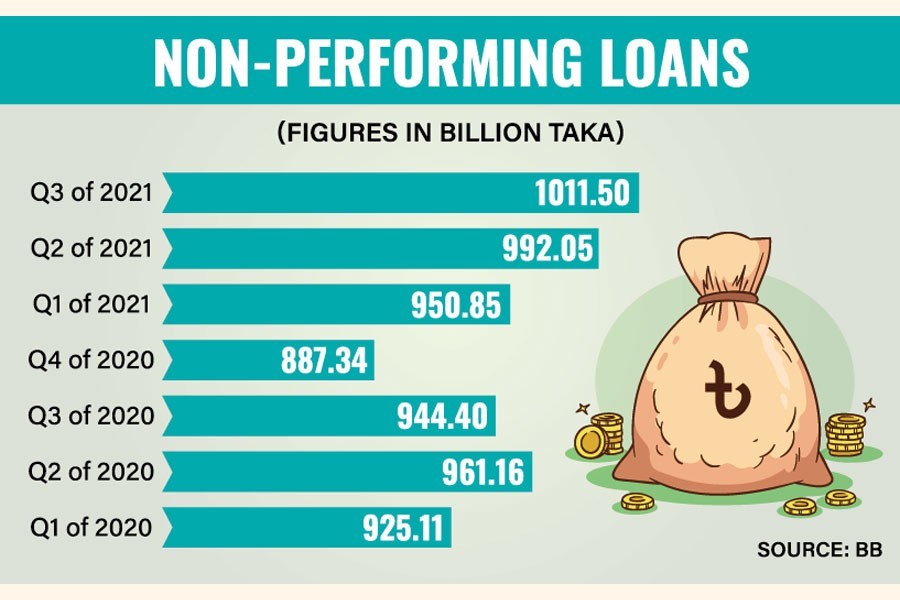

The volume of non-performing loans (NPLs) grew by nearly 14 per cent or Tk 124.16 billion to Tk 1011.50 billion as on September 30, from Tk 887.34 billion as on December 31, 2020, according to the central bank's latest statistics.

The amount of classified loans was Tk 944.40 billion a year before.

In September 2019, the volume of classified loans in the banking sector soared to an all-time high at Tk 1.16 trillion despite close monitoring by the central bank.

The total size of classified loans will go ballooning further if the amount of write-offs is included in the figure.

The outstanding amount of written-off credits stood at Tk 435.44 billion as on June 30 this year.

The Bangladesh Bank introduced guidelines for writing off classified loans in 2003 aiming to improve loan recovery and make the financial statements of banks more transparent and accountable.

Writing off loans is a global practice. But it will depend on the capability of the banks concerned to write off bad loans to make their financials look tidy.

Before making any final decision in this regard, the bank management has to ensure 100-per cent provisioning against the amount to be written off.

Former Bangladesh Bank (BB) governor Dr Salehuddin Ahmed suggested the policymakers to strengthen monitoring and supervision by both the central bank and scheduled banks to curb the rising trend in NPLs in the banking sector.

"The wilful ones of defaulters often are reluctant to repay their loans," the former governor said while explaining latest NPL situation.

The BB officials, however, said the amount of NPLs increased slightly in the third quarter (Q3) compared to the second quarter (Q2) of this calendar year because of 'relaxed repayment policy' pursued during the period under review.

The volume of NPLs increased by nearly 2.0 per cent or Tk 19.45 billion to Tk 1011.50 billion as on September 30 from Tk 992.05 billion three months before, the BB data showed.

"The amount of classified loans increased slightly in the Q3 of 2021 following higher volume of total outstanding loans in the banking sector," Md Serajul Islam, the central bank's spokesperson, told the FE while explaining the latest NPL trend.

The volume of outstanding loans rose by 2.66 per cent to Tk 12453.91 billion as on September 30 this year from Tk 12131.64 billion three months ago, according to the official figures.

On the other hand, the share of NPLs came down to 8.12 per cent of the total outstanding loans during the period under review from 8.18 per cent as on June 30 this year. It was 7.66 per cent as on December 31, 2020.

The higher amount of outstanding loans has also helped reduce percentage of classified loans, according to Mr Islam, also a BB executive director.

The classified loans cover substandard, doubtful and bad/loss portions of the total outstanding credits, which reached Tk 12453.91 billion as on September 30 on a consolidated basis. It was Tk 11587.75 billion nine months before.

The central bank has been preparing the consolidated statement since the final quarter of the last calendar year.

Earlier, the BB prepared two statements of classified loans separately for domestic banking units and offshore banking units.

Talking to the FE, another BB official said some court stay orders regarding loan classification have already been vacated that have also pushed up the overall default-loan situation.

Senior bankers, however, say most of the borrowers availed the ongoing eased repayment facility during the period following BB's policy relaxation on loan repayment.

Under the latest policy relaxation, the banks are barred from treating any loan as substandard if the borrowers paid 25 per cent of the dues for the months of January to December of the year 2021, even if the payment is made on the last working day of the calendar year under consideration.

The borrowers will be allowed to adjust the overdue amounts for the year 2021 by the end of the existing tenure of the loans, according to a notification issued by the BB on August 26 this year.

"Recovery was very poor," Syed Mahbubur Rahman, former chairman of the Association of Bankers, Bangladesh (ABB), said while explaining the rising trend in classified loans in Bangladesh.

Mr Rahman, also managing director (MD) and chief executive officer (CEO) of Mutual Trust Bank Limited, said: "It is likely to improve slightly in the final quarter of this calendar year if the banks strengthen their recovery drives."

Write-off and rescheduling of loans will also help reduce the amount of classified loans in the banking sector, according to the senior banker.

During the first nine months of 2021, the total amount of NPLs with six state-owned commercial banks (SoCBs) rose to Tk 440.16 billion as on September 30 this year from Tk 422.73 billion as on December 31 last. It was Tk 438.36 billion in Q2 of 2021.

On the other hand, the total amount of classified loans with 42 private commercial banks (PCBs) reached Tk 507.43 billion during the period under review from Tk 403.61 billion in the final quarter of last year. It was Tk 491.91 billion as on June 30 this year.

The NPLs from nine foreign commercial banks (FCBs) rose to Tk 26.92 billion as on September 30 from Tk 20.38 billion in the Q4 of 2020. It was Tk 24.92 billion of the Q2 of 2021.

The classified loans with two development-finance institutions (DFIs) also came down to Tk 36.99 billion as on September 30 last from Tk 40.61 billion nine months before. It was Tk 36.85 in the Q2 of this calendar year.