Prime Minister's Economic Affairs Adviser Dr Mashiur Rahman has stressed reining in default loans which he felt have gone out of control at present.

He has suggested strengthening the capacity of the central bank and reviewing the bankruptcy law to reduce the burden on the country's banking sector.

"The non-performing loans (NPLs) have gone out of control now as pictured in the media," he said.

The adviser was addressing the '2nd Bangladesh Economic Conference' on the central bank's role in the country's development over the last five decades, organised by the vernacular daily Banik Barta at a city hotel on Wednesday.

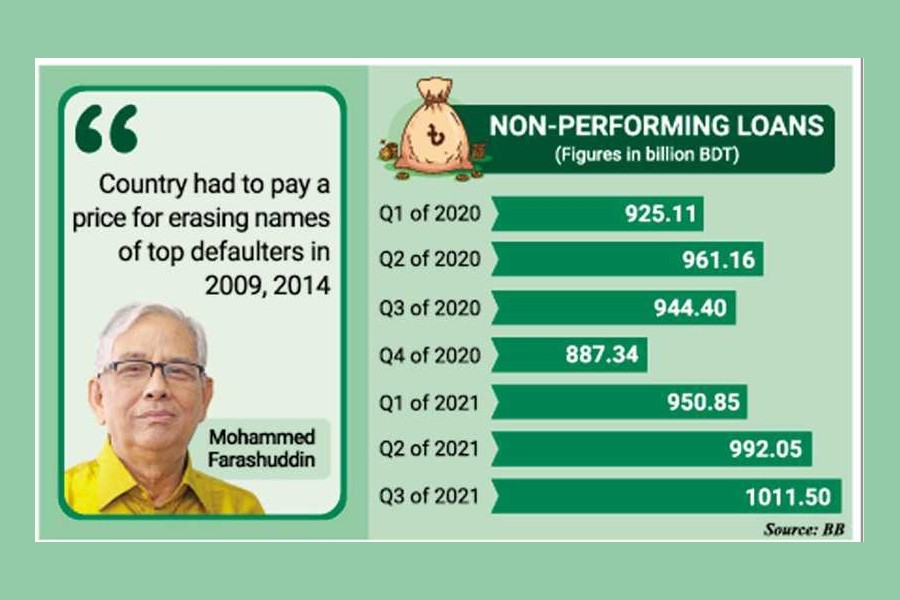

Classified loans in Bangladesh's banking system swelled to more than Tk 1.0-trillion mark, as of September, despite receiving state policy support.

The volume of non-performing loans (NPLs) grew by nearly 14 per cent or Tk 124.16 billion to Tk 1011.50 billion as on September 30, from Tk 887.34 billion as on December 31, 2020, according to the central bank's latest statistics.

Mr Rahman said that many big borrowers were not repaying their loans and the banks' lending capacities were shrinking, depriving the really-deserving people of getting access to credit.

"It is a social crime," he said, adding that the ones, who had approved the loans that turned bad, should also be made equally accountable.

Mr Rahman pointed out that the authority of Bangladesh Bank (BB) is too limited to tackle the big borrowers or large NPLs.

"(It is) limited in a sense that the mortgage against the large NPLs cannot easily be settled due to the size of large entities," he said. "That is why the time has come to look at our bankruptcy law and its procedures."

He added: "If the bankruptcy law is amended, it is possible to declare a large business entity bankrupt and sell them in pieces so that it can be managed."

Addressing the conference, eminent economist Wahiduddin Mahmud said that there are many weak institutions in the country, and there are many people who do not deserve holding key positions.

"Bangladesh Bank is the only exception … it always gets the right and deserving governor since independence," he said.

Senior Secretary of Finance Abdur Rouf Talukder stressed on better coordination between the central bank and Ministry of Finance for expediting economic growth of the country.

He mentioned that automation has brought significant changes in the banking sector in the last one decade.

Presenting the keynote paper, Bangladesh Bank Governor Fazle Kabir pointed out that the country's economic recovery process from the fallouts of the Covid-19 pandemic would continue in the present and next fiscal years.

"We are trying to orderly overcome the Covid situation and seamlessly get back into the pre-Covid business as usual at the earliest possible time," he said, adding that restoring the growth momentum is one of the key challenges of BB.

The governor said that the challenges are steep, but not unattainable.

Former BB Governor Mohammed Farashuddin said the country was not recognising the contribution of bank loans to its growth.

In a recorded video speech, he said that if any investigation on financial crime is kept hidden in the drawer, the doors of newer crimes get opened.

About the default loans, he said the country had to pay a price for erasing the names of top loan defaulters in 2009 and 2014.

He recommended withdrawal of cash incentives from exports, import and remittance, and introduction of a mechanism for necessary depreciation of currency.

These measures would yield better results in the economy, he added.

He said that if the government commits to stop money laundering, the central bank, border security and law enforcing agencies together can do it.

Former BB Governor Salehuddin Ahmed said the central bank has enough autonomy as defined by the law so far.

"Autonomy evolves and it has to be earned too," he said, adding that it would not be possible to make the central bank entirely free from political influence as it has to deal with the politicians.

Bangladesh Bank needs to take a stand when needed by using its autonomy, he said.

Mr Ahmed said that the laws and policies are of international standard, but the problem is with ensuring compliance.

Former BB Governor Atiur Rahman proposed to increase the incentive on inward remittance by 1.0 per cent as the remittance played a very important role during the Covid-19 pandemic.

He also recommended reduction of interest rates on dollar-denominated bonds on top of the ceiling or lifting the ceiling and making them open ended.

Ha-Meem Group Chairman A K Azad that the government can reduce the default loans if it has that good intention.

He blamed political influence for the ballooning of the NPLs in the banks.

He suggested merging of all the state-owned banks into one entity and administering it under the central bank, and said it will help cut existing default loans significantly.

Islami Bank MD Mohammed Monirul Moula and Sonali Bank MD Ataur Rahman Prodhan also spoke at the programme.

City Bank MD Mashrur Arefin delivered the opening speech while Bonik Barta Editor Dewan Hanif Mahmud moderated the discussion.