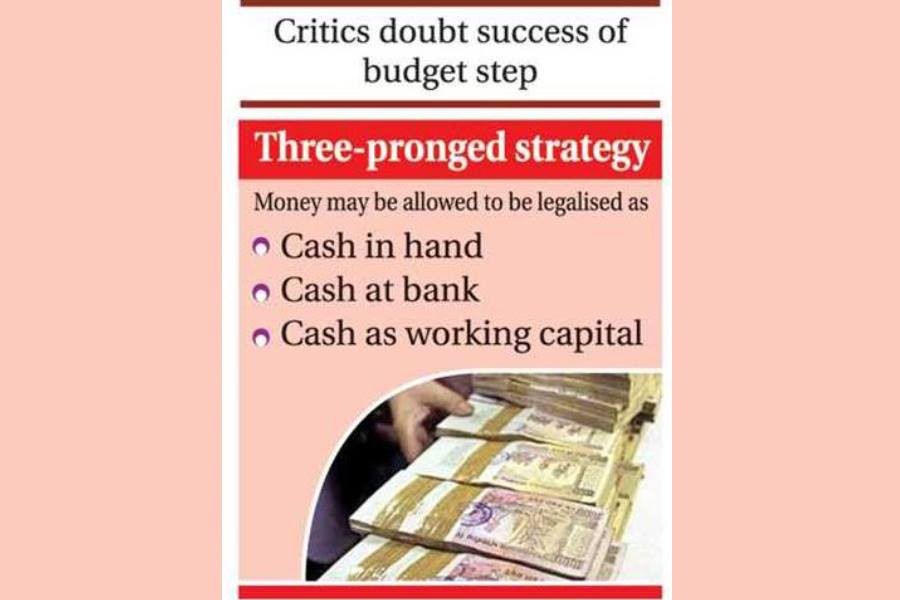

People having undisclosed cash are expected to get the chance to legalise their money in three methods while filing return during the current fiscal year.

The taxmen may allow the relevant taxpayers to show their undisclosed amount as 'cash in hand,' 'cash at bank' and 'cash as working capital' and legalise the same by paying tax at a flat rate of 10 per cent.

The income tax wing under the National Board of Revenue (NBR) has recently worked out the three different processes in which untaxed money can be legalised.

Officials said the process of disclosing money would be explained in detail in an income tax missive for fiscal year 2020-21.

They said the income tax paripatra (circular) is likely to be published by the end of next month.

Talking to the FE, a senior NBR official said undisclosed money holders have to show their undeclared cash by June 30, 2021.

They will need to show that they were in possession of undisclosed cash on June 30, 2020.

"The amount of cash has to be shown in the return through bank statement, company accounts balance sheet or through other means," he said.

Individual taxpayers have to submit their tax returns by November 30, 2020, but they would be allowed to show undeclared cash even in their revised returns, he said.

The government, for the first time, offered the opportunity for people to legalise their undeclared cash without any question.

In the budget for current fiscal year, the government also offered amnesty for whitening black money by investing in the capital market.

There are two types of opportunity for capital market investors.

The first one is for the existing investors who can declare their investments by June 30, 2021.

The second one would be valid for the next fiscal year for those who would invest in bourses from July 01, 2020 through June 30, 2021.

The investors will declare their investment of undisclosed money in FY 2021-2022 and pay the tax to legalise the income, the official said.

In the budget, finance minister AHM Mustafa Kamal widened the scope for whitening black money.

"No authority, including the income tax collector, can raise any question on such declarations," he said in the budget speech.

Economists are sceptical about any significant outcome of such an opportunity.

Former lead economist of the World Bank in Dhaka Dr Zahid Hussain said time-bound opportunity with penalty may help channelise black money into formal economy.

He said the "credible" anti-corruption drive brought success of the measure in 2008-2009 when the country was under an army-backed interim government.

The continuation of such facility every year prompts people to adopt wait-and-see approach, he argued.

Executive director of the think tank Policy Research Institute (PRI) Dr Ahsan H Mansur said it is "unjust" as people are paying up to 39 per cent tax for legally-earned income while the rate is 10 per cent for the ill-gotten money.

Such a fiscal measure may discourage the genuine taxpayers from paying taxes, he said.

People may not respond to such an opportunity as fat cats may not want to be revealed, he said.

"I have doubt over the success of the fiscal measure as the black money is already driving the economy," he said.

Unless the government could hit the source of the black money it would continue to be generated further, he added.

In FY 2018-19, some 85 people availed the black money whitening opportunity legalising a minuscule Tk 1.26 billion with Tk 130 million taxes.

In 2017-18, some 90 people took the facility, almost double the number in FY 2016-17.