The amount of classified loans in the micro-finance institutions (MFIs) jumped by 25 per cent in fiscal year (FY) 2019-20 mainly due to the Covid-19 pandemic, officials said.

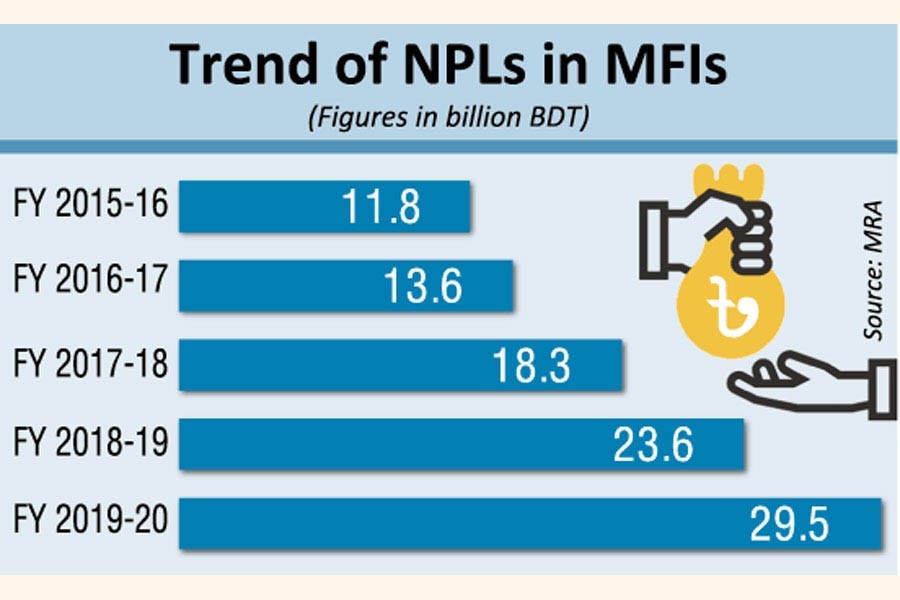

The non-performing loans (NPLs) grew by Tk 5.9 billion to Tk 29.5 billion in FY'20 from Tk 23.6 billion in the previous FY, according to the latest statistics of Micro-credit Regulatory Authority (MRA).

The market operators have expressed the fear that the upward trend of NPLs in the MFIs may continue also in FY'21 on the same ground.

The share of NPLs also rose by 0.30 percentage point to 3.30 per cent of the total outstanding loans in FY'20 from 3.0 per cent in the previous FY, according to the official figures, calculated by the Bangladesh Bank (BB).

Meanwhile, total outstanding loans in the MFIs increased by nearly 13 per cent to Tk 889.0 billion in FY'20 from Tk 787.6 billion in FY'19.

"If the borrower selection and their credit needs are not assessed prudently, overlapping of loans of borrowers may create credit traps in the long run, which may increase the sector's NPLs ratio further," the central bank said in its latest Financial Stability Report (FSR) 2020.

It also said that a structured Credit Information Bureau (CIB) for MFIs and a technology-based monitoring system may be helpful in reducing these problems.

The MRA has already taken preparations to set up a CIB aiming to check overlapping of loans in the MFIs, a MRA senior official told the FE on Sunday over phone.

"We're going to establish the CIB by taking support from the central bank shortly to mitigate credit risk of the MFIs," the MRA official said while replying to a query.

Talking to the FE, Md. Jamal Hossain, director (administration) of Bastob, a non-government organisation (NGO), said recovery of loans dropped significantly, particularly in the final quarter of FY'20 mainly due to the pandemic.

Bangladesh's overall economic activities had almost halted during the 66-day coronavirus shutdown that started from March 26 last year.

During the shutdown period, the people were confined to their homes that had almost stopped the overall economic activities.

"The rising trend of NPLs in the MFIs may continue in FY'21 because of the pandemic situation in Bangladesh," Mr. Hossain predicted.

On the other hand, the central bank has found that the microfinance sector has been highly concentrated in terms of loans, savings and number of members in a small number of institutions.

The top 10 MFIs mobilised 71.97 per cent of total savings of the members, while 71.96 per cent of the MFI sector's outstanding loans pertained to them as of end FY'20, the FSR said.

It added that the MFIs provided financial services to 73.3 per cent of their total members.

"The high degree of market dominance by the top MFIs indicate that their financing activities need to be monitored closely. Otherwise, deterioration of their performance may pose a threat to the stability of this sector," the BB warned.