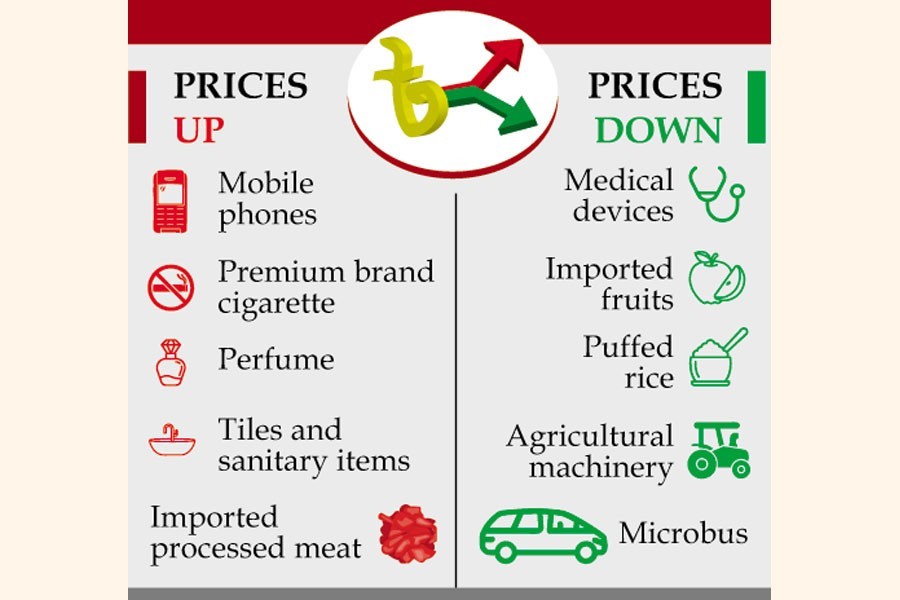

The cost of imported mobile phones may go up as the government has proposed raising import duty to 25 per cent from 10 per cent, according to the Finance Bill-2021.

Prices of perfume, liquor, tiles and sanitary items, imported carrot, mushroom, denatured salt, fresh fruits, imported processed meat, tomato and imported capsicum, chewing gum and turnips, fresh or chilled, wrapped/canned in bulk prices may also be costlier.

Prices of a number of products that may go down, include medical devices, imported fruits, puffed rice, agricultural machinery, microbus, highbred vehicle, raw, locally produced TV, refrigerator, air cooler and LED Lamp, LPG cylinder, soya protein concentrate used in poultry, concretes, cement, iron and iron products, sanitary napkin, diaper, old battery, local fresh fruits, puffed rice, computer monitor (up to 22 inch), computer and units sand other equipments, computer modem, machinery, locally produced mobile phone, air conditioner, refrigerator, home appliances, washing machine, iron/steel, liquefied petroleum gas cylinder, microbus, and hybrid vehicle.

Sodium sulphates, disodium sulphate, meat and edible offal of bovine animals, low erucic acid rape or colza seeds, wrapped/canned upto 2.5 kg, low erucic acid rape or colza seeds in bulks, carrots and turnips, fresh/chilled/frozen imported meat, motor exceeding 750 W, static converters, mineral oil, rice hauler and wheat crusher, nuts, recycled lubricanting oil, soap, moped four stroke engine in CKD may see price increase if the budget is passed as proposed.

Cost of stainless steel, some feed ingredients used in poultry/dairy/fish feed, medical device manufacturing, anti-cancer medicine manufacturing, active pharmaceutical ingredients, textile fabrics coated with gum, black ink imported, sprinkler system and equipment, busbar trunking system, electric panel, locally produced washing machine, locally manufactured computer, local LPG cylinder, compressor, firefighting equipment, toy and some raw material of textile industry may go down.