Living gets costlier for people as inflation maintains a steep rise amid price rises, although official figures apparently water down the inflationary pressures.

The point-to-point inflation over the last couple of months has maintained a steep rise with the September consumer price index (CPI) having recorded a bit high as per official statistics revealed Thursday.

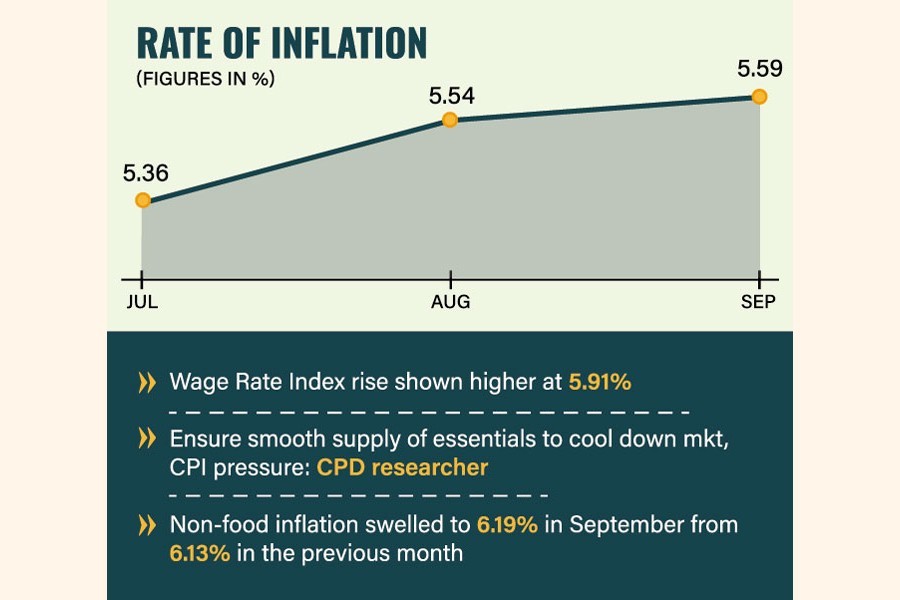

In the last month of September, the rate of point-to-point inflation rose to 5.59 per cent underpinned by higher CPI of non-food items, Bangladesh Bureau of Statistics (BBS) data showed.

The national statistical agency shows the rate of non-food inflation having swelled to 6.19 per cent in September from 6.13 per cent in the previous month, riding on higher trends in both rural and urban areas.

The data show the rate of food inflation at the national level at 5.21 per cent in September this year, 0.05-percentage-point higher than in August.

Economists were, however, critical about the lower food-inflation data in comparison to real market prices of rice, vegetables, edible oils, onions etc across the country.

Meanwhile, the overall point-to-point inflation a year ago in September 2020 was recorded at 5.68 per cent.

After higher inflation in June (5.64 per cent), it had been cooling down in the following months of July and August but again heated up in September -- evidently amid quirky price rises of some essential items.

The rate of inflation in July was recorded at 5.36 per cent and in August at 5.54 per cent, according to the BBS data.

A senior BBS official told the FE that since the CPI of the non-food items had been surging over the years, the overall inflation had also been showing a higher trend over the last three months.

"Since the expenses for house rents, clothing and footwear, fuel and lighting, furniture, house equipment and some other products had been boosted, the non-food inflation across the country increased," he told the FE.

According to the statistical bureau, the rate of point-to-point inflation both in rural and urban areas increased too in the past month of September.

In the rural areas, the inflation rate went up to 5.77 per cent last month from 5.71 per cent in the previous month, August.

The food inflation in the rural areas was recorded at 5.74 per cent last month against 5.67 per cent in August.

Inflation on account of non-food items in the villages increased 0.05 percentage points to 5.84 per cent in September from 5.79 per cent in the previous month.

The pint-to-point inflation in the urban areas inflated marginally to 5.25 per cent last month from 5.22 per cent in August as per the official count.

Food inflation in the urban areas rose a little bit to 4.03 per cent in September from 4.02 per cent in the previous month.

The rate of inflation on non-food items increased significantly to 6.65 per cent in September from 6.59 per cent in August.

Research Director at the Centre for Policy Dialogue (CPD) Dr Khandker Golam Moazzem takes official inflation arithmetic with a grain of salt, as he says there is difference between the official food-inflation data and people's perception.

"It is true that the non-food inflation has risen. At the same time the prices of different food items had also increased significantly in recent weeks across the country. So, there is a difference between peoples' perception and the official inflation data."

The policy researcher suggests that the government ensure a smooth supply of the essential items to cool down the market as well as the pressure on the CPI.

Meanwhile, the 12-momth average inflation, in-between October 2020 and September 2021 maintained an average softer stance as it was recorded at 5.50 per cent.

The BBS also released the Wage Rate Index (WRI) on a point-to-point basis for the month of September 2021 as it was recorded a bit higher at 5.91 per cent compared to inflation that reflects the cost of living.

In the previous month, the WRI was 5.80 per cent.