Bangladesh keeps posting higher economic growth with the falling investment-to-GDP ratio despite incremental government investments in infrastructure development as private investors seemingly pause, analysts say.

An FE analysis finds that a splurge of public investment, particularly in megaprojects on the infrastructure front, couldn't pull up private investment over the years, to the effect of the ratio maintaining a steep downturn over the last three years.

Economists feel that failure in attaining quality output from the public investment makes the expectation of higher local and foreign investments in the country fade out.

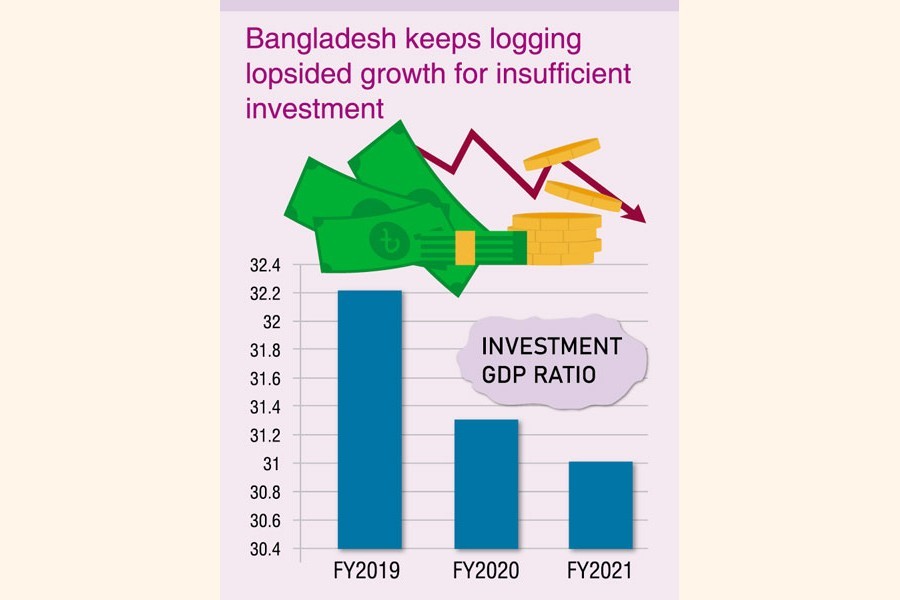

Bangladesh Bureau of Statistics (BBS) showed that although the gross domestic product (GDP) growth in the last fiscal year (FY) 2020-21 rebounded with doubling the rate than in the previous fiscal, the investment-GDP ratio still stayed on the lower trajectory.

The economy expanded at a 6.94-per cent rate in the last FY2021, in the final reckonings, recovering from a massive fall to 3.45 per cent, shattered due to the Covid-19 impact, in the previous FY2020.

BBS's latest estimation showed that the investment-GDP ratio in the last FY2021 was 31.02 per cent, 0.29 percentage points lower than the previous FY2020 and 1.19 percentage points down than in the FY2019.

The FE analysis finds out that the public-sector and-private-sector investments have behaved just opposite over the years, resulting in a lower trend in overall investment, a sine qua non for Bangladesh at this juncture of its socioeconomic transition.

Analysts said Friday that when a government invests for developing its infrastructure and social services, the investment climate gets boosted and inspires local and foreigner investors.

However, the government's incremental public investment-GDP ratio has yet to touch the extended bubble, which is much-expected for Bangladesh.

The FE observation has found the public investment in proportion to GDP on the rise, year on year, since FY2016.

The investment-GDP ratio on government part for developing infrastructure and social services was 6.96 per cent in FY2019 which rose to 7.29 in FY2020 and to 7.32 in FY2021.

On the other hand, the private investment-to-GDP ratio was steering an opposite course of fall over the last three-year period.

The private investment-GDP ratio was 25.25 in FY2019 which fell headlong to 02.24 in the following corona-troubled FY2020 and 23.70 in FY2021, BBS data show.

Policy Research Institute (PRI) Executive Director Dr Ahsan H Mansur told the FE that it is clear that the incremental public investment had been failing to attract investment from both local and overseas sources.

"Usually, the higher public investment shall crowd in private investment.

But the investment trajectory is behaving opposite here in Bangladesh. So, it has a big question over quality public investment," he says.

Although there is a possibility of getting some environment-climate improvements after the opening of the megaprojects, but those are still uncompleted for many years with upward price and time adjustments, Dr Mansur notes.

"Actually, the lack of governance had been failing to bring the benefit of incremental public investments in Bangladesh," the PRI ED says.

Former World Bank Lead Economist Dr Zahid Hussain finds lack of quality public investment behind failure to improve the investment climate in the country.

"And the incremental public investment is failing to uplift the overall investment-GDP ratio in Bangladesh," he says.

He finds some inconsistencies in the recently published GDP data. The BBS in its provisional estimation (based on first three quarters) in November last showed a 5.43-per cent economic growth for the FY2021. It has recently showed a 6.94-per cent growth in the final estimation. "How the growth is lifted so hugely?" he questioned.

"You know that there were massive attacks of Covid-19 pandemic in the last quarter (April-June) of the FY2021. So, which economic indicator performed better in the 4th quarter and enhanced the GDP growth to 6.94 per cent," Dr Hussain says.

"The higher GDP growth is questionable as there are some inconsistencies in private and public consumption data, gross capital formation, private-sector credit growth, and remittance inflow in the last quarter of the FY2021," the former WB economist adds.

He also observes that although government's investment is rising, but its delay in megaprojects completion is a big setback to reaping positive outcome from the private investment.