Bangladesh's treasury yield curve has now flattened further due, many believe, to hikes in policy rates and other regulatory moves tightening the monetary stances to fight stubbornly high inflation.

The shape of yield curve, also called a 'snapshot' of an economy, helps investors get a sense of the likely future course of the interest regime with its economic implications-for the better or the worse to come.

A normal upward-sloping curve means that long-term securities have a higher yield while an inverted curve shows short-term securities having a higher yield. The flat- yield curve implies an uncertain economic outlook.

According to economic literature, a flattening curve may come at the end of a high economic-growth period that is leading to inflation and fears of a slowdown. And this may appear at times when the central bank is expected to increase interest rates.

However, Bangladesh Bank (BB) has been plotting secondary-market yield curves alongside the primary-market cutoff yields on regular basis.

Contacted for comment on the current shape of yield curve, some central bankers argued that the interest on deposits has been increased crossing over the 6.0-percent cap on grounds of higher inflation persisting in the economy.

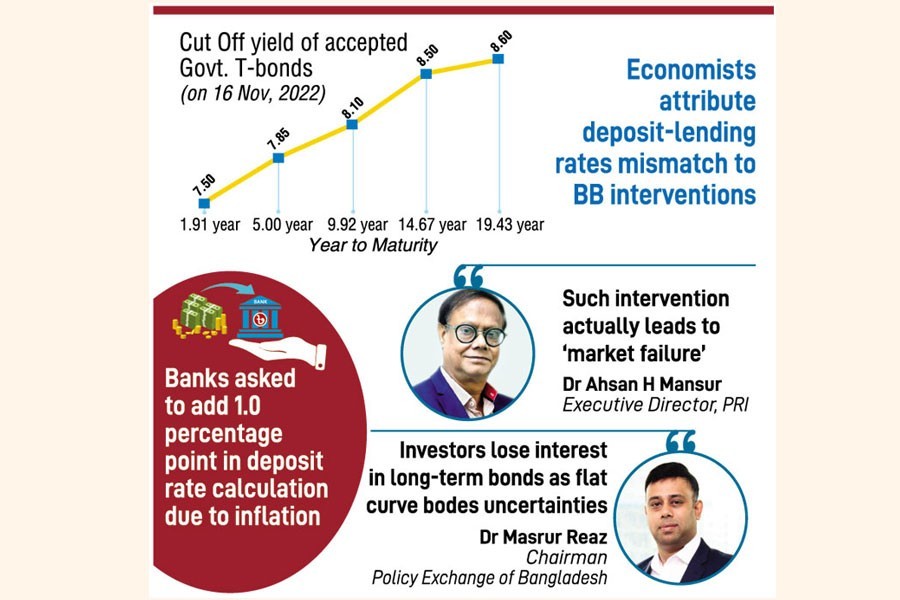

The BB has directed banks and financial institutions to maintain at least 1.0- percentage point of the inflation rate in interest calculation. This is applicable to time deposits having the bigger shares in total deposits.

"Since the deposit rate has been hiked but the lending rate remained the same at 9.0 per cent that's why the yield curve has flattened," one central banker, who is familiar with the developments on the financial front, told the FE on Thursday, after the flattening of treasury yield curve a day before.

He also said there were many moves pertaining to policy-rate spikes and tighter monetary stances that all have contributed to the yield-curve movements.

"Actually such developments on the money market have reflected on the worries of the investors towards the investment in the risk-free instruments."

Leading economists having direct knowledge of the financial market told the FE that yield curve is a good indicator but the existing curve does not reflect the "real picture" of the economy. They point out that Bangladesh Bank often intervenes in the market through the purchase of bonds. Such interventions do not help raise the yields naturally. They think this is more or less predicting the course of economy.

"Bangladesh Bank intervenes on the market and it buys to halt the natural market behaviours of the yields," says Dr Ahsan H. Mansur, executive director of the Policy Research Institute of Bangladesh (PRI).

When the yield inches towards 9.0 per cent, the Bangladesh Bank purchases the bonds so that interest cannot cross the 9.0-percent cap, Dr Mansur points out.

Such intervention actually leads to 'market failure', says the economist.

Another economist, Dr M. Masrur Reaz, chairman at the Policy Exchange of Bangladesh, told the FE that yield curve has implications as investors are not interested in the long-term bonds as they believe there are more uncertainties in the economies.

"The flatter curve means all maturities have almost same yields as the investors prefer short terms," he notes.

The treasury finances government budget obligations by issuing various forms of debt instruments, including treasury bills, with maturities from 91 days out to one year, and bonds from two years to 20 years.

Shapes of yield curves and implications show that, typically, the yield curve slopes upwards because investors expect more compensation for taking on the risk that rising inflation will lower the expected returnd from owning longer-dated bonds.

Longer-dated bonds, for example, 20-year bonds, typically yield more than short-dated bonds due to the longer duration and risk associated with the period.

A steepening curve typically means that there is a prospect for stronger economic activity. As the yield curve steepens, banks and other financial institutions are able to borrow money at lower interest rates and lend at higher interest rates although Bangladesh has caps both on lending and deposits.

During the recent visit for assessing Bangladesh's creditworthiness pending a USD4.5 billion worth of loan, an IMF mission pressed the central bank and the finance division to go for market-based rates instead of artificial caps.

When the flattening curve appears, the investors expect rate hikes in the near term and lose confidence in the economy's growth outlook.

Under such a situation, short-term yields increase and banks tend to raise their benchmark rates for their products and loans. SME loans and credit cards and consumer loans become expensive.

There is another shape of the curve that is more worrying for an economy-inverted yield curve. This appears when the short- term yields become larger than the longer-term yields. Typically, this is seen as an ominous sign for an economy.

The BB has been plotting a yield curve after each auction based on the primary-market performances. Banks and financial institutions usually use it as benchmark rates. The banks have been accustomed to this for long.

After the beginning of trading on the bourses, the central bank of Bangladesh started plotting the secondary yield curve. The secondary-market yield curve is more representative. Almost all economies rely on it as it truly gives a picture of the economy. This is the best practice for financial institutions to abide by the secondary-market yield curve. It is an indicator of how the economy will behave.

In the midst of latest developments, including a financial crunch in sync with the global economic ills, Bangladesh Bank high-ups Thursday met with all leading banks with an agenda of using the secondary yield curve. The banks having bigger holdings like Sonali Bank, BRAC Bank, and other leading banks attended the meeting.

The BB wants the banks should have immediately used it for their asset prices and other benchmarks.

The bankers argue that they want to begin using it on parallel -primary and secondary yield curves. But they also pledged to switch over to using the secondary-market yield curve two or three months later.