The allocation of Special Drawing Right (SDR), an official currency of the International Monetary Fund, will ease many challenging funding conditions for Bangladesh, some economists say about a $650-billion fund being disbursed globally.

Bangladesh's import payments are now on the rise while remittance inflow and export receipts are on the decline in recent months under impact of the pandemic.

However, the central bank of Bangladesh received the SDR in dollar worth 1.45 billion Tuesday, distributed by the IMF as per Bangladesh's voting shares at one of the Bretton Woods Institutions.

The IMF created a fund of $650 billion in SDR on August 23 which gives the member-states the right to access dollars at essentially zero cost without an IMF programme. About $275 billion went to the share of emerging and frontier markets, including Bangladesh.

Dr Ahsan H. Mansur, executive director at the Policy Research Institute of Bangladesh (PRI), says: "Although Bangladesh is not a distressed country like Sri Lanka, Bangladesh needs such amount for mitigating its many challenges."

He mentioned the rising import cost, decline in the remittance inflow and cost for vaccinations.

Dr Mansur told the FE that status of the country's foreign-exchange reserves remained at a static level following pressure from import payments.

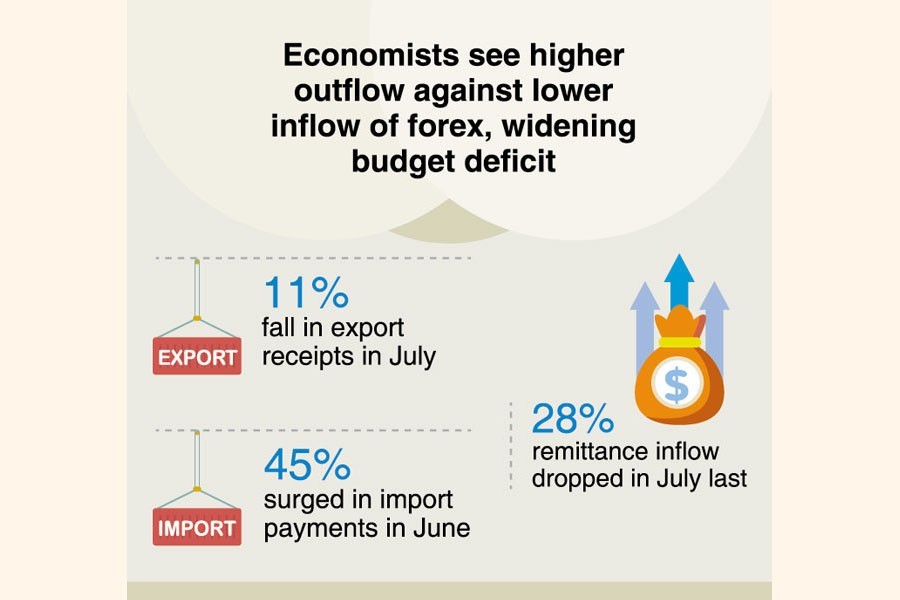

The remittance inflow dropped by nearly 28 per cent in July last and export receipts fell by over 11 per cent in the month, according to Bangladesh Bank data. The import payments also surged nearly 45 per cent in June.

"Actually the IMF created the biggest SDR to boost the global equity to fight a number of economic and social challenges facing the member-nations because of the covid-19. So Bangladesh is also facing the similar economic conditions due to the pandemic," Dr Mansur, who worked as division chief at the middle-east of the IMF.

Dr Zahid Hossain, a former lead economist of the World Bank, said this would give a breathing space for Bangladesh as fiscal deficit is on the rise in recent years for covid consequences.

"The amount has now condition. So, fiscal agency may use it to narrow the deficit down."

Bangladesh's fiscal deficit for the current fiscal year is estimated at 6.2 per cent, which usually does not exceed the 5.0 percent ceiling of the GDP.

He said Bangladesh needs funds for purchasing vaccines to prevent the covid pandemic. So it will give an additional breathing space for the fiscal agency.

Mr Hossain also said the fresh SDR that costs almost nothing may be invested in profitable financial assets.

In the meantime, Bangladesh's foreign-exchange reserves crossed US$48.0- billion mark for the first time on Tuesday with injection of the amounts from the IMF.