As Bangladesh struggles to keep its position as the second-largest apparel exporter of the world, the country is desperately in need of policy support to make a solid foothold on potential man-made fibre (MMF) in which its rival marches ahead.

This apparel sub-sector holds the prospect of emerging as the game-changer in global textile trade, as is evident from its growth, outmatching the traditional wear.

Over the decade the world has seen a spectacular growth of the MMF sector in apparel trade, but, in Bangladesh, the contribution of MMF to the country's apparel basket is less than 30 per cent, far below the world average of 63 per cent.

Industry experts say that if the country fails to boost the share of MMF in the trade cake, it may slip from its present ranking as one of the top apparel exporters.

The share of cotton in fibre consumption was 41 per cent 10 years ago but now dwindled to 26 per cent whereas the share of MMF grew to 63 per cent.

"There is no doubt that we have to enhance our share in MMF products, but we are not getting proper policy support," Mohammad Ali Khokon, President of Bangladesh Textiles Mills' Association (BTMA), told the FE.

"We have urged the government to reduce VAT on the MMF from TK 6 to TK 3, but that was not materialised yet," he said, adding that VAT for the cotton yarn is TK 3.

"On the other hand, setting up MMF factory is a huge cost-intensive issue and we sought duty waiver on import of capital machinery for the setting up of MMF factories. But the authorities concerned have not responded positively to our demand," Mr Khokon said.

According to the BTMA president the textile mills have 13 million spindles of which only 15 per contribute to MMF products.

Dr Mostafizur Rahman, Distinguished Fellow at the Centre for Policy Dialogue (CPD), thinks that a string of measures can be taken by the government to boost the MMF sector.

"There should be credit support from the various government funds, including Bangladesh Bank's export fund, as this is a capital-intensive sector. The government can also establish dedicated industrial park for this sector with infrastructure support," he said.

"There should also be support for skills development as this is comparatively a new sector to us," he suggests.

Vietnam, which is Bangladesh's main competitor, is "ahead of us in MMF sector", he reminded.

Chairman of the Policy Research Institute Dr Zaidi Sattar thinks that luring foreign investment is crucial for enhancing the MMF sector.

"Worldwide, the demand for MMF is growing, and it is a high-value-added product, so we need to take measures to strengthen this sector," he said.

Global fibre consumption is growing, having risen to 108 million tonnes in 2019 from 100 million tonnes in 2016.

The share of the synthetic fibres is 63 per cent, and according to an international survey by Lenzing the MMF market will see a steady growth at a rate of 3-4 per cent up to 2024.

Experts say the global fibre consumption will rise to 140 million tonnes of which the share of MMF will be 108 million tonnes.

Wood Mackenzie, an international industry-research firm, in 2018 said cotton contributes only 26 per cent of the total fibre consumption, whereas polyester as 56 per cent followed by polypropylene with 4.9 per cent, nylon 4.8 per cent, and acrylic 1.6 per cent.

Industry-insiders say the growth of MMF results from rising demand for MMF-based apparel in fashion industry.

"It is also cost-effective and easily recyclable, unlike cotton," a RMG buyer said.

MMF has versatile use in end-use categories such as sportswear, leisurewear, women dresses, home textiles, automotives, carpets and other industrial sectors. All this makes it an ideal 'fibre of the future, he added.

Bangladesh has established itself as a strong producer in the ready-made garment sector with more than 4,600 factories operating. In the spinning sector, around 430 mills are operating out of which only 27 are producing manmade yarn, in particular, polyester. The production facilities for other manmade fibres like polypropylene, nylon, acrylic etc have yet to be established in Bangladesh

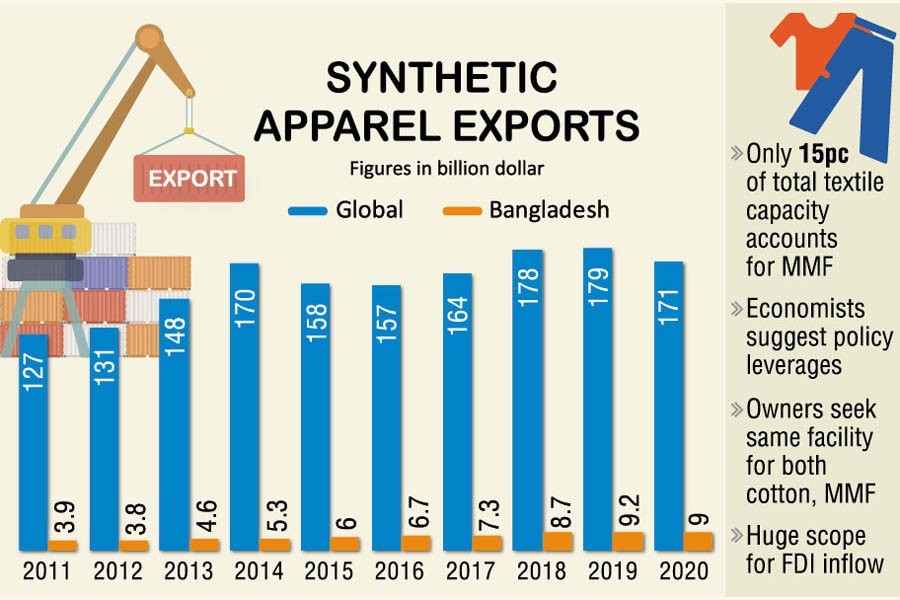

According to a report, in the year 2019, the global manmade-apparel trade stood at around $179 billion with Bangladesh holding roughly 5-percent market share, whereas its main rival, Vietnam, had a 10- percent share.

The 27 factories producing manmade yarns in Bangladesh meet only 20 percent of the national demand.

Foreign investors are, however, eager to set up MMF factories in Bangladesh sensing a huge untapped demand. Korean textile company Youngone has invested $65 million in 3 factories and announced its plan to invest another $120 million for another 2 MMF factories in the Korean EPZ, owned by the company.

Talking to the FE, Chairman of the company Kihak Sung said Youngone already started manufacturing polyester fabrics in the two state-of-the-art factories, each having a 430,000-square-foot floor space.

"Both factories will be expanded soon," he added.

Industry analysts suggest that incentives in producing MMF can also lure huge FDI into the country as Bangladesh has a strong forward linkage in the apparel sector.