Tax officials have found it difficult to fix the progressive rates of corporate taxes in the national budget considering uncertainty of the economic situation.

Both the members of income tax and value added tax (VAT) have said the government devises fiscal measures considering the current economic situation such as the Covid-19 pandemic when the industry needs support.

Dr Abdul Mannan Shikder of VAT wing and Md Mahbub Hossain of income tax wing made the observations at a post-budget webinar on "The salient features of Finance Bill-2021" organized by Snohomish Maimed and Co, Chartered Accountants Firm.

Representatives from businesses, economists, accounting professionals and other stakeholders took part in the virtual discussion.

Fellow member of Institute of Chartered Accountants of Bangladesh (ICAB) Snehasish Barua and founding partner of that CA firm gave a detailed presentation on the salient features of the proposed budget for the fiscal year 2021-22.

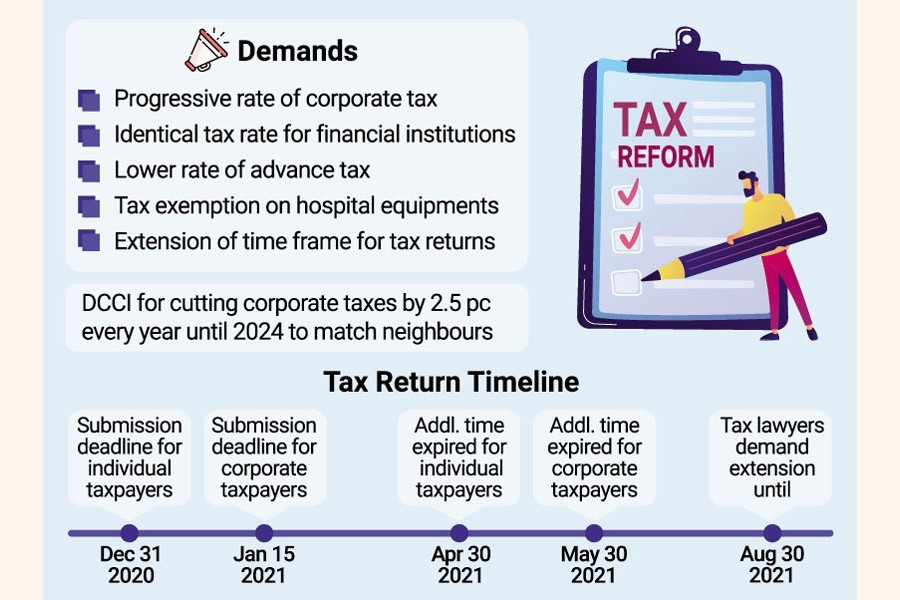

Businesses have long been demanding a progressive rate of corporate taxes for three to five years to help them prepare investment plan on the basis of tax rates.

The Dhaka Chamber of Commerce and Industry (DCCI) in its budget proposal urged the government to cut corporate tax rates by 2.5 per cent every year until 2024 to bring it down to the level of other neighbouring countries.

VAT member Dr Shikder said although it is difficult to set tax rates for a longer time, it is present for some sectors where tax exemption has been given for several years.

In the programme, business representatives have demanded identical tax rates for banks and other financial institutions like other corporate taxpayers.

Except Pakistan, all other countries have no such separate tax rates for financial institutions, said Managing Director (MD) and Chief Executive Officer (CEO) of IPDC Finance Limited Mominul Islam.

MD of Berger Paints Bangladesh Limited Rupali Chowdhury said the proposed budget has not offered any tax benefit for the banks and the telecom sector.

She said the effect of increased non-performing loans on financial health of banks should be considered in the budget.

On the telecom industry, she said tax has been deducted at Tk 53 on spending of Tk 100 by mobile phone users, hurting the penetration of this sector now.

Ms Chowdhury also requested the government to bring down the rate of advance tax and suggested taking measures for raising the domestic demand for the sake of survival of the local industry.

Chief Financial Officer (CFO) of Evercare Hospital Dhaka Mustafa Alim Aolad said the proposed 10-year tax holiday for hospitals would not help investors much as the given time would be required for establishment of a new hospital to make it profitable.

He rather demanded tax exemption on imports of all types of equipment for hospital purposes.

Founder and MD of Shohoz Maliha Quadir demanded reduction in the cost for internet and use of SIMs and not to increase the corporate tax rate on Mobile Financial Services (MFS).

Mominul Islam also echoed her for ensuring access to finance for marginal group of people.

Chairman and CEO of Policy Exchange of Bangladesh Dr. M. Masrur Reazsaid some US$2.4 billion would be required for Covid vaccination but the budget lacks allocation.

"It is not a corona responsive budget. There is no allocation for the protection of employment," he said.

The opening remarks were given by Founding Partner of the CA firm Zareen Mahmud Hosein. Another partner of the firm Sukanta Bhattacharjee gave the closing remarks at the event.

However, tax lawyers at a press conference on Monday demanded extension of the timeframe for submission of corporate tax returns for the FY 2020-21 considering the Covid-19 pandemic situation.

Dhaka Taxes Bar Association (DTBA) and Bangladesh Tax Lawyers Association alleged that a section of tax officials was not receiving tax returns from corporate taxpayers now as the deadline expired.

At the press conference jointly organized by the two associations at the National Press Club, tax lawyers demanded extension of the timeframe for tax returns under 184G.

The deadline for submission of individual tax returns expired on December 31, 2020 while for corporate tax returns on January 15, 2021.

The tax lawyers demanded extension of the time until August 30, 2021 to help businesspeople comply with the tax law.

As per tax law, deputy commissioner of taxes and joint commissioner of taxes are authorized to allow taxpayers enjoy extended timeframe for submission of returns.

The time expired on April 30, 2021 for individual taxpayers and May 30, 2021 for corporate ones.

Md Jahangir Alam, Executive Director of Golden Bangladesh, said tax department was not defined as emergency service providers during the lockdown until May 17, 2021.

Many corporate taxpayers failed to submit tax returns within the deadline due to this reason, he added.

General secretary of DTBA Md Mustafizur Rahman and BTLA convener Md Sohrabuddin, among others, spoke at the programme.