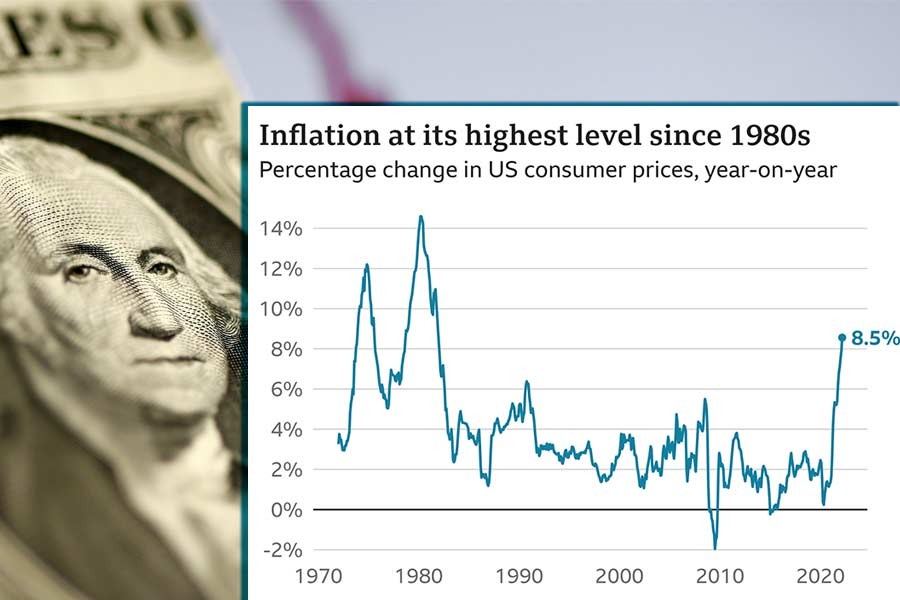

The US inflation rate hit a fresh 40-year high in the year to March after fuel prices soared during the first full month of the Ukraine war.

Consumer prices increased by 8.5 per cent, the largest rate since December 1981, following a double-digit rise in energy prices, reports BBC.

Last month, US President Joe Biden banned all imports of oil and gas from Russia following the invasion of Ukraine.

At the same time, US fuel prices reached new records.

The attack on Ukraine began on 24 February and triggered a wave of international sanctions against Russia, which is the world's second-largest oil exporter.

US energy prices rose by 32 per cent in the year to March, according to the country's Labor Department.

It also said that food prices had surged over the same period, up by 8.8 per cent. Like energy, food price inflation has been exacerbated by Russia's invasion of Ukraine. Both countries are big exporters of widely-used goods such as wheat and sunflower oil.

"The Russia-Ukraine war has added further fuel to the blazing rate of inflation via higher energy, food, and commodity prices that are turbocharged by a worsening in supply chain problems," said Kathy Bostjancic, chief US economist at Oxford Economics.

The soaring rate of US inflation prompted the Federal Reserve last month to lift its key interest rate for the first time in three years. The US central bank also signalled that the interest will raise a number of times this year.

On Tuesday, Russian President Vladimir Putin said that inflation and rising food and petrol prices in Western countries would start to put pressure on politicians there.

Inflation rates were already rising before Russia's invasion of Ukraine as many global economies reopened following the lifting of Covid restrictions. However, prices appear to be accelerating at a time when wage growth is struggling to keep up.

Recent figures show that average hourly earnings in the US rose by 5.6 per cent in the year to March, well below the latest rise in the cost of living.

But some economists believe that inflation may be close to or has already peaked in March.

On a month-by-month basis, inflation rose 1.2 per cent in March compared with a 0.8 per cent increase in February. However, stripping out volatile fuel and food prices, core inflation rose by 0.3 per cent which was lower than expected.

Peter Cardillo, the chief market economist at Spartan Capital Securities, said: "The bottom line is inflation is going to stick around for a while, but we could see it begin to reverse in the summer months, provided we get some cooling off in agricultural and energy prices."