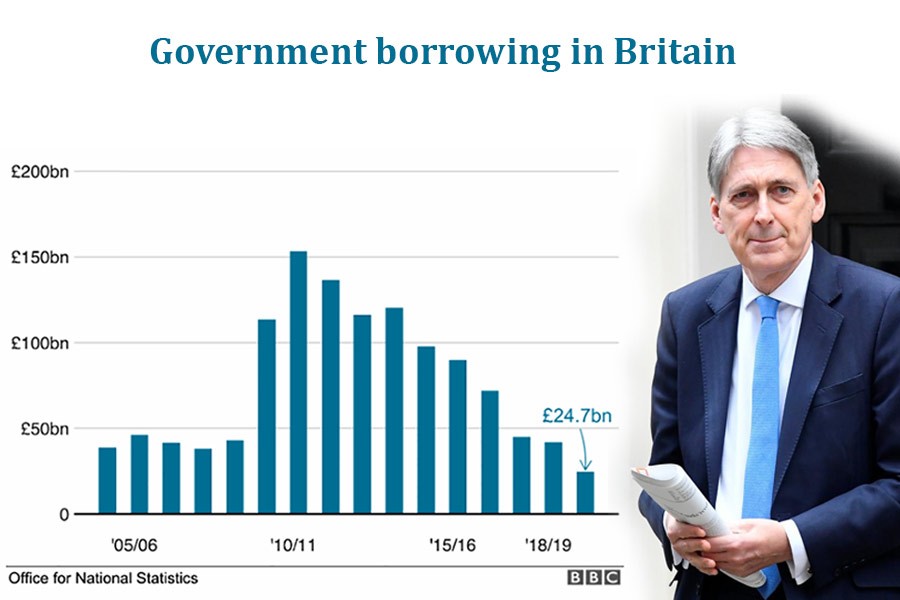

Government borrowing in Britain for the 2018-19 financial year fell to its lowest annual level in 17 years, official figures show.

British Finance Minister and Chancellor of the Exchequer Philip Hammond also missed his target for bringing down Britain’s budget deficit in last financial year.

Borrowing for last year was £24.7bn, £17.2bn less than in the previous financial year, the British Office for National Statistics said, reports BBC.

Despite the drop, the amount was still higher than the Office for Budget Responsibility's forecast last month.

Economists believe the reduction should give the Chancellor freedom to ease the austerity measures of the last decade.

The figures showed tax receipts continued to grow strongly in March, but higher government spending accounted for the wider-than-expected deficit, mostly down to the purchases of goods and services.

British Finance Minister Philip Hammond speaking to the Treasury Select Committee on Wednesday reiterated that by the financial year 2020/21 the government would have around of £27bn "headroom" to use on a range of options.

But he added: "Until we have resolved the Brexit issue I don't think it makes sense to to plump for one option or another and rule out our optionality."

Samuel Tombs, UK economist of Pantheon Macroeconomics, explained that the chancellor had set a borrowing target equivalent to 2% of GDP. Borrowing last year was equivalent to 1.2% of GDP, down from 10% at the height of the financial crisis, giving the chancellor some extra spending room.

Mr Tombs said: "The chancellor still should be able to scrap the further austerity measures planned for 2020/21 in the Budget later this year and meet his target."