The final report of the Financial Sector Commission on Modern Slavery and Human Trafficking was formally released at an important UN event in New York on September 27, said a press release.

The Commission was set up during the UN General Assembly meeting of the previous year at the initiative of Government of Liechtenstein and joined by the Governments of Australia, the Netherlands, and the United Nations University Centre for Policy Research.

The Commission was formed to put the financial sector at the heart of global efforts to end modern slavery and human trafficking. Target 8.7 of the UN Sustainable Development Goals requires working to end modern slavery and human trafficking by 2030. Today 10,000 people become victims of modern slavery and human trafficking everyday.

The Chair of the Commission was Fiona Reynolds, CEO of the UN-backed Principles for Responsible Investment.

The Prime Minister of Liechtenstein, H.E. Mr. Adrian Hasler, was the Convenor of the Commission.

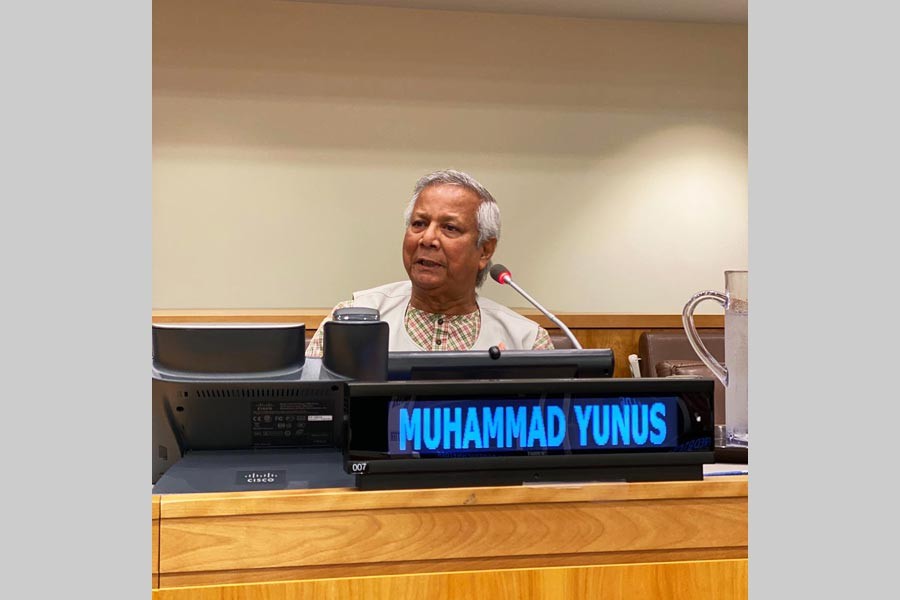

Co-convenors were the Foreign Minister of Australia, Senator The Hon. Marise Payne, and Foreign Minister of the Netherlands, H.E. Mr. Stef Blok, and Nobel Prize laureate, Professor Muhammad Yunus.

The final report of the Commission has a Blueprint for mobilising finance against slavery and trafficking.

It provides a collective action framework where different financial sector actors can implement it in their own ways and at their own speeds.

Over time, their collective action will lead to a stronger connection between an enterprise’s behaviour and its costs of capital. The Blueprint sets 5 goals, accompanied by 30 actions – 15 to start with now.

There is growing evidence that lack of access to safe and affordable financial products and services heightens the risk of modern slavery and human trafficking.

Financial innovation and investment that increase that access are keys to prevent modern slavery and human trafficking.

Professor Muhammad Yunus, the Co-Convenor of the Commission, in his remarks pointed out that it is not a market failure which deprived almost half the population of the world unreached by financial services, it is clearly a system failure.

Existing financial institutions are not built to reach the low income men and women. World needs to create Banks for the Poor, particularly with social business principles, to fill that gap, added he.