Property prices in China held stable in June with slower growth rates amid an ongoing crackdown on speculation in the real estate market, figures released by the National Bureau of Statistics (NBS) showed on Monday.

"The growth rates of home prices and second-hand housing dropped in first-, second- and third-tier cities in the country on a year-on-year basis," read an analysis by the NBS, citing statistician Liu Jianwei, which was posted on the official website on Monday.

According to the bureau, prices of new homes in first-tier cities rose by 4.4 per cent year-on-year, a growth rate that was 0.3 percentage points lower than the previous month. Prices of second-hand houses rose 0.2 per cent in June, 0.1 percentage points less than in May.

Prices of new commercial residential housing in second-tier cities rose 11.4 per cent, 0.7 percentage points less than in the previous month, while prices in third-tier cities rose 10.9 per cent, also showing a lower growth rate.

Analysts said that the housing market will remain stable as local authorities move to keep prices in check and carry out the "housing is for living, not for speculation" principle.

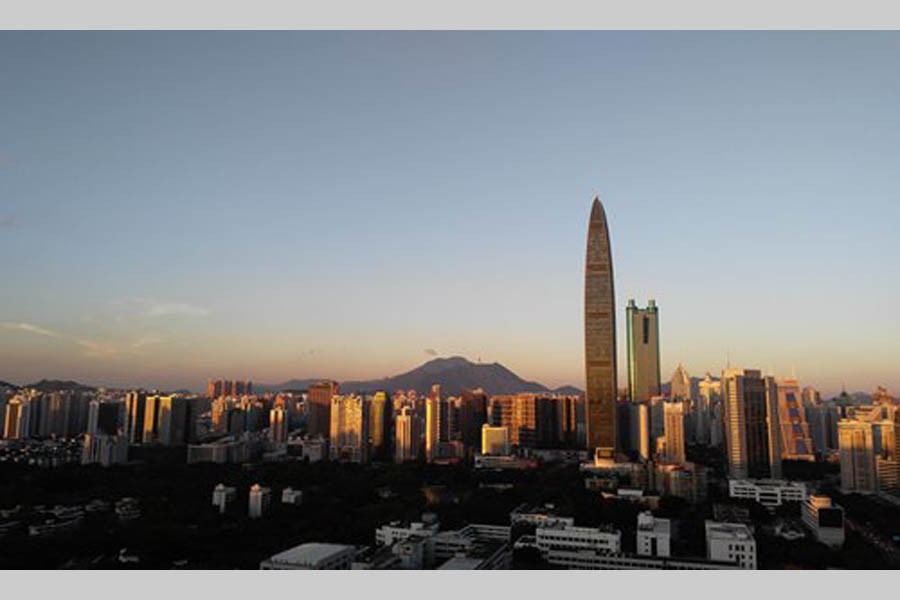

For instance, authorities in Shenzhen, South China's Guangdong Province said recently that the city will no longer publish price data of commodity housing on the local level.

Relevant data can only be obtained through the official platform of the NBS.

Yan Yuejin, research director at E-house China R&D Institute, said on Monday that Shenzhen's move could stabilize prices, as local figures don't reflect the true situation of the local real estate market.

The Shenzhen Municipal Housing and Construction Bureau said that as the housing market keeps fluctuating, average housing prices cannot be used as a decision-making basis for the city to manage its property market.

"The act of the Shenzhen housing bureau can stabilise and ease market sentiment," Li Zhanjun, an analyst at E-house China R&D Institute, told Global Times on Monday.

In August 2018, sunshinehome.net, the official housing platform of Guangzhou, the capital of Guangdong Province, stopped publishing average transaction prices, according to media reports.

"Shenzhen's example can be used for reference by other cities," said Yan.

"The move is also in line with the plans of the central government to stabilise property prices and ensure the stable and sound development of the real estate market," said Li.